Reference no: EM13979078

Problem Set 1:

1 Nominal Anchors in the Long Run.

Explain the main differences between the three main nominal anchor choices presented in Chapter 3:

i) Exchange Rate Target;

ii) Money supply target; and

iii) Inflation target plus interest rate policy.

Use equations to support your answer and do not forget to describe how each of these nominal anchors affect inflation in the long-run.

2 Outsourcing.

In the past few decades, firms from industrial economies have installed production plants in developing countries.

This strategy allowed them to move production from expensive locations to cheaper ones (a phenomenon called outsourcing).

If the Chinese Remninbi appreciates against the US dollar, what would happen to outsourcing in China by US companies? Explain.

3 Money Market and Foreign Exchange Market.

Use the foreign exchange market and money market diagrams to answer the following questions. This question considers the relationship between Swedish kronor (SK) and Danish krone (DK).

Let the exchange rate be defined as Swedish kronor per Danish krone, SK/DK. On all graphs, label the initial equilibrium point A. Suppose that there is an exogenous increase in the real money demand in Sweden.

a Assume this change in real money demand is temporary. Using the foreign exchange market and money market diagrams, illustrate and explain how this change affects the money and foreign exchange markets. Label your short-run equilibrium point B and your long-run equilibrium point C.

b Now assume this change in real money demand is permanent. Using a new diagram, illus- trate how this change affects the money and foreign exchange markets. Label your short-run equilibrium point B and your long-run equilibrium point C.

c Illustrate how each of the following variables changes over time in response to a permanent increase in real money demand: nominal money supply MS , price level PS , real money supply MS/PS , Swedish interest rate iSK , and the exchange rate ESK/DK.

4 Foreign Exchange Market Equilibrium.

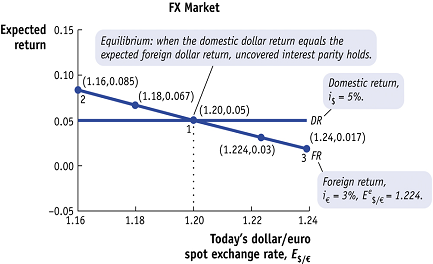

We say that the foreign exchange market is in equilibrium when deposits of all currencies offer the same expected rate of return (when returns are denominated in the same currency). Formally,

i$ = ie + ( E$/ee + E$/e )/E$/e

(a) Explain why in points 2 and 3 in Figure 1 the foreign exchange market is not in equilibrium. Do not forget to use a graph to support your answer and describe how the equilibrium can be restored.

(b) Now suppose the foreign exchange market is in equilibrium (i.e. point 1 in Figure 1). Ex- plain what would happen to the US/euro nominal exchange rate if the interest rate in Europe increases. Do not forget to use a graph to support your answer.

Figure 1: Foreign Exchange Market Equilibrium

5 Overhooting of the Nominal Exchange Rate.

Using figures for both the U.S. money market and foreign exchange market in the short run and the long run, show the effects of a permanent increase in the U.S. money supply on the nominal exchange rate between the US dollar and the euro. Assume that the U.S. real national income is constant and that Europe is the foreign economy.

6 Fundamental Equation to the Exchange Rate (General Model).

Using the fundamental equations from the general monetary approach, describe how each of the following will affect the home and foreign price level, real money balances, and the exchange rate, EH/F in the long run. Also, state whether the home currency appreciates or depreciates for each.

a A permanent increase in home money supply.

b A permanent increase in the foreign money supply.

c An increase in home real income level

7 Answer True or False.

Briefly explain your answer. No credit without explanation. Support your answer with a graph and/or equations if needed.

a. Appreciation of the domestic currency today (i.e. e1 in class) lowers the expected rate of return on foreign currency deposits.

b. The Fisher Effect states that, all else equal, a rise in a country's expected inflation rate will eventually cause an equal decrease in the interest rate that deposits of its currency offer