Reference no: EM13522906

Financial Derivatives II Project

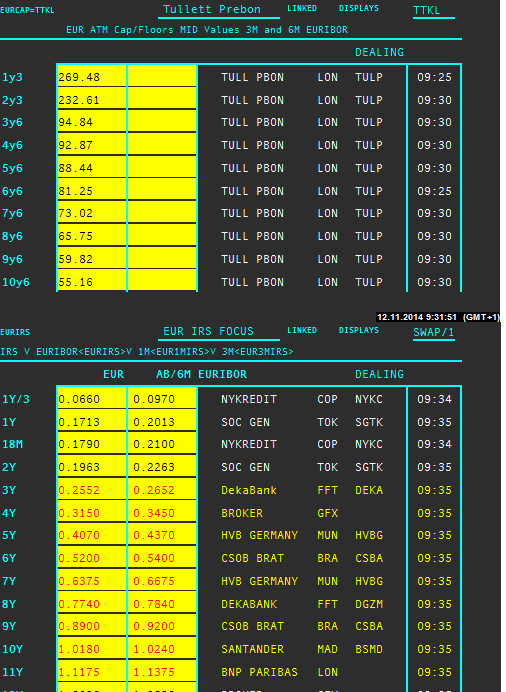

A public entity considers entering into a derivative hedging transaction in order to swap fix interest payments on its debt into float payments. The following ("range accrual") swap is proposed by a bank to the public entity. What would be your recommendation to the entity? Does the proposed swap fulfil the hedging goals? What is your estimate of its market value based on the market data as of 12 November, 2014? Would the swap be profitable for the bank or for the entity at the Trade date? Use different valuation approaches if possible.

General specifications of the swap transaction

Party A Fix payer - Bank

Party B Float payer - Client - Public entity

Notional Amount 100 000 000 EUR

Trade Date 12 November 2014

Start Date 14 November 2014

Maturity Date 14 November 2029

Floating Amounts

Floating Rate Payer Party B - Client

Floating Rate Payer Payment Dates 14 May and 14 November in each year

from and including 14 May 2015

to and including 14 November 2029,

Modified Following Business Day Convention

Floating Rate EURIBOR 6M with the floor 0.5% p.a. and capped at 5% p.a.

Floating Rate Day Count Fraction Actual/360 (According to ISDA 2000)

Reset Date First date of each calculation period

Fixed Amounts

Fixed Rate Payer Party A - Bank

Fixed Rate Payer Payment Dates 14 November in each year from and including

14 November 2015 to and including

14 November 2029

Fixed Rate 4 % p.a.

Fixed Amount Calculation Notional Amount x 4 % x (n/D)

n Number of business days during coupon period that 12M EURIBOR fixes between the Lower Barrier and the Upper Barrier

D Total number of business days during period

Fixed Rate Day Count Fraction Actual (n) /Actual (D)

Business Days for EUR Target Settlement Days

Barrier Specification

|

Year

|

Lower Barrier

|

Upper Barrier

|

|

1-3

|

-999%

|

999%

|

|

4-9

|

0.50%

|

2.50%

|

|

10-15

|

1%

|

3.00%

|