Reference no: EM131160131 , Length:

Assignment topic:

Liquidity risk, Basel III liquidity requirements, and Australian banks' liquidity position.

Report

1. Define liquidity risk and distinguish between asset liquidity and liability liquidity management. What are the main features of an effective liquidity management strategy for a typical commercial bank?

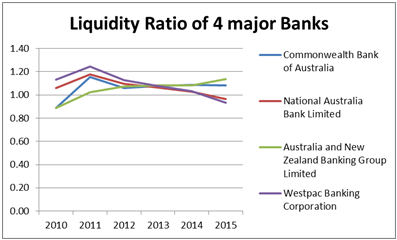

2. Use actual bank data to calculate liquidity ratios and construct comparison graphs for the four major Australian banks over the years 2010-2015. Conduct both peer and trend analysis based on these figures. (10 marks) Note: Various ratios can be used to measure different aspects of bank liquidity. Your analysis should focus on one ratio (for all four banks) and provide meaningful interpretation.

3. As part of Basel III liquidity requirements, the Liquidity Coverage Ratio framework was implemented in Australia in January 2015, while the Net Stable Funding Ratio will be introduced in 2018. Provide an overview of these two requirements and discuss how they may help promote more comprehensive bank liquidity management.

Question 2 data and graph

|

Liquidity Ratio

|

|

|

2010

|

2011

|

2012

|

2013

|

2014

|

2015

|

|

Commonwealth Bank of Australia

|

0.89

|

1.16

|

1.06

|

1.08

|

1.09

|

1.08

|

|

National Australia Bank Limited

|

1.06

|

1.18

|

1.10

|

1.06

|

1.03

|

0.97

|

|

Australia and New Zealand Banking Group Limited

|

0.89

|

1.02

|

1.07

|

1.08

|

1.08

|

1.14

|

|

Westpac Banking Corporation

|

1.13

|

1.24

|

1.13

|

1.08

|

1.03

|

0.93

|

Suggested data sources for part 2: Banks' annual reports 2010-2015, Bankscope (access via Monash library website)

Suggested reference sources for part 3: RBA and APRA discussion papers on the implementation of Basel III liquidity framework in Australia Instructions to students You are required to retain a copy of the assignment until results are finalised.

Faculty Style Guide Work submitted for this assessment must follow the REPORT style as outlined in the Faculty Q Manual.

|

The main methods of starting 3 phase induction motors

: Give the main methods of starting 3 phase induction motors. - Which method is considered best for starting squirrel cage induction motors.

|

|

How the author uses things like metaphor or allusion

: If a poem is open, describe how the author uses things like metaphor or allusion. Remember to include in text citations and a works cited page. This paper must be at least 1000 words, and this does not include the poems.

|

|

American psychological association

: View the American Psychological Association (APA) style report (6th edition). Next, review the APA requirements. Then, explain what you believe to be the most challenging aspect of APA formatting.

|

|

Limitations that prevent achievement of maximum power

: What are the main limitations that can prevent the achievement of maximum power in the transmission in practice?

|

|

Management strategy for a typical commercial bank

: 1. Define liquidity risk and distinguish between asset liquidity and liability liquidity management. What are the main features of an effective liquidity management strategy for a typical commercial bank?

|

|

What is the company cost of equity capital

: Skillet Industries has a debt–equity ratio of 1.5. Its WACC is 9 percent, and its cost of debt is 5.5 percent. The corporate tax rate is 35 percent. What is the company’s cost of equity capital? What is the company’s unlevered cost of equity capital?

|

|

Ethical considerations draft

: This week, you will submit your Ethical Considerations draft. This portion of the Course Project will provide an evaluation of the ethical considerations associated with the student's chosen technology in relation to its impact on humanity (roughl..

|

|

Representation of export tax on natural resource flows

: Provide a fully labeled graphical representation of an export tax on natural resource flows from a small country. How much is supplied in total? How much is supplied to the local market and how much to the international market before and after the ta..

|

|

Majority of high performance embedded

: Problem: A vast majority of High Performance Embedded systems today use RISC architecture why?

|