Reference no: EM131704979

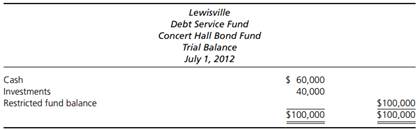

Question: (Journal entries, financial statements, and closing entries for a Debt Service Fund) The following are a trial balance and several transactions that relate to Lewisville's Concert Hall Bond Fund:

The following transactions took place between July 1, 2012, and June 30, 2013:

1. The city council of Lewisville adopted the budget for the Concert Hall Bond Fund for the fiscal year. The estimated revenues totaled $100,000, the estimated other financing sources totaled $50,000, and the appropriations totaled $125,000.

2. The General Fund transferred $50,000 to the fund.

3. To provide additional resources to service the bond issue, a property tax was levied upon the citizens. The total levy was $100,000, of which $95,000 was expected to be collected.

4. Property taxes of $60,000 were collected.

5. Revenue received in cash from the investments totaled $1,000.

6. Property taxes of $30,000 were collected.

7. The fund liability of $37,500 for interest was recorded, and that amount of cash was transferred to the fiscal agent.

8. A fee of $500 was paid to the fiscal agent.

9. Investment revenue totaling $1,000 was received in cash.

10. The fund liabilities for interest in the amount of $37,500 and principal in the amount of $50,000 were recorded, and cash for the total amount was transferred to the fiscal agent.

11. Investment revenue of $500 was accrued. Use the preceding information to do the following:

a. Prepare all the journal entries necessary to record the preceding transactions for the Concert Hall Bond Fund.

b. Prepare a trial balance for the Concert Hall Bond Fund as of June 30, 2013.

c. Prepare a statement of revenues, expenditures, and changes in fund balance and a balance sheet for the Concert Hall Bond Fund (assume all fund balance is restricted).

d. Prepare closing entries for the Concert Hall Bond Fund.