Reference no: EM131981

Background:

Performance Drinks, LLC is owned by Dave N. Port. Performance Drinks produces a variety of sports centered drinks. They began operations in 1993 shortly after Mr. Port graduated with his M.B.A. from Davenport University. The company saw early success as sports and fitness nutritional products gained new popularity in the 1990's. Financially the company is sound and has been wise in controlling their growth over the years. However, within the last 18 months Mr. Port has noticed a drop in overall company profitability. This is especially troubling considering that the company has continued to experience top-line growth. Mr. Port and his management team have been considering developing a new product line. However, those plans have been put on hold until they can figure out why their profits are shrinking.

Performance Drinks makes four different kinds of sports drinks. Those drinks are as follows:

- Basic

- Hydration

- Intensity

- Post-Workout

Each of these drinks contains a slightly different nutritional profile and is targeted for different users and uses. The Basic drink has the least nutritional benefit and is targeted for general consumption. The Hydration product targets endurance athletes and specializes in hydration replacement. The Intensity product was designed with energy enhancement in mind. It serves the needs of extreme athletes who need long durations of sustained energy. Lastly, the Post-Workout product is a nutritional replacement product that is generally used following exertion.

Information Related to Case #2:

You are the Controller for Performance Drinks. You feel as though you have a good handle on the financial reporting and the overall company performance. However, admittedly, your accounting information system has been designed to serve the needs of external users from an aggregate perspective. To that end you utilize absorption costing exclusively within the organization. You recall studying the concept of Activity Based Management (ABM) and Activity Based Costing (ABC) while taking a managerial accounting course. You wonder if applying those ideas to your business would help to uncover the mystery of the disappearing profits.

You recall from your Management Accounting class that product costs are comprised of:

- Direct Materials

- Direct Labor

- Manufacturing Overhead

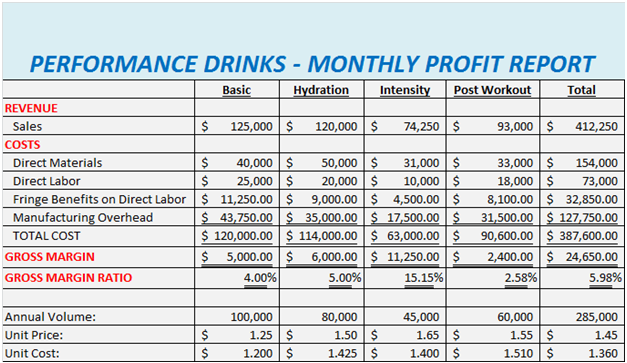

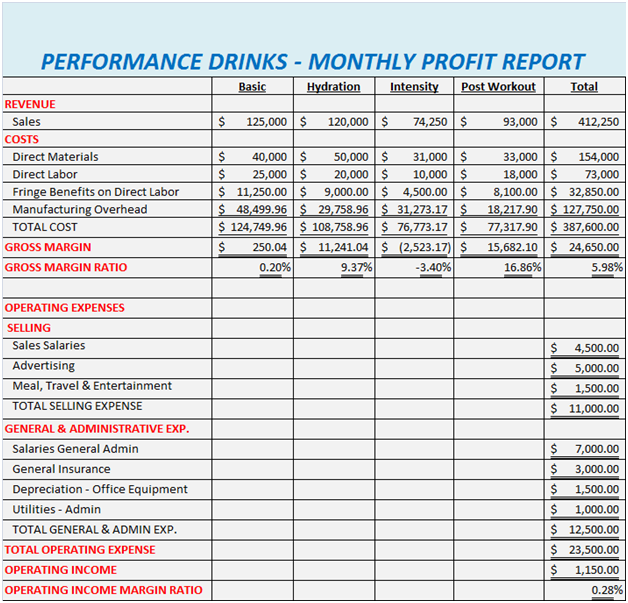

You don't suspect that anything strange is going with your direct costs. You do wonder, however, if a more thorough understanding of your indirect costs may be in order. Over a series of weeks you talk with a variety of employees, representing a multitude of functional areas, from within the company. During those conversations you take careful note on what activities might be consuming resources and how those activities might be measured. You sharpen your pencil and begin to unpack what you've learned. You start with reviewing last month's Product-Level Profit Report. That report is following:

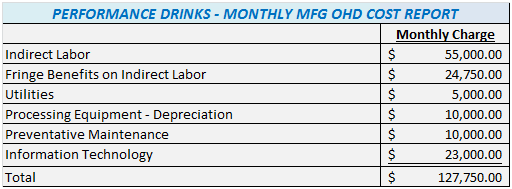

Since your primary area of focus is on the indirect costs you compile the following report which further details your overhead charges:

Overhead Activities:

Using traditional costing methods, which support your absorption costing system, you base overhead allocation on direct labor cost. Furthermore, "fringe benefits" are a function of direct labor cost.

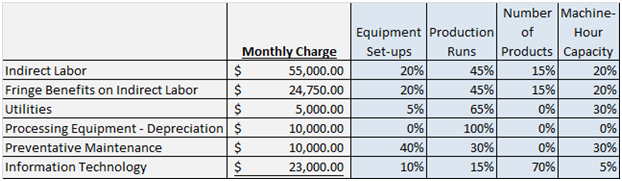

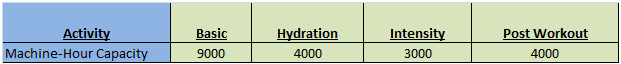

As a result of your many meetings to discuss company overhead you determine that the majority of your indirect costs are related to four primary activities. Those activities are equipment set-ups, production runs, production management and machine-hour capacity. "Production Management" refers to a number of items that are correlated to the number of products the company produces. Ultimately you determine that your key activities have the following usage patterns, as they pertain to the monthly overhead costs:

Upon reviewing budget data from the last budget cycle you discover that the monthly number of set-ups was estimated to be 85. The number of production runs was estimated to be 250. That monthly machine-hour capacity is presently at 20,000 machine-hours. Lastly, Performance Drinks produces a total of four products.

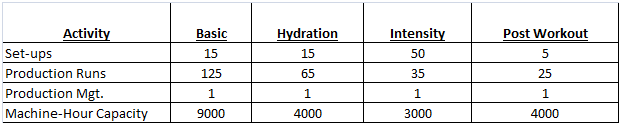

After talking with the Plant Manager you create the following usage data relative to products and activities:

New Information Pertaining to Case #3:

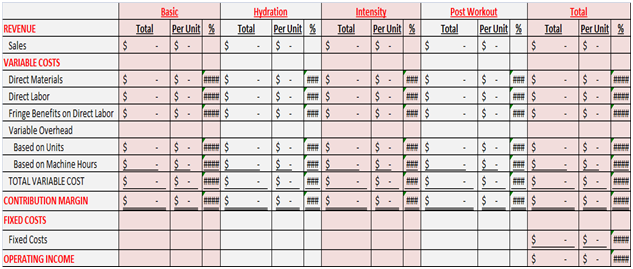

The financial reporting to date has been done using absorption costing. That is to say that the manufacturing costs included direct materials, direct labor, variable manufacturing overhead and fixed manufacturing overhead. In this sense the Income Statements have historically reported Gross Margin. Following is a Monthly Income Statement, based on absorption costing, for Performance Drinks:

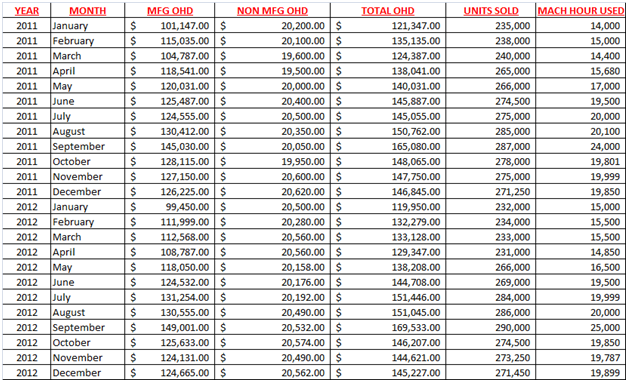

You begin to wonder if there would be any value in repackaging the income statement in a way that would report Contribution Margin as opposed to Gross Margin. You know that in order to report Contribution Margin you will need to understand your costs as variable and fixed. Unfortunately the general ledger does not specifically report costs as variable and fixed. You remember learning that regression analysis can be used to generate data that can be used to create a total cost equation. With the total cost equation we can understand our total cost as the sum of fixed costs and variable costs. After doing some research your collect the following data related to overhead and possible causal factors:

Requirement #1

Using the data above, which has also been provided electronically in Excel, run the following regression analyses:

- Linear regression analyzing total overhead cost and units sold

- Linear regression analyzing total overhead cost and machine hours used

- Multiple regression analysis analyzing total overhead cost along with both units sold and machine hours used

Requirement #2

Based on the results from the three regression analyses determine which correlation provides the best estimate of the total cost equation. Explain why you selected the correlation that you did.

Requirement #3

Write out the total cost equation using the results from the multiple regression test.

Requirement #4

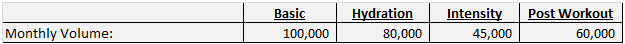

Create a "Contribution" formatted income statement using the results from the multiple regression test. Use the following additional information regarding machine hours, used by each product, which has also been provided in Excel electronically:

Reference the following sales volumes, by product, for your cost allocation related to units sold:

Use the following template as a guide for the format of your "Contribution" Income Statement:

Requirement #5

Compute the following:

- Break-even point in units

- Break-even point in sales dollars

- Targeted profit point in units (use $50,000 as your targeted profit point)

- Margin of Safety

Requirement #6

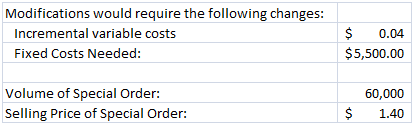

A new customer has surfaced. That customer has asked you to consider producing a special one-time order for them. This special order would require a modification to the recipe that will slightly increase the variable cost per unit. Furthermore, there would be a small fixed cost addition. The details for the order as follows:

Conduct a differential analysis regarding this special order. Would you accept this order under the conditions provided? Explain and defend your position.

Requirement #7:

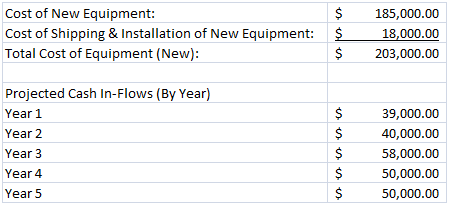

Your management team has asked you to consider investing in a new piece of equipment. The details of that investment opportunity are following:

The discount rate for this project is 5%. Compute the following:

- Net Present Value

- Internal Rate of Return

Would you recommend investing in this new piece of equipment? Explain and defend your position.