Reference no: EM13381401

Lease or Buy decision

Larine Industries wants an airplane available for use by its corporate staff. The airplane that the company wishes to acquire, a Superjet 25, can be either purchased or leased from the manufacturer.

Larine Industries' cost of capital is 20% and the tax rate is 30%.

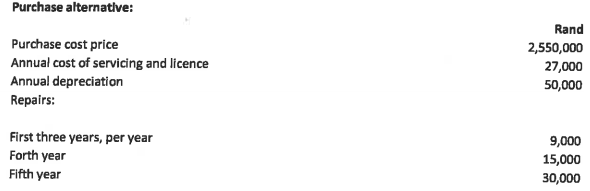

The company has made the following evaluation of the two alternatives:

The Superjet 25 would be sold after five years. Based on current values, the company would be able to sell it for one third of its original cost at the end of the five year period.

Lease alternative:

If the Superjet 25 is leased, then the company would have to make an immediate deposit of 8150 000 to cover any damage during use. The lease would run for five years, at the end of which time the deposit would be refunded.

The lease would require an annual rental payment of R600 000 at the end of each year. As part of the lease cost, the manufacturer would provide all servicing and repairs.

At the end of the five-year period, the plane would revert to the manufacturer, as owner.

Required:

1 Calculate the total after-tax cost of the present values of the cash flows associated with each alternative.

2 Which financial alternative would you recommend that the company accept? Why?