Reference no: EM13543392

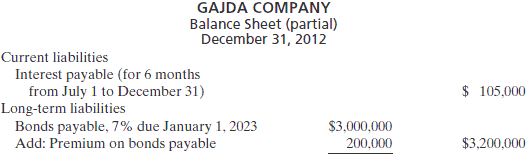

The following is taken from the Gajda Company balance sheet.

�

Interest is payable semiannually on January 1 and July 1. The bonds are callable on any semiannual interest date. Gajda uses straight-line amortization for any bond premium or discount. From December 31, 2012, the bonds will be outstanding for an additional 10 years (120 months).

Instructions

(a) Journalize the payment of bond interest on January 1, 2013.

(b) Prepare the entry to amortize bond premium and to pay the interest due on July 1, 2013, assuming no accrual of interest on June 30.

(c) Assume that on July 1, 2013, after paying interest, Gajda Company calls bonds having a face value of $1,200,000. The call price is 101. Record the redemption of the bonds.

(d) Prepare the adjusting entry at December 31, 2013, to amortize bond premium and to accrue interest on the remainingbonds.

|

Calculate equivalent units of transferred-in costs

: Calculate equivalent units of transferred-in costs, direct materials, and conversion costs - summarize total costs to account for, and calculate the cost per equivalent unit for transferred-in costs, direct materials, and conversion costs.

|

|

What was the investors actual real after tax rate of return

: What was the investors actual real after tax rate of return and the firm may ask a bank for which of the following to allow it to obtain the permits?

|

|

Prepare a multiple-column cash receipts journal

: Prepare a multiple-column cash receipts journal a multiple-column cash payments journal - record the transaction(s) for May that should be journalized in the cash receipts journal and cash payments journal.

|

|

Prepare adjusting entries required of financial statements

: For each of the followig separate cases prepare adjusting entries required of financial statements for the year ended (date of) December 31, 2013.

|

|

Journalize the payment of bond interest on january

: Journalize the payment of bond interest on January 1, 2013 - Prepare the entry to amortize bond premium and to pay the interest due on July 1, 2013, assuming no accrual of interest on June 30.

|

|

What portion of the total contract price

: Same facts as those shown on page 1139 except that Hamilton uses the cost-recovery method of accounting, what portion of the total contract price would be recognized as revenue in2013?

|

|

What is the cost of the raw materials requisitioned

: What is the cost of the raw materials requisitioned in June for each of the three jobs and how much direct labor cost is incurred during June for each of the three jobs?

|

|

Prepare an income statement for july

: Prepare an income statement for July, a retained earnings statement for July, and a balance sheet as of July 31 - Determine the amount of retained earnings as of July 1 of the current year.

|

|

What is the dollar amount of income

: London purchased a piece of real estate last year for $82,200. The real estate is now worth $103,400. If London needs to have a total return of0.20 during the year, then what is the dollar amount of income that she needed to have to reach her obje..

|