Reference no: EM131827074

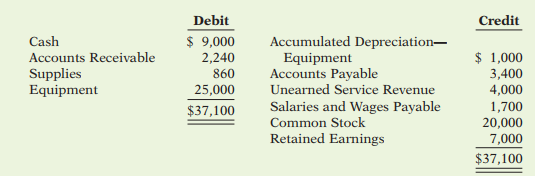

Question: On November 1, 2017, IKonk, Inc. had the following account balances. The company uses the perpetual inventory method.

During November, the following summary transactions were completed.

Nov. 8 Paid $3,550 for salaries due employees, of which $1,850 is for November and $1,700 is for October.

10 Received $1,900 cash from customers in payment of account.

11 Purchased merchandise on account from Dimas Discount Supply for $8,000, terms 2/10, n/30.

12 Sold merchandise on account for $5,500, terms 2/10, n/30. The cost of the merchandise sold was $4,000.

15 Received credit from Dimas Discount Supply for merchandise returned $300.

19 Received collections in full, less discounts, from customers billed on sales of $5,500 on November 12. 20 Paid Dimas Discount Supply in full, less discount. 22 Received $2,300 cash for services performed in November.

25 Purchased equipment on account $5,000.

27 Purchased supplies on account $1,700.

28 Paid creditors $3,000 of accounts payable due.

29 Paid November rent $375.

29 Paid salaries $1,300.

29 Performed services on account and billed customers $700 for those services.

29 Received $675 from customers for services to be performed in the future. Adjustment data:

1. Supplies on hand are valued at $1,600.

2. Accrued salaries payable are $500.

3. Depreciation for the month is $250.

4. $650 of services related to the unearned service revenue has not been performed by month-end. Instructions

(a) Enter the November 1 balances in ledger T-accounts.

(b) Journalize the November transactions.

(c) Post to the ledger accounts. You will need to add some accounts.

(d) Journalize and post adjusting entries.

(e) Prepare an adjusted trial balance at November 30.

(f) Prepare a multiple-step income statement and a retained earnings statement for November and a classified balance sheet at November 30.

(g) Journalize and post closing entries.