Reference no: EM13496276

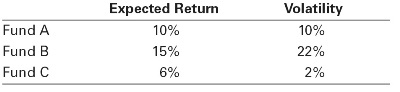

1.Assume the risk-free rate is 4%. You are a financial advisor, and must choose one of the funds below to recommend to each of your clients. Whichever fund you recommend, your clients will then combine it with risk-free borrowing and lending depending on their desired level of risk.

Which fund would you recommend without knowing your client’s risk preference?

2. Assume all investors want to hold a portfolio that, for a given level of volatility, has the maximum possible expected return. Explain why, when a risk-free asset exists, all investors will choose to hold the same portfolio of risky stocks.

3.In addition to risk-free securities, you are currently invested in the Tanglewood Fund, a broadbased fund of stocks and other securities with an expected return of 12% and a volatility of 25%. Currently, the risk-free rate of interest is 4%. Your broker suggests that you add a venture capital fund to your current portfolio. The venture capital fund has an expected return of 20%, a volatility of 80%, and a correlation of 0.2 with the Tanglewood Fund. Calculate the required return and use it to decide whether you should add the venture capital fund to your portfolio.

4.You have noticed a market investment opportunity that, given your current portfolio, has an expected return that exceeds your required return. What can you conclude about your current portfolio?

5.You are currently only invested in the Natasha Fund (aside from risk-free securities). It has an expected return of 14% with a volatility of 20%. Currently, the risk-free rate of interest is 3.8%. Your broker suggests that you add Hannah Corporation to your portfolio. Hannah Corporation has an expected return of 20%, a volatility of 60%, and a correlation of 0 with the Natasha Fund.

a. Is your broker right?

b. You follow your broker’s advice and make a substantial investment in Hannah stock so that,considering only your risky investments, 60% is in the Natasha Fund and 40% is in Hannah stock. When you tell your finance professor about your investment, he says that you made a mistake and should reduce your investment in Hannah. Is your finance professor right?

c. You decide to follow your finance professor’s advice and reduce your exposure to Hannah. Now Hannah represents 15% of your risky portfolio, with the rest in the Natasha fund. Is this the correct amount of Hannah stock to hold?

6.Calculate the Sharpe ratio of each of the three portfolios in Problem 5. What portfolio weight in Hannah stock maximizes the Sharpe ratio?

|

What is the amount of capital in excess of par

: What was the amount of retained earnings at the beginning of the year?

|

|

Calculate the normal force exerted by the incline

: A duffel bag of mass 15 kg slides down a 35o incline with an acceleration of 1.1 m/s2, Calculate the normal force exerted by the incline on the bag

|

|

Compute the amounts of dividends

: Compute the amounts of dividends, in total and per share, that would be payable to each class of stockholders.

|

|

What is the optimal fraction of your wealth

: What is the optimal fraction of your wealth to invest in the venture fund? (Hint:Use Excel and round your answer to two decimal places.

|

|

Is your finance professor right

: You follow your broker’s advice and make a substantial investment in Hannah stock so that,considering only your risky investments, 60% is in the Natasha Fund and 40% is in Hannah stock. When you tell your finance professor about your investment, he s..

|

|

Explain the enthalpy change during the reaction

: CH3OH(g) is decomposed by this reaction at constant pressure. (c) For a given sample of CH3OH, the enthalpy change during the reaction is 82.1 kJ

|

|

Differences between ordinary income and statutory income

: Explain using examples and relevant sections of the act, what the differences between Ordinary Income and Statutory income are. Use your own examples (not from MTG or Barkoczy text)

|

|

Obtain the magnitude and direction of the field

: A proton moves at 1.0x10^7 m/s perpendicularly to a uniform magnetic field. Determine the magnitude and direction of the field

|

|

Evaluate [oh-] or [h3o+] and ph for each solution

: For each of the following salt solutions, indicate whether the solution will be acidic, basic or neutral. Then using data given below, calculate [OH-] or [H3O+] and pH for each solution

|