Reference no: EM131519034

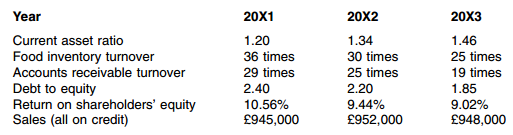

Question: The following financial information highlights the profitability and financial stability in the last three years of FlyingFood, one of Heathrow Airport's restaurants:

Required: Using the above information, answer each of the following questions, including an explanation of why you answered each question in this way.

(a) On average, is the restaurant extending a shorter or longer credit period to its customers?

(b) Over the years has more or less money been invested in food inventory?

(c) During the period, has the liquidity of the restaurant improved?

(d) Do you expect the shareholders to be satisfied with their return on investment? From the shareholders' point of view, is the profitability of the operation improving or not?

(e) Imagine that in 20X3 the restaurant wants to finance a proposed expansion through a loan. Relative to its financial position in 20X1 do you think it will be easier or harder to borrow?