Reference no: EM13217586

1) "If we held an economic "airing of grievances" (in the Seinfeld-inspired "Festivus" tradition), the Bank of Canada would surely express their disappointment that growth is stuck in neutral, once again significantly underperforming expectations. The main culprits are weak Canadian exports and investment which means that for growth to accelerate in 2014, added strength in these two areas will be critical.The other components of Canada's gross domestic product offer little potential upside. Highly-leveraged households are spending cautiously, the housing sector is slowing, and governments are restraining spending to balance budgets over the medium-term. Businesses generally have strong balance sheets but are delaying investments to expand their production capacities because of inadequate demand.

Canada's ongoing competitiveness challenges also remain a big concern, as seen by our declining share of global export markets in the past decade. One reason for optimism is the recent spate of good news on the trade front, which could provide a boost beyond 2014. This includes the recently-announced trade deal with the European Union (CETA), as well as the much narrower focus on "economic diplomacy" of Canada's foreign policy."

- Globe and Mail, Dec. 2013

a) Use a diagram to show the effects of weak exports and investment on actual versus potential GDP in the Canadian macroeconomy.

b) How might the announced trade deal with the European union provide a source of optimism?

c) Suppose that optimism causes Canadian businesses to feel more confident and that simultaneously there signs of strong economic growth in the USA. What should the government or the Bank of Canada do if anything? Explain using aggregate demand/ aggregate supply analysis.

2. Discuss how capacity utilization and product differentiation affect internal rivalry and entry barriers with the analytical framework of the Porter 'Five Forces' model. Use the economic theories of costs and production and market structure to justify your arguments.

3. Suppose that in a perfectly competitive industry the market price of the product is $48. Firm A is producing the output level at which average cost is $60, marginal cost is $48 and average variable cost is $30. If the short term, what should firm A do in order to maximize profits?

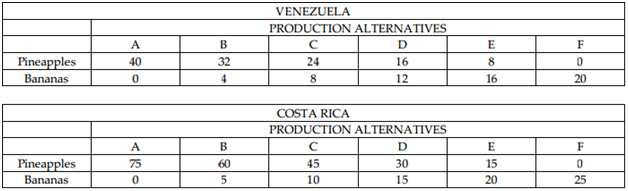

4. The Consider the following tables which show alternatives for producing pineapples and bananas in Venezuela and Costa Rica (in the absence of trade between the two countries).

a. Does each country have an absolute advantage in the production of a good? Explain.

b. Determine which country has a comparative advantage in the production of each good. Explain your answer.

c. Suppose that in the absence of trade, each country chooses production alternative C.

Show how specialization and trade could leave each country better off compared to the no-trade situation.

5) The marketing manager of Townsend Company Ltd. has been asked to submit a pricing recommendation for a new product. Demand analysis suggests that the price elasticity of demand is -3.0. According to the production manager, there are two options for the firm;

Option A: the firm will need to make a lump sum investment of $1million for custom tools and marginal cost will be constant at approximately $18 per unit.

Option B: the firm can use less customized tools with a lump sum investment of $500,000 and marginal cost will be constant at approximately $40 per unit.

What price should the marketing manager suggest for each option in order for the firm to maximize profit? Does the marketing manager have enough information to recommend which option the firm should take? Explain.

6) A manufacturer of pencils contemplates backward integration into the production of rapeseed oil, a key ingredient in manufacturing the eraser component of the pencil. Rape seed oil is traded in world commodity markets and its price fluctuates as supply and demand conditions change. The argument that has been made in favor of vertical integration is this "Our costs of production are significantly lower if we operate at full capacity. If we owned and controlled our own supply of rape seed oil we would be insulated from short-term fluctuation in supply. This would enable us to maintain low cost production and would give us a competitive advantage over our rivals." Would you vertically integrate into rape seed oil? Explain why or why not.

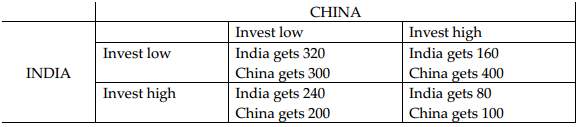

7) Consider the following game (see payoff matrix below) in which the India and China must decide whether to invest a high or a low amount into 3D printing technologies. The payoff numbers represent the economic benefits to each country in billions of dollars per

year.

8) Suppose two firms compete in the same market with identical products.

a. Explain what will happen if the firms compete by choosing output levels (quantity competition). Draw a diagram that illustrates this.

b. Explain what will happen if firms compete by choosing price (price competition). Draw a diagram that illustrates this.

c. In the case of quantity competition between two firms, what would they do if there were no legal impediments to explicit collusion?

9) Publishers of even the smallest daily newspapers usually own their own printing presses but even the largest book publishers normally contract out their printing jobs to independent printers. What accounts for this difference?

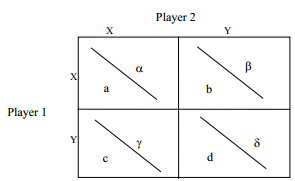

10) Consider the following one-shot, simultaneous-move game between Player 1 and Player 2. Player 1's payoffs are given by a, b, c, and d, while player 2's payoffs are α, β, γ, and δ.

a) Construct a payoff ordering for this game so that Player 1 has a dominant strategy and Player 2 has a strategy which is "do the opposite of player 1". Is there a unique (pure strategy) Nash equilibrium in this game? Explain.

b) Suppose the game you constructed in (a) is changed to a sequential-move encounter in which player 1 moves first followed by player 2. Draw the extensive form of the sequential-move game and calculate the sub-game perfect Nash equilibrium.

c) Does your sequential game in (b) indicate a first-mover or a second-mover advantage?

11) What have been the key elements of China's economic development strategy between 1989 and 2009? What opportunities and challenges still face China today?

12) The Allentown Corporation is a retail seller of sofas in Ontario. The CEO has set a profit target of $15,000 per month. Currently the price per sofa is $400 and average variable cost is $150. Allentown's monthly fixed costs are $4000 per month.

a. How many sofas does Allentown have to sell per month to make the CEO's profit target? What is average total cost when the firm is making the profit target?

b. A large department store chain located in New York State (where you have no retail stores) has made an offer to purchase 100 sofas per month from you at a discounted price of $300 per sofa. In order to sign this contract while continuing to sell sofas in in Ontario (at the monthly quantity you determined in part (a) at a price of $400), Allentown must expand its production facilities and invest in machinery and tools. The expansion will mean an additional $10,000 in fixed costs per month; however the investment will also cause average variable cost to decline to $100 per sofa. How much profit does Allentown stand to make per month if it signs a contract with the Department store? What will average total cost be after signing and fulfilling the contract?

c. Would you recommend signing the contract? Explain why or why not.

13. You are given market data that says when the price of pizza is $4, the quantity demanded of pizza is 60 slices and the quantity demanded of cheese bread is 100 pieces. When the price of pizza is $2, the quantity demanded of pizza is 80 slices and the quantity demanded of cheese bread is 70 pieces.

Can the Price-Elasticity of Demand be calculated for either good? If so, calculate the price elasticity of demand.

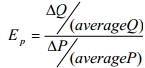

To calculate a price elasticity, use the following formula:

-

14) Wal-Mart has just built a new store in Martinsville, IN. Given the current population and spending habits in the local market, Wal-Mart is currently earning a profit that just covers its cost of capital, despite the fact that it is currently a monopolist in this geographic market area. In the next five years, market demand is expected to double in size. Is it likely that a second discount retailer will enter as a competitor for Wal-Mart when this happens? Explain using the economic analysis of market structure.

15) Explain how globalization and advances in information technology might affect the trade-offs between technical and agency efficiency? Provide at least one example to support your arguments.

16) Suppose two countries have exactly the same amount and quality of workers and capital and both countries produce the same two goods. If production of these two goods is characterized by economies of scale, can the two countries gain from trading with one another? Explain.

17). Two firms are competing in a Cournot market structure. Alpha Corporation is considering an investment in new production technology, which will result in lower variable (marginal) costs for the company. Alpha's competitor, Beta Inc., does not have access to the resources necessary for a similar investment. Alpha's financial planners have reported that at current output levels the present value of the cost saving from the investment is slightly less than the cost of the project. However, as a strategy consultant, you point out that a proper analysis of the project would take the investment's effect on output decisions (of both firms) into account. What do you expect such analysis will show? Explain.

18). If a large economy is experiencing an inflationary gap then what would happen to wages and prices? Illustrate the effect using an AD/SRAS diagram. If the central bank is targeting inflation then how would the central bank respond and what effect would this response have on interest rates and on investment spending on physical assets such as new capital equipment and factories?

19). There are some who argue that tariff removal is only beneficial to Canada if Canada's trading partners reciprocate by removing their tariffs. Use a supply and demand analysis to analyse the impact of Canada unilaterally removing a tariff on an imported good (i.e. trading partners keep their tariffs). Show which Canadians win and which Canadians lose from tariff reduction by examining changes to Canadian consumer surplus, Canadian producer surplus and tariff revenue for the Canadian government. Determine whether tariff removal is in the collective Canadian interest. (i.e. could the winners compensate the losers and still be better off.