Reference no: EM13921800

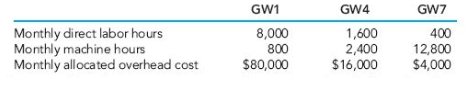

LO. 1 ( Overhead application) Last June, Lacy Dalton had just been appointed CFO of Garland & Wreath when she received some interesting reports about the profitability of the company’s three most important product lines. One of the products, GW1, was produced in a very labor- intensive production process; another product, GW7, was produced in a very machine- intensive production process; and the third product, GW4, was produced in a manner that was equally labor and machine intensive. Dalton observed that all three products were produced in high volume and were priced to compete with similar products of other manufacturers. Prior to receiving the profit report, Dalton had expected the three products to be roughly equally profitable. How-ever, according to the profit report, GW1 was actually losing a significant amount of money and GW7 was generating an impressively high profit. In the middle, GW4 was producing an average profit. After viewing the profit data, Dalton developed a theory that the ‘‘ real’’ profitability of each product was substantially different from the reported profits. To test her theory, Dalton gathered cost data from the firm’s account-ing records. Dalton was quickly satisfied that the direct material and direct labor costs were charged to products properly; however, she surmised that the manufacturing overhead allocation was distorting product costs. To further investigate, she gathered the following information:

Dalton noted that the current cost accounting system assigned all overhead to products based on direct labor hours using a predetermined overhead rate.

A). Using the data gathered by Dalton, calculate the predetermined OH rate based on direct labor hours.

B). Find the predetermined OH rate per machine hour that would allocate the current total overhead ($ 100,000) to the three product lines.

C). Dalton believes the current overhead allocation is distorting the profitability of the product lines. Determine the amount of overhead that would be allocated to each product line if machine hours were the basis of overhead allocation.

D). Why are the overhead allocations using direct labor hours and machine hours so different? Which is the better allocation?

|

Compare and contrast leadershilp styles

: Leadership is improtant in shaphig the culture of an organization. With regard to this, compare and contrast leadershilp styles - Demonstrate competence in the use of written and oral communication skills using a range of techniques and technology.

|

|

Lesley used the effective interest rate method

: What item(s) in the table would appear on the 2016 statement of cash flows?

|

|

Find the revenue maximizing output and price

: Find the revenue maximizing output and price. Calculate the total revenue. Is this outcome on the elastic, inelastic, or unitary elastic part of the demand curve?

|

|

What is the issue discussed in the visual media item

: What is the creator's viewpoint on the issue? What details in the resource support the author's claim? Provide evidence from the item to support your response.

|

|

Intensive production process

: Lacy Dalton had just been appointed CFO of Garland & Wreath when she received some interesting reports about the profitability of the company’s three most important product lines. One of the products, GW1, was produced in a very labor- intensive prod..

|

|

Diameters of mature pine and spruce trees

: A field researcher is gathering data on the trunk diameters of mature pine and spruce trees in a certain area. The following are the results of his random sampling. Can he conclude, at the 0.10 level of significance, that the average trunk diame..

|

|

Calculate the point elasticities for price and income

: The BJC Company has the following demand function: Calculate the point elasticities for price and income. Is the product a normal or an inferior good?

|

|

What will happen to revenue if the company raises its price

: Is demand elastic or inelastic? What will happen to revenue if the company raises its price?

|

|

What is the overall effect on equilibrium price

: The market for gasoline has changed in a couple significant ways over the last few years: new technologies have decreased the costs associated with producing gasoline, and automobiles are becoming more fuel efficient. Describe how these changes af..

|