Reference no: EM13676723 , Length: 1742 Words

Essay 1

Option a. Monetary Policy

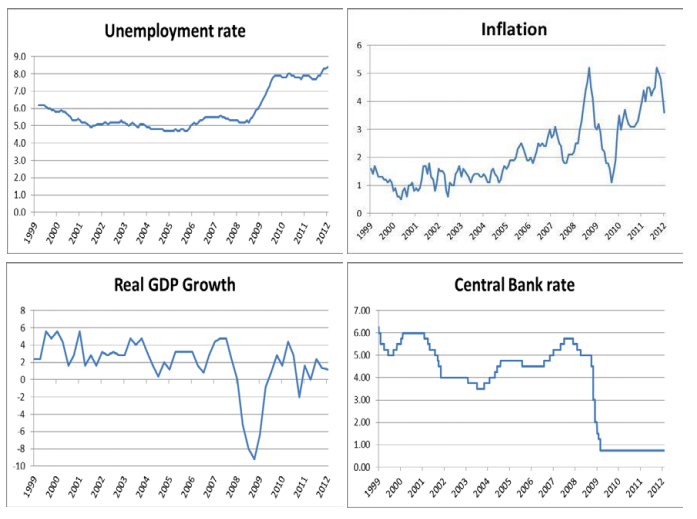

We are in 2012 and you have just been appointed Governor of the Central Bank of a hypothetical advanced economy, and you have to chair your first Monetary Policy meeting. The charts below display three major indicators for the economy, together with the Central Bank rate, your main policy tool (your economy operates under a free floating exchange rate regime, and the Central Bank is independent).

What should you do? Briefly but carefully explain the pros and cons.

Note: You should focus on answering the question asked, based on the information given only; there is no need or interest in second guessing which country it could be.

Option b. Russian public debt downgrade

Standard and Poors, a rating agency, has very recently downgraded Russia's credit rating. It is now below the level that is considered "investment grade", which reflects growing fears that Russia will not be able, or willing to, service its public debt.

Russia's current public debt level is however very low (around 16% of GDP). Carefully explain the mechanisms by which current conditions in Russia could lead to a sovereign debt crisis.

Note: for this essay, you may want to have a look at some data or articles (see for instance this one) in order to get a good overview of current conditions. Please keep however in mind that I am interested in how you relate this to the course theoretical frameworks and the class discussions rather than a summary of newspaper articles.

Essay 2

Deep macro forces

We have discussed deep macroeconomic forces that have reshaped the business environment in the past few decades (ICT, globalization, and deregulation). We have also explored what new forces could potentially prevail in the decades to come (sustainability, demographics, re-regulation, and many others).

1. Pick a sector that you know well and identify and discuss the key macro risks for the coming five to ten years. (Hint: thinking both in terms of value added and profitability could be useful.)

2. Consider the longer term and come up with an original scenario where a deep macroeconomic force completely reshapes this sector's environment. (Hint: think of new kinds of competitors, threat to existing market structure, market price, competition for key resource, etc.). Discuss the underlying business opportunities that this would create (in this sector, or related ones).

3. If you knew for sure that this scenario was to happen in the near future, what kind of investment would put you in the best position to take full advantage of your foresight (in physical and/or human capital)?