Reference no: EM131477113

Question: ‘The sauce', a well-known pizza factory, have asked you to evaluate the factory free cash flow (FCF) activity. You have estimated that the FCF of the factory is $4,500,000, its WACC is 12.5% and its estimated growth is 5% each year. If you know that ‘The sauce' debt is $19,000,000 and it has 6,500,000 outstanding shares, what should be the share's price? Repeat the question by using mid-year discounting as well.

1. XYZ Corp. has just paid a dividend of $5 per share. You think this dividend will grow at 8% per year. If you think the correct discount rate for the dividend stream of XYZ is 25%, how much should you be willing to pay for the stock?

2. You just bought a share of ABC Corp. for $28. The company has just paid a dividend of $2 per share, and you anticipate that this dividend will grow at a rate of 12% per year. What is your implied cost of equity for ABC?

3. You are considering purchasing a stock of ABC Corp, which has just paid a $3 annual dividend per share. The company does not repurchase any of its shares. You anticipate that the company's dividends will grow at a rate of 20% per year for the next 5 years. After this time, you think that the growth of the annual dividends will slow to 5% per year. If your cost of equity for ABC is 10%, what price should you be prepared to pay for the stock?

4. Suppose that a firm is financed with 70% equity and 30% debt. The interest rate on debt is 8%, and the expected return on the common stocks is 17%. The firm's tax rate is 40%. What is the firm's weighted average cost of capital?

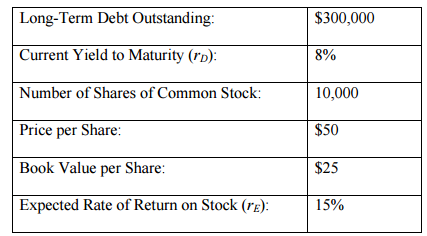

5. are given the following information for Twin Inc.

a) Calculate Twin Inc.'s weighted-average cost of capital (assuming that the firm pays no taxes).

b) How would rE and the weighted-average cost of capital change if Twin Inc.'s stock price falls to $25 due to declining profits? Assume that business risk is unchanged.

|

European exploration of north america

: Why did the Monarchy continue to support explorers who did not bring back large amounts of gold and spices?

|

|

Define the risk free rate

: You are considering a new project to your firm. This project requires investment of $500,000 and generates cash flow of $70,000 for the next 10 years.

|

|

Define business continuity risk management

: FINC20019 - Demonstrate your understanding of classical and modern, domestic and global operations of money and capital markets

|

|

Earnings of the alpha corporation

: It known that when the earnings of the Alpha Corporation go up, its stock price usually goes up. In fact, when earnings go up in one quarter, 65%.

|

|

How would re and weighted-average cost of capital change

: ‘The sauce', a well-known pizza factory, have asked you to evaluate the factory free cash flow (FCF) activity. You have estimated that the FCF of the factory.

|

|

Write essay describing your thoughts after you watch movie

: Watch movie Sound and Fury, write an essay describing your thoughts after you watch the movie. Please don't copy other essay.

|

|

Claim as a mathematical statement

: For the statement below, write the claim as a mathematical statement. State the null and alternative hypotheses and identify which represents the claim.

|

|

Describes the steps you took to receive the grant

: Prepare a presentation to the board that describes the steps you took to receive the grant and how the organization should now manage this grant.

|

|

Perform a formal swot analysis

: Determine which stakeholder groups have the most influence on each of the elements identified in the formal SWOT analysis.

|