Reference no: EM132436376

Question

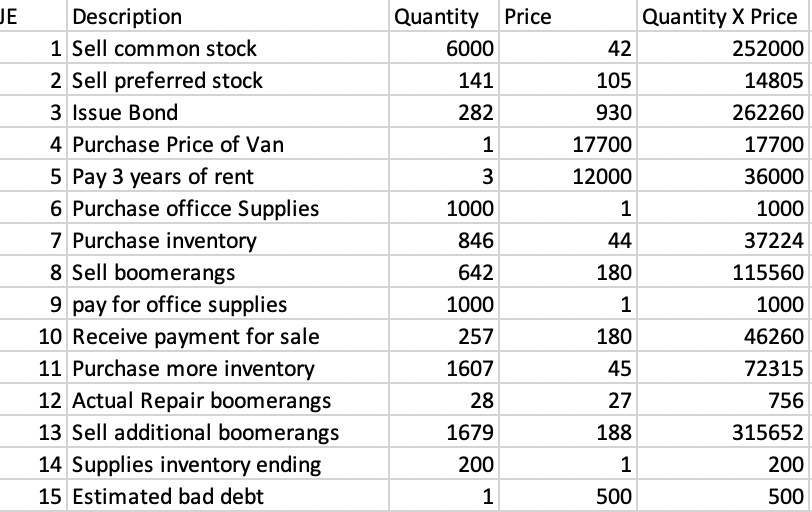

How to record the journal entries for these 7 questions

Question (1) Jenny issues shares of $1 par common stock for cash.

Question (2) She issues shares of $100 par 5% cumulative preferred stock for cash.

Question (3) She issues 5 year 10% coupon bonds for cash and receives 93% of the face value of the bonds. Each bond has a $1,000 face value. The bonds pay interest once per year beginning December 31st 2019. The market rate of interest for these bonds (yield) was 12%.

Question (4) On January 2nd, Jenny purchased a delivery van for cash. Jenny estimates that the business will use the van for 8 years and that it will have a resale value after 8 years for 30% of the purchase price. In addition to the purchase price of the van, Jenny had to pay $1,000 for tax and delivery charges.

Question (5) Also on January 2nd, Jenny signed a three year lease on retail space at the local mall. The rent on the retail space is normally $1,100 per month. However, the landlord offers a discount if tenants prepay the rent. Jenny pays $36,000 in cash for three years of rent ($1,000 per month).

Question (6) In her final transaction for January 2nd, Jenny purchase office supplies on account.

Question (7) On January 3rd, Jenny purchased boomerangs from a boomerang factory for cash.