Reference no: EM13177690

As discussed in the chapter, an important consideration in evaluating current liabilities is a company's operating cycle. The operating cycle is the average time required to go from cash to cash in generating revenue. To determine the length of the operating cycle, analysts use two measures: the average days to sell inventory (inventory days) and the average days to collect receivables (receivable days). The inventory-days computation measures the average number of days it takes to move an item from raw materials or purchase to final sale (from the day it comes in the company's door to the point it is converted to cash or an account receivable). The receivable days computation measures the average number of days it takes to collect an account.

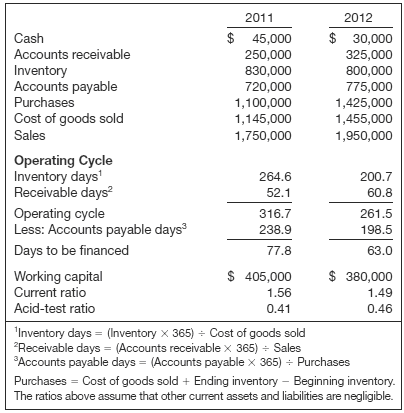

Most businesses must then determine how to finance the period of time when the liquid assets are tied up in inventory and accounts receivable. To determine how much to finance, companies first determine accounts payable days-how long it takes to pay creditors. Accounts payable days measures the number of days it takes to pay a supplier invoice. Consider the following operating cycle worksheet for BOP Clothing Co.

�

These data indicate that BOP has reduced its overall operating cycle (to 261.5 days) as well as the number of days to be financed with sources of funds other than accounts payable (from 78 to 63 days). Most businesses cannot finance the operating cycle with accounts payable financing alone, so working capital financing, usually short-term interest-bearing loans, is needed to cover the shortfall. In this case, BOP would need to borrow less money to finance its operating cycle in 2012 than in 2011.

Instructions

(a) Use the BOP analysis to briefly discuss how the operating cycle data relate to the amount of working capital and the current and acid-test ratios.

(b) Select two other real companies that are in the same industry and complete the operating cycle worksheet on the previous page, along with the working capital and ratio analysis. Briefly summarize and interpret the results. To simplify the analysis, you may use ending balances to compute turnoverratios.

|

Prepare an amortization table for sycamore

: Prepare an amortization table for Sycamore Co. assuming the effective interest method is used and prepare an amortization table for Sycamore Co. assuming the market rate was 6% and the effective interest method is used

|

|

Find any absolute or local maximum and minimum values

: find any absolute or local maximum and minimum values of f(x)=8-2x if x≥6.

|

|

Determine price elesticity of demend

: Studies indicate that the price elasticity of demand for cigarettes is about .4. If a pack of cigarettes currently costs $2, and the government wants to reduce smoking by 20 percent, by how much should it increase its price?

|

|

What is the percent of decrease

: A handbag originally cost $85.00. Now it is priced at $68.00. What is the percent of decrease?

|

|

How the operating cycle data relate to working capital

: Use the BOP analysis to briefly discuss how the operating cycle data relate to the amount of working capital and the current and acid-test ratios.

|

|

How the operating cycle data relate to working capital

: Use the BOP analysis to briefly discuss how the operating cycle data relate to the amount of working capital and the current and acid-test ratios.

|

|

What is the equivalent present value of series of payments

: What is the equivalent present value of the following series of payments: $7000 the first year, $6500 the second year, $6000 the third year, $5500 the fourth year, and $5000 the fifth year? The interest rate is 10%, compounded annually. Answer: $2..

|

|

Determine the following before deciding a prescription

: Determine the following before deciding a prescription: (a) maximize effectiveness at the least cost; (b) maximize effectiveness at a fixed cost of $10,000; (c) achieve a fixed-effectiveness level of 6,000 units of service at a fixed cost of $20,0..

|

|

Calculate the f-statistic to two decimal places

: The BETWEEN groups sum of squares was calculated to be 1,892.6, and the WITHIN groups sum of squares was calculated to be 14,482.9. (NOTE: These are not the mean sum of squares) Calculate the F-statistic to two decimal places.

|