Reference no: EM13492001

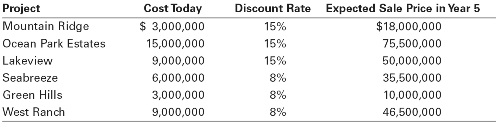

1.Kaimalino Properties (KP) is evaluating six real estate investments. Management plans to buy the properties today and sell them five years from today. The following table summarizes the initial cost and the expected sale price for each property, as well as the appropriate discount rate based on the risk of each venture.

a. What is the IRR of each investment?

b. What is the NPV of each investment?

c. Given its budget of $18,000,000, which properties should KP choose?

d. Explain why the profitably index method could not be used if KP’s budget were $12,000,000 instead. Which properties should KP choose in this case?

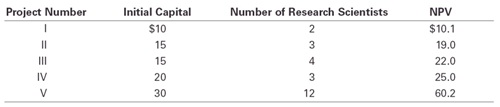

2.Orchid Biotech Company is evaluating several development projects for experimental drugs. Although the cash flows are difficult to forecast, the company has come up with the following estimates of the initial capital requirements and NPVs for the projects. Given a wide variety of staffing needs, the company has also estimated the number of research scientists required for each development project (all cost values are given in millions of dollars).

a. Suppose that Orchid has a total capital budget of $60 million. How should it prioritize these projects?

b. Suppose in addition that Orchid currently has only 12 research scientists and does not anticipate being able to hire any more in the near future. How should Orchid prioritize these projects?

c. If instead, Orchid had 15 research scientists available, explain why the profitability index ranking cannot be used to prioritize projects. Which projects should it choose now?

Project PI NPV/Headcount

I 1.01 5.1

II 1.27 6.3

III 1.47 5.5

IV 1.25 8.3

V 2.01 5.0

|

Explain which equation represents the rate of reaction

: For the reaction below, which equation represents the rate of reaction. 6CH2O + 4NH3 (CH2)6N4 + 6H2O

|

|

How high must the person climb

: An 63 kg weight watcher wishes to climb a mountain to work o? the equivalent of a large piece of chocolate cake rated at 690 kcal (1 kcal = 1000 cal). How high must the person climb

|

|

Evaluate the standard potential for the cell

: A galvanic (voltaic) cell consists of an electrode composed of aluminum in a 1.0 M aluminum ion solution and another electrode composed of copper in a 1.0 M copper(II) ion solution, connected by a salt bridge. Calculate the standard potential for ..

|

|

What is the maximum possible total current

: In this simulation you can choose between seven possible circuits by clicking on one of the small circuit diagrams shown at the upper right. What is the maximum possible total current that can be obtained in this simulation

|

|

How should orchid prioritize these projects

: Suppose in addition that Orchid currently has only 12 research scientists and does not anticipate being able to hire any more in the near future. How should Orchid prioritize these projects?

|

|

Calculate sem pty ltds taxable income

: Sections of the Acts and relevant case law how the Revenue and Expense items (together with the Notes) in the company's accounts are treated for tax purposes and calculate SEM Pty Ltd's taxable income for 2011/12

|

|

Evaluate the volume in liters at stp occupied by he

: A 1.91 L flask at 17degree contains a mixture of Nitrogen , He and Ne at partial prassure 0f 0.261 atm for N2, 0.195 atm for He, and 0.397 for Ne. Calculate the volume in liters at STP occupied by He and Ne if the N2 is removed.

|

|

Evaluate partial pressures of nitrogen and hydrogen

: Sample of ammonia gas is completely decoposed to nitrogen and hydrogen gases over heated iron wool. If the total pressures is 661mmHg after the reaction. Calculate partial pressures of nitrogen and hydrogen.

|

|

Advise taxpayer whether the amount is assess or not

: Advise the taxpayer whether the amount of $500,000 is assessable under s6-5.[Cite relevant authority.](b) Advise the taxpayer whether the Arthur Murray principle applies to some orall of the $1,200,000 amount.Other Information

|