Reference no: EM131623938

Question: Mike and Julie Bedard are a working couple. They will file a joint income tax return. This year, they have the following taxable income:

1. $125,000 from salary and wages (ordinary income)

2. $1,000 in interest income

3. $3,000 in dividend income

4. $2,000 in profit from sale of a stock they purchased two years ago

5. $2,000 in profit from a stock they purchased this year and sold this year

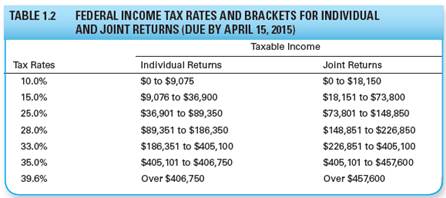

Use the federal income tax rates given in Table to work this problem.

a. How much will Mike and Julie pay in federal income taxes on item 2 above?

b. How much will Mike and Julie pay in federal income taxes on item 3 above? (Note: Remember that dividend income and ordinary income are taxed differently.)

c. How much will Mike and Julie pay in federal income taxes on item 4 above?

d. How much will Mike and Julie pay in federal income taxes on item 5 above?