Reference no: EM131974783

Assignment

Practice Problem -Ch .6

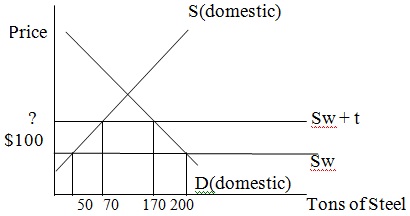

Use the following graph to answer the questions below.

a. Assume that the world price of steel is $100 per ton, and that the United States is a small country in the world market of steel. Under free trade, how much of Steel is consumed in the US? How much do the domestic producers produce? How much is imported?

b. Assume that the US imposes a 40 percent tariff on steel imports. Show the effects on the graph. What is price after tariff? How much is imported after tariff? How much do domestic producers supply?

c. Explain the welfare effects of tariffs by computing and comparing the individual effects in this example: effect on the domestic producers; effect on the domestic producers (known as the redistributive effect); production inefficiency effects; revenue effects; and consumption inefficiency effects. (Explain by calculating dollar values of the relevant areas for each effect).

d. Calculate dead weight loss from tariff in the graph above.

e. If, instead of the tariff, a quota were used by the United States, would dead weight loss be smaller or larger? Explain your answer.

Questions:

1. If the consumption effect of a tariff were 50 units and the production effect of a tariff were 40 units, then imports would

a) Increase by 10 units.

b) Increase by 90 units.

c) Decrease by 90 units.

d) Decrease by 10 units.

2. If a tariff in a small country produces a deadweight loss of $60, reduces consumer surplus by $200, and increases producer surplus by $40, which of the following is correct?

a) National welfare falls by $220.

b) National welfare falls by $160.

c) Tariff revenues equal $100.

d) The price of the imported good must have fallen.

3. Which of the following must be true if a large nation imposes a tariff on an imported good?

a) The price received by domestic producers will fall.

b) The price received by foreign producers will fall.

c) Domestic consumers will gain.

d) The nation will gain.

4. A large nation imposes a tariff on an imported good, which causes the world price to fall by $4. At the new world price the large nation has deadweight losses of $500 and imports of 300. Which of the following must be true?

a) The large nation has gained.

b) Domestic producer surplus has fallen.

c) Domestic consumer surplus has increased.

d) Total tariff revenues must be less than the deadweight loss.

5. If a tariff of $10 per unit reduces the world price by $4, then

a) The nation imposing the tariff must be a small nation.

b) Domestic consumers pay $6 of the $10 per unit tariff.

c) Foreign producers pay $6 per unit of the $10 per unit tariff.

d) The nation imposing the tariff must necessarily lose.

6. Given that the imposition of a tariff will improve the welfare of a large nation, which of the following is true?

a) World welfare will increase if all large nations impose the tariff.

b) The large nation's gains are equal to its trading partners' losses.

c) World welfare will fall.

d) Large nations should impose a prohibitive tariff.

7. If a nation imposes a tariff on laptop screen, an important input in the production of laptops then

a) The nominal tariff on laptops will increase.

b) The rate of effective protection on computer screen will decrease.

c) The rate of effective protection on laptops will decrease.

d) Employment in the laptop producing industry will increase.

Chapter: 7- Practice Questions

1) Japanese tariffs and quotas reduce national welfare the most in

A) agriculture.

B) machinery.

C) textiles.

D) clothing.

E) chemical products

2) U.S. tariffs and quotas reduce national welfare the most in

A) agriculture.

B) machinery.

C) textiles.

D) clothing.

E) chemical products.

3) In the United States, the average cost to consumers for each job saved with protection is

A) approximately $12,000.

B) approximately $55,000.

C) approximately $69,000.

D) well over $100,000.

4) Two sectors of economic activity that were not part of the General Agreement on Tariffs and Trade until the Uruguay Round made them part of the WTO are

A) steel and cars.

B) textiles and agriculture.

C) agriculture and computers.

D) aircraft and cars.

E) textiles and cars.

5) The pattern of protection in industrial countries is particularly harmful to the interests of

A) low-income developing countries.

B) high-income industrial countries.

C) Asian nations.

D) European nations.

E) None of the above.

6) High-income industrial nations such as the United States and Japan tend to have their highest tariffs in

A) newer, high-technology manufacturing industries.

B) capital-intensive, diversified manufacturing.

C) agriculture, clothing, and textiles

D) Both A and B.

E) None of the above.

7) One reason why consumers are unlikely to be too upset about tariffs is because

A) most consumers benefit from protection.

B) tariffs are an inexpensive way to create jobs.

C) consumer losses are not real losses.

D) the costs are so spread out that no one pays a big share of the total.

E) the gains of producers are larger.

8) One reason why producers have an incentive to organize in favor of protection is because

A) producer gains are spread across so many firms that no one gets a large share of the benefits.

B) producer gains are relatively concentrated.

C) there is no real cost to the economy.

D) producer gains outweigh consumer losses.

E) it is a cheap way to keep their employees happy.

9) A major difficulty with the infant industry argument for protection is that

A) government revenue will fall with a tariff.

B) it requires the nation to fall into the large country case for tariff protection.

C) effective rates of protection are usually greater than nominal rates.

D) Whether the industry will succeed in the long run is hard to predict and uncertain.

E) the productivity of infant industries is usually declining.

10) The optimal way for a nation to protect its access to a strategic mineral is with

A) an infant industry tariff.

B) a high rate of effective protection to keep local mines in business.

C) a quota on imports of the mineral.

D) a low nominal rate of protection.

E) a stockpile building

11) Which of the following products has the highest cost per job saved from protection in the European Union?

A) Agriculture

B) Clothing

C) Textiles

D) Television programming

E) Steel

12) Economic sanctions

A) usually work to create policy change in the targeted country.

B) are more likely to work if the international community supports them.

C) are more likely to work if military force is not used.

D) never work to create policy change in the targeted country.

E) Both A and B.

13) A countervailing duty is a tariff that is levied to counteract

A) the dumping of goods in the domestic market by foreign firms.

B) a sudden surge of imports which hurt a domestic industry.

C) subsidies given to foreign firms by their own governments.

D) the tariff on domestic goods that are enacted by foreign governments.

E) low prices for imported goods that are made in countries with low wages.

14) Dumping occurs when a firm

A) sells too much of a good in a foreign country.

B) sells in a foreign country at prices that are below fair value.

C) sells in its home market at prices that are below the average price charged by its competitors.

D) sells in a foreign market at prices that are below the prices charged by firms based in the foreign market.

E) charges more than a fair price.

15) If a country makes it onto the United States' Super 301 list, it means that the country has

A) exceeded average import growth by more than 301 percent.

B) exceeded average export growth by more than 301 percent.

C) tariffs that are above 301 percent.

D) been charged by the United States with systematically engaging in unfair trade practices.

E) been charged by the WTO with violating its trade obligations.

Chapter 9- Sample Questions

1. Which of the following is classified as a credit in the US balance of payments?

A) US exports

B) US gifts to other countries

C) A flow of gold out of the US

D) Foreign loans made by US companies

2. In a country's balance of payments, which of the following transactions are debits?

A) Domestic bank balances owned by foreigners are decreased

B) Foreign bank balances owned by domestic residents are decreased

C) Assets owned by domestic residents are sold to nonresidents

D) Securities are sold by domestic residents to nonresidents

3. ____________ is an example of a debit transaction in the balance of payments.

A) Exports of goods and services

B) Unilateral transfers to foreigners

C) Capital inflows

D) Receipt of a vase as a gift from a foreign country

4. ____________ is an example of a credit transaction in the balance of payments.

A) Import of goods and services

B) Unilateral transfers to a foreign country

C) Capital inflows

D) Capital outflow

5. The balance of payments is the sum of which of the following?

A) Current account balance

B) Current account balance + financial account balance

C) Current account balance + financial account balance + statistical discrepancy

D) None of the above

6. Which of the following is an example of a surplus in the balance of payments?

A) The excess of debits over credits in the current and financial accounts

B) The excess of credits over debits in the current account

C) The excess of credits over debits in the financial account

D) Both B & C

7. Which of the following is not included in the current account?

A) Currently produced goods and services

B) Income on foreign investments

C) Unilateral transfers

D) Direct Foreign Investment

8. If a foreign investor purchases $800 of US treasury bills and pays by drawing down his bank balances in the US by an equal amount, what would the entries be in the US balance of payments?

A) Treasury stock - credit of $800; Cash - debit of $800

B) Capital outflow - credit of $800; Capital inflow - debit of $800

C) Treasury stock - debit of $800; Cash - credit of $800

D) Capital inflow - credit of $800; Capital outflow - debit of $800

9. If the US government gives a US bank balance of $900 to the government of Argentina as aid, what entries would be made in the US balance of payments?

A) Goodwill - credit of $900; Cash - debit of $900

B) Unilateral transfers made - debit of $900; Capital inflow - credit of $900

C) Goodwill - debit of $900; Cash - credit of $900

D) Unilateral transfers made - credit of $900; Capital inflow - debit of $900

10. If a US resident were to visit Japan and spend $500 on food and shelter, what entries would be made into the US balance of payments?

A) Travel services - credit of $500; Capital inflow - debit of $500

B) Accounts Payable - debit of $500; Goods imports - credit of $500

C) Travel services - debit of $500; Capital inflow - credit of $500

D) Accounts Payable - credit of $500; Inventory - debit of $500

11. Which of the following is an example of a capital outflow for the US?

A) A domestic increase of assets held by foreign investors

B) A reduction in US foreign asset holdings

C) Unilateral transfers from foreigners

D) A domestic decrease of assets held by foreign investors

12. Which of the following is an example of a capital inflow for the US?

A) A domestic decrease of assets held by foreign investors

B) A reduction in US foreign asset holdings

C) An increase in US foreign asset holdings

D) Importation of goods and services.