Reference no: EM131157677

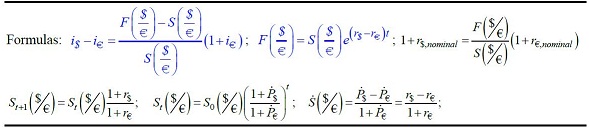

1. Biogen expects to receive royalty payments totaling £5 million next month. It is interested in protecting these receipts against a drop in the value of the pound. It can sell 30-day pound futures (futures contract size of £62,500 ) at a price of $1.6500 per pound or it can buy pound put options with a strike price of $1.6700 at a premium of 4.0 cents per pound. The spot price of the pound is currently $1.6500, and the pound is ex¬pected to trade in the range of $1.6250 to $1.7500. Biogen's treasurer believes that the most likely price of the pound in 30 days will be $1.6650.

a. How many futures contracts will Biogen need to protect its receipts? How many options contracts?

b. Diagram Biogen's profit and loss associated with the put option position and the fixtures position within its range of expected exchange rates. Ignore transaction costs and margins. Label all axes, and all S($/£1) prices.

c. Calculate Biogen's profit and loss associated with the put option position and the futures position within its range of expected exchange rates, including its most likely value. Ignore transaction costs and margins.

|

|

S=$1.6250

|

S=

|

S=

|

S=

|

|

|

OPTION

|

|

|

|

|

|

|

INFLOW

|

|

|

|

|

|

|

OUTFLOW

|

|

|

|

|

|

|

Premium

|

|

|

|

|

|

|

Exercise cost

|

|

|

|

|

|

|

POFIT/LOSS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

FUTURES

|

|

|

|

|

|

|

INFLOW

|

|

|

|

|

|

|

OUTFLOW

|

|

|

|

|

|

|

PROFIT/LOSS

|

|

|

|

|

|

|

TOTAL gain/loss

|

|

|

|

|

|

2. Suppose that Bechtel Group wants to hedge a bid on a Japanese construction project But because the yen expostue is contingent on acceptance of its bid. Bechtel decides to buy a put option for the ¥15 billion bid amount (Its flan receivable) rather than sell it forward. In order to reduce its hedging cost. however. Bechtd simultaneously sells a all option for Ii IS billion with the same strike price. Bechtel reasons that it wants to protect its downside risk on the contract and is willing to sacrifice the upside potential in order to collect the all premium. Com¬ment on Bechtel's hedging strategy.

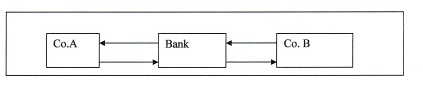

3. Company A, a French manufacturer, desires to bonow U.S. dollars at a fixed rate of interest for one year. Company B, a U.S. multinational. wishes to borrow euro at a fixed rate of Interest for one year. They have been uuaed the following rates per annum (adjusted for differential tax effects)

|

Company

|

Euro

|

US. Dollar

|

|

Companv A

|

10.6%

|

7.0%

|

|

Company 13

|

11%

|

6.2%

|

a) Design a swap that will net a bank, acting as intermediary, 20% of QSD (quality spread differential) per annum and that will generate a gain of 50% of QSD per annum for A and 30% of QSD for company B.

b) Suppose that the notional value of swap is $11 million and €10 million at the Initial spat exchange rate of S0(1.10/ €).

Calculate gains (losses) for the intermediary bank if the exchange rate will be ,S1($0.95/ €) one year from now.

|

Brief history and the development of each theory

: Write a 2-3+ page, double-spaced essay about classical, behavioral, and modern management approaches to leading. Give a brief history and the development of each theory. Discuss why the principles are important for managers in the workplace

|

|

Determine areas for concern in the scenario presented

: Determine areas for concern in the scenario presented, reflecting on what you have learned regarding best practices for GLD and factors that contribute to cross-cultural business failures. Include external global concerns as well as internal cultu..

|

|

Prepare summary on the health journal

: 2-3 paragraph summary on above topic .Can not be more the 2 years old in apa format can be out of a haelth magazine journal or newspaper such as new york journal ,the health journal,new york times etc no wikipedia or blog NO PLAGERISM!

|

|

Calculate the flow rates of burets y and z

: The stoichiometric point in the titration is reached 60.65 minutes after Y and Z were started simultaneously. The total volume in the beaker at the stoichiometric point is 655 mL. Calculate the flow rates of burets Y and Z. Assume the flow rates r..

|

|

How many futures contracts will biogen need to protect

: Calculate Biogen's profit and loss associated with the put option position and the futures position within its range of expected exchange rates.

|

|

Extraction from the leaves of a tropical plant

: A drug (D) is produced in a three-stage extraction from the leaves of a tropical plant. About 1000 kg of leaf is required to produce 1 kg of the drug. The extraction solvent (S) is a mixture containing 16.5 wt% ethanol (E) and the balance water (W..

|

|

How capital budgeting analysis is performed

: Explain to the class how Capital Budgeting analysis is performed within your organization (or at a former employer). Discuss methods used for assessing the financial viability of proposed capital projects and the approval process

|

|

What are the known risk factors for this condition

: What questions would you ask as part of your focused assessment? What history would be associated with the symptom? What are the risk factors for this condition?

|

|

Develop an expression for the heat flow through the wall

: Show how the expression in (a) can be simplified when (r1 - ro)/ro is verysmall. Interpret the result physically

|