Reference no: EM13934347

Question 1

a) You put money into an account that earns a 5 percent nominal interest rate. Theinflation rate is 3 percent, and your marginal tax rate is 20 percent. What is your after-tax real rate of interest?

b) Suppose that changes in bank regulations expand the availability of credit cards so that people need to hold less cash. How does this event affect the demand for money? What is the impact on the price level? If the Fed wants to keep the price level stable, what should it do? Draw money demand and money supply diagram to explain. Label the diagram clearly.

c) If the money supply is growing at a rate of 6 percent per year, real GDP is growing at a rate of 3 percent per year, and velocity is constant, what will the inflation rate be? If velocity is increasing 1 percent per year instead of remaining constant, what will the inflation rate be?

Question 2

a) The economy is in a recession with high unemployment and low output. Use a graph of aggregate demand and aggregate supply (AD-AS diagram) to illustrate the current situation. Be sure to include the aggregate demand curve, the short-run aggregate supply curve, and the long-run aggregate supply curve. Now, suppose the Fed expands the money supply to help the economy to recover from the recession. Using AD-AS diagram, show how it will help the economy to get back to the long-run equilibrium.

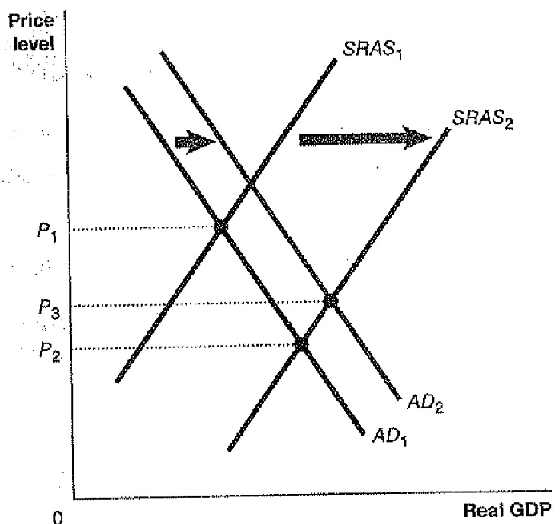

b) A student was asked to draw an AD-AS graph to illustrate the effect of an increase in aggregate supply. The student drew the following graph.

The student explains the graph as follows:

"An increase in aggregate supply cause a shift from SRAS1 to SRAS2. Because this shift in the aggregate supply curve results in a lower price level, consumption, investment, and net exports will increase. The change causes the aggregate demand curve to shift to the right, from AD1 to AD2. We know that real GDP will increase, but we can't be sure whether the price level will rise or fall because that depends on whether the aggregate supply curve or the aggregate demand curve has shifted further to the right. I assume that aggregate supply shifts out farther than aggregate demand, so I show the final price level, P3, as being lower than the initial price level, P1"

Explain whether you agree with the student's analysis. Be careful to explain exactly what- if anything-you find wrong with this analysis.

|

Calculate the company cost of capital

: The market value of Cable Company's equity is $60 million, and the market value of its risk-free debt is $40 million. If the required rate of return on the equity is 15% and that on the debt is 5%, calculate the company's cost of capital. (Assume no ..

|

|

Consider the mean-variance portfolio optimization

: Consider the mean-variance portfolio optimization with n risky assets, but no short sales. Write down the first order optimality conditions of the problem. Can you characterize the set of efficient portfolio?

|

|

What is the firms operating cash flow

: An all-equity firm has net income of $28,300, depreciation of $7,500, and taxes of $2,050. What is the firm's operating cash flow?

|

|

Should the trailer be exempt from the bankruptcy estate

: In 2008 Virgil Hurd was kicked out of his home by his ex-wife. At that time he moved into his horse trailer (the “Trailer”) to keep warm. The Trailer is twenty feet long and six feet wide. Virgil gets electricity for the Trailer from a socket and wat..

|

|

How does this event affect the demand for money

: You put money into an account that earns a 5 percent nominal interest rate. Theinflation rate is 3 percent, and your marginal tax rate is 20 percent. What is your after-tax real rate of interest? Suppose that changes in bank regulations expand the av..

|

|

Relative purchasing power parity-inflation rate

: Currently, you can exchange $1 for £0.53. Assume that the average inflation rate in the U.S. over the next four years will be 4% annually as compared to 5% in the U.K. Based on relative purchasing power parity, you should expect the _____ over the ne..

|

|

What is the bank''s cost of preferred stock

: Holdup Bank has an issue of preferred stock with a $8 stated dividend that just sold for $95 per share. What is the bank's cost of preferred stock? The price of any asset is the present value of future cash flows. The preferred stock has a constant d..

|

|

Sale of one more unit have on the operating cash flow

: The tax rate is 35 percent. What effect would the sale of one more unit have on the operating cash flow?

|

|

Compute the return that harold earned on his portfolio

: Harold Rawlings has computed the returns he earned last year from each of the stocks he holds in his portfolio. Compute the return that Harold earned on his portfolio during the year. Harold has decided to keep Danka in his portfolio, even though it ..

|