Reference no: EM13214174

Question

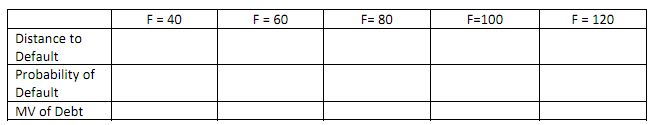

Consider a firm that has issued zero coupon debt. It only has one type of debt outstanding. The face value of the debt is F. The market value of the firm's assets is 100 (= A(0)). The volatility of the rate of return on the firm's assets is 20%. The instantaneous risk free rate of interest is 3%.

Part A

If the maturity of the debt is one year, what is the probability of default, the distance to default and market value of debt?

How does leverage affect the distance to default?

When you increase the face value of debt, how does this affect the probability of default and the market value of debt?

Part B

Plot your results, with the distance to default on the x-axis and the probability of default on the y-axis (vertical axis).

How could you use this graph to predict the probability of default on a commercial basis?

Part C

If the firm had short term debt of 40 and long term debt of 80, what is the probability of default? Please provide a justification for your answer.

(Hint: the firm has two types of debt outstanding. If you want to use the Merton model, how would represent the total amount of debt. Try different combinations.) Justify your recommendation.

|

Why do people move to some cities and away from others

: Cities do not reproduce themselves. Why do people move to some cities and away from others You may want to examine why some cities grew from 1990 to 2000, but you need to examine key concepts that underlie urban growth.

|

|

What is the rate of output that maximizes zzz

: ZZZ, Inc. operates in a monopolistically competitive industry. Its demand curve can be written as P = 160 - Q and its short run total cost curve is equal to TC = 1000 + Q^2. What is the rate of output that maximizes ZZZ, Inc.'s short run profits

|

|

What would keynesian economists propose to govt enact

: Suppose the economy is at a position below the physical production possibilities frontier but above the institutional production possibilities frontier. In response to this situation, Keynesian economists would propose that government enact.

|

|

State the gases in increasing order of their particles

: Four samples of gas - O2, CO2, Ar, and He - are available at the same temperature. Rank the gases in increasing order of their particles' average velocity, beginning with the slowest.

|

|

How does leverage affect the distance to default

: How does leverage affect the distance to default and what is the probability of default, the distance to default and market value of debt?

|

|

What is the optimal level of advertising

: Company Y is a monopoly industry. Its contribution margin is estimated at 20% (P-MC)/P = 0.2). From past experience, the owner has determined the following relationship exists between expenditures on advertising and total sales

|

|

Compute the volume and density of titanium

: then dried the flask and added some pieces of titanium to it. the stoppered flask plus the titanium weighed 64.763g. then filled the flask w/water, leaving the titanium pieces in the flask, and found a mass of 67.561g for the flask plus titanium a..

|

|

Explain combustion reaction to producee calcium hydroxide

: Calcium Oxide reacts with water in a combustion reaction to producee calcium hydroxide: CaO(s) + H2O(l)----> Ca(OH)2(s)

|

|

Explain a sample of chlorine gas at a pressure

: A sample of chlorine gas at a pressure of 420 mm Hg and in a volume of 3.50 L was heated from 18.0oC to 45.0oC after being transferred to a container of volume 2.35 L. The pressure in this new container should be about

|