Reference no: EM131326782

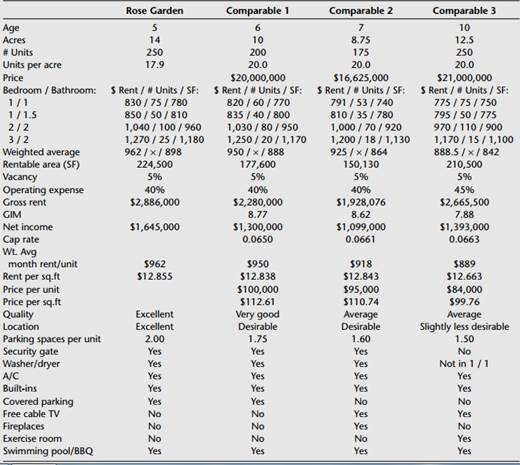

You are an analyst with Perception Partners and have been asked to make pricing recommendations regarding the acquisition of Rose Garden Apartments. This project was built five years ago and contains 250 units in a suburban market area. The broker that brought the project to your attention indicates that the asking price will be $27,000,000. She has also provided the attached information based on a market survey showing data from three sales of comparable apartment properties that have occurred in a one-mile radius of Rose Garden during the past six months (see table below).

Perception believes that market returns (IRR) should be in a range of 8 percent (compounded annually) for this type of investment. Perception (1) plans to own the property for five years and then sell it and (2) believes that rents will grow at 3 percent per year.

At the present time, Perception believes that the sale price that it hopes to achieve at the end of year 5 should be based on a "going-out" cap rate that will be .005 greater than the "going-in" cap rate. The property is to be acquired on an "all cash" basis.

a. Prepare an analysis of Rose Garden with the three comparable properties. Based on this analysis, do you think that the "going-in" cap rate today for Rose Garden should be higher or lower than the cap rates shown for the comparables?

b. If Rose Garden is acquired for $27,000,000, what would be the "going-in" cap rate at that price? How does this compare to cap rates for the comparables?

c. If Rose Garden is acquired for $27,000,000, would the 8 percent required return be achieved over the five-year period of ownership?

|

Asking about database technology

: Why are database management systems (DBMSs, but really just asking about database technology) important in the business community? Can you provide an example of database technology in the business world?

|

|

What is the new implied land value

: Suppose the warehouse income would grow at 3 percent per year instead of 2 percent. Does this change the highest and best use of the site? If so, what is the new implied land value?

|

|

Discuss the financial statements are there financial trends

: Discuss the financial statements...are there financial trends that show the org is meeting its mission? The analysis of the organization using an accounting perspective.

|

|

Part of industry benchmarks-regulations and quality systems

: Standards are very important part of industry benchmarks, regulations, and quality systems. Explain the following in details:

|

|

How does given compare to cap rates for the comparables

: If Rose Garden is acquired for $27,000,000, what would be the "going-in" cap rate at that price? How does this compare to cap rates for the comparables?

|

|

Prepare the journal required journal entry

: Acct 311- Construct a new pension worksheet to submit in Excel or Word format, using the sample worksheet below. Complete sheet. Prepare the journal required journal entry.

|

|

What research design did rogers use in his studies

: How much congruence do you think there is between your actual, ideal, and ought selves? How does this affect how you think, feel, and act?

|

|

What should be the property value at the end of year 5

: What should be the property value (REV) at the end of year 5?- What should be the present value of the property today?

|

|

Resolve the problems outlined in lab exercise

: Discuss with your Learning Team the configurations needed to resolve the problems outlined in this lab exercise. The configurations that have been applied to the devices within this lab have a number of incorrect settings and are causing numerous ..

|