Reference no: EM13182395

The L&L Accounting Firm

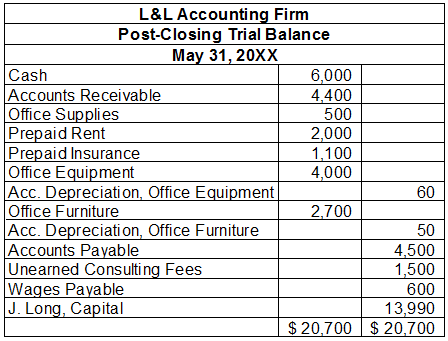

The May 31, 20XX, post-closing trial balance for the L&L Accounting Firm appears below.

During June, the firm engaged in the following transactions:

1 Received an investment of cash from J. Long, $8,000.

3 Purchased office equipment with cash, $2,000.

4 Received office equipment transferred to the firm from J. Long, $1,800

7 Purchased extra office supplies with cash, $190

9 Completed bookkeeping services for Elliott Electric Company that began on May 30 and billed Elliott for the total services performed, including the accrued revenues that had been recognized in an adjusting entry in May, $1,400

10 Paid the receptionist for two weeks' wages, $1,600

13 Paid the amount due to Office Depot for the office equipment purchased last month, $750

14 Accepted an advance in cash for services to be done for a new client, $2,200

15 Purchased a copier (office equipment) from Office Depot for $2,400, paying $400 in cash and agreeing to pay the rest in equal amounts over the next six months.

16 Performed consulting services and received a cash fee, $1,650.

17 Received payment on account from Sally's Salon for services performed last month, $3,200.

18 Paid amount due for the telephone bill that was received and recorded at the end of May, $260.

19 Performed consulting services for Sally's Salon and agreed to accept payment next month, $4,600.

20 Performed bookkeeping services for cash, $780.

23 Received and paid the utility bill for June, $340.

24 Paid the secretary for two weeks' wages, $1,600.

27 Paid the rent for July in advance, $2,000.

28 Received the telephone bill for June, which is to be paid next month, $220.

30 Paid cash to J. Long as a withdrawal for personal expenses, $1,750.

Create a set of financial statements based on the accounting information provided for a service or merchandising company. See the Preparing Financial Statements handout andStudent Template for details.

Refer to the Course Schedule within the Syllabus for specific project deliverables and due dates.

DELIVERABLE

1. Record the journal entries for June.

2. Post the June transactions to the general ledger accounts.

3. Prepare a trial balance.

4. Prepare adjusting entries in a worksheet using the information below:

• Three days' wages accrued by the end of June.

• Consulting services performed (that will not be billed until July) total $380.

• Consulting services for which payment has been received in advance amounted to $1,460.

• Depreciation on office equipment for June is $320.

• Depreciation on office furniture for June is $200.

• An inventory of office supplies shows $200 still on hand as of June 30.

• One month's prepaid insurance has expired in the amount of $100.

• One month's prepaid rent has expired in the amount of $2,000.

Record the closing entries and post them to the ledger accounts.

Prepare a post-closing trial balance.

From the worksheet, prepare an income statement, statement of owners' equity, and balance sheet.

Answer the following questions as a summary of your work:

• What information were you able to glean about the financial situation of this company from the financials?

• How does this accounting information impact business decisions?