Reference no: EM131227673

Task -

You are required to complete all questions, in the same sequence as listed below, and submit all necessary workings. Follow the assignment requirements

Content assessed - Topic 5, 6, 7, 8, 9, and 10: internal control and cash, introduction to management accounting, cost-volume-profit analysis, relevant information and special decisions, budgeting, capital budgeting.

Question 1 - Internal Control

See Reading 5 (Horngren C.T. Harrison W.T. & Oliver M.S., 2012, Internal control and cash. Accounting 9th ed, ch 7, pp 355-403. Pearson) in the learning materials within Interact2 or in CSU library resources.

Define internal control. Outline 4 components of internal control from the reading. Give examples of each.

Question 2 - Bank Reconciliation

A. How can the bank reconciliation be used as a control device?

B. Create a spreadsheet model to show a bank reconciliation statement. Use the Baylor Associates example in Reading 5 (Horngren C.T. Harrison W.T. & Oliver M.S., 2012, Internal control and cash. Accounting 9th ed, ch 7, pp 355-403. Pearson) (page 369) as a template for inspiration but change/create your own original data. Implement all the usual spreadsheet requirements.

Question 3 - Introduction to management accounting

A. Who uses information from an accounting system? Give examples.

B. Distinguish among scorekeeping, attention directing and problem solving. Give examples of each.

C. "The problem with accounting is that accountants never get to become top managers such as CEOs." Do you agree? Explain. Illustrate your explanation with examples. Use the internet as a resource.

Question 4 - Ethical Issues

Suppose you are controller of a medium-sized gold exploration company in the Northern Territory. You adhere to the standards for ethical conduct for management accountants. How would those standards affect your behaviour in each of the following situations? Identify the relevant source for ethical standards in each case.

1. Late one Friday afternoon you receive a geologist's report on a newly purchased property. It indicates a much higher probability of gold than had previously been expected. You are the only one to read the report that day. At a party on Saturday night, a friend asks about the prospects for the property.

2. A gold industry stock analyst invites you and your wife to spend a week in Darwin free of charge. All she wants in return is to be the first to know about any financial information your company is about to announce to the public.

3. It is time to make a forecast of the company's annual earnings. You know that some additional losses will be recognized before the company prepares its final statements. The company's CEO has asked you to ignore these losses in making your predictions because a lower-than-expected earnings forecast could adversely affect the chances of obtaining a loan that is being negotiated and that will be completed before actual earnings are announced.

4. You do not know whether a particular expense is deductible for income tax purposes. You are debating whether to research the tax laws or simply assume the item is deductible. After all, if you are not audited, no one will ever know the difference. If you are audited, you can plead ignorance of the law.

Question 5 - Work Integrated Assessment case study

Qantas Annual Report

Learning Objectives: The subject you are studying is vocational. It is designed with the workplace in mind. Work integrated assessment provides opportunities for students to link theory and skills learned in a subject to a real work context. Students can use these opportunities to develop and practice the professional and academic skills they learn about in a subject or through the online environment and then be assessed on their capabilities in these simulated authentic environments. Work integrated assessment allows students to simulate and situate their learning in an authentic workplace that encourages them to explore their knowledge and apply it to practice. Integrating real world, authentic assessment tasks allows students to learn about the particular environments and culture of their chosen professions, while at the same time absorbing and practicing the skills they need to succeed. Doing these tasks can help students develop skills that can help their employability.

Resources for this task include the 2015 Annual Report for Qantas.

Your friend Tom is studying architecture at another University and knows very little about accounting and annual reports. Tom's uncle gave him $30,000 recently to invest. Tom knows you have begun studying accounting and is considering buying Qantas shares. Tom has some questions for you.

Present your answers concisely in a business report format.

Tom's questions:

1. How much profit did Qantas make?

2. What is the Earnings per share?

3. What expertise does Todd Sampson bring to the Board of Directors?

4. Explain EBITDA, Revenue Seat Factor, Revenue received in advance and Retained Earnings.

5. Calculate the Working Capital ratio.

6. Create a chart in Excel showing 3D columns for the operating cash flows and another showing a pie chart for the components of current assets. Paste the spreadsheet graphs in your assignment. Show the data area.

7. Summarise your advice to Tom re the investment decision.

Find the Qantas 2015 Annual Report on the web.

Question 6 - Costing

A. Give your own three examples of variable costs and fixed costs.

B. Describe three ways of lowering the breakeven point.

Question 7 - CVP chart

Create a simple CVP chart using Excel. You may choose to use examples from the Web. Show the data area and clearly label your CVP chart.

Question 8 - Decision making

Suppose you're on a TV game show, and you're given the choice of three doors. Behind one door is a brand new car, behind the others, nothing. You pick a door. The TV host, who knows what's behind the doors, chooses another door and opens it to show you that it has nothing. Should you change your decision?

Please be frank and creative in answering the following questions.

A. (i) Suppose you're on a TV game show, and you're given the choice of three doors. Behind one door is a brand new car, behind the others, nothing. You pick a door. The TV host, who knows what's behind the doors, chooses another door and opens it to show you that it has nothing. Should you change your decision?

Don't think about this too deeply just yet. Do you feel (intuit?) that you should change your choice? Answer initially without researching the question. What is the thinking behind your answer? Conduct a survey of ten of your friends/colleagues to give their opinion. You may wish to provide them with a copy of the problem.

Include in your answer a table setting out the results of your survey. Also create a simple chart with Excel to present the results of your survey.

A (ii) After you answer the first part of this question, search the Internet for the Monty Hall problem. Provide your own explanation of the correct solution. Why do so many get the wrong answer? Did you?

B. A man goes to see his medical doctor to find out whether or not he has a deadly disease. The test is positive. The test is 95% accurate and one in one thousand men of his age has this disease. What is the probability he has the disease? He decides to seek a second opinion but the results are exactly the same. When this question was put to a group of student doctors, 80% of them answered "95%". He now plans to sell up all his assets, tell his boss what he really thinks of her, quit his job on the spot and live in Mauritius in the time he has left. Is this a rational decision? Explain.

C. Suppose an urn contains 100 marbles, 65 red and 35 black. A marble is drawn at random from the urn and you are asked to guess what colour you believe the marble to be. The marble is then shown, replaced, and the urn's contents again randomised. The aim is to maximise the number of correct guesses. Before reading any further, what strategy would you employ? What would you guess?

Assume 4 red come out in a row. What would your next guess be? Why? Include a brief discussion of the gambler's fallacy (Monte Carlo fallacy).

D. Creatively discuss the rationality of human decision making using these and other examples. Use the Internet as a source (about 300 words for this section).

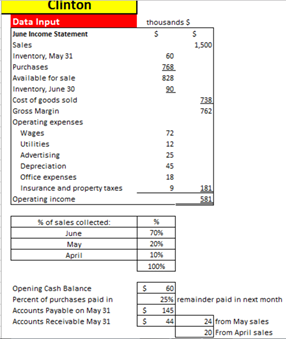

Question 9 - Cash Budget

Spreadsheet required. See the text p317.

Solve with the data in the spreadsheet below.

Prepare the cash budget for June.

Question 10 - Variance analysis

Spreadsheet the following to calculate materials and labour variances. Follow all spreadsheet requirements. Use the IF function to determine if variances are favourable or unfavourable. Highlight your answers to the two requirements.

|

Sphero Inc. Variance Analysis - Materials and Labour Data

|

|

Standard direct-labour rate

|

$11.00

|

|

Actual direct-labour rate

|

$13.20

|

|

Standard direct-labour hours

|

12,000

|

|

Direct-labour usage variance - unfavourable

|

$9,800

|

|

Standard unit price of materials

|

$4.80

|

|

Actual quantity purchases and used

|

1,900

|

|

Standard quantity allowed for actual production

|

1,650

|

|

Materials purchase price variance-favourable

|

$198

|

Required:

1. Compute the actual hours worked, rounded to the nearest hour.

2. Compute the actual purchases price per unit of materials, rounded to the nearest cent.

Question 11 - Capital budgeting

PriceDeloitteYoung, an accounting firm is considering the replacement of its old accounting system with a new system that is expected to save $10,000 per annum in net cash operating costs. The old system has zero disposal value but could still be used for the next 5 years. The estimated useful life of the new system is 5 years with zero salvage value, and it will cost $40,000. The required rate of return is 14%.

Create a spreadsheet solution to answer the following. Include data and report areas. Use the Excel NPV function.

A. What is the payback period?

B. Calculate the NPV using the Excel NPV function.

C. What would be the NPV if the useful life was 3 years? Or 10 years?

D. Suppose the life will be 5 years but the savings will be $8,000 per annum instead of $10,000. Calculate the NPV.

E. Suppose the annual savings will be $9,000 for 4 years. Calculate the NPV.

F. Create a second version of each of the parts A through E above with your own changed numbers for all data inputs. Begin with the cost of the new system being $500,000 and make rational/sensible changes to all other data inputs.

G. Write a business report on how is this situation an example of sensitivity analysis and describe sensitivity analysis and its usefulness to management. Use your text and the Internet (about 400 words).

Paste two normal views and one formula view.

Question 12 Business Report

Write a business report to senior management on the significance of two of the following to the function of management accounting. About 300-400 words each report. Use the Internet as a resource. Give examples to illustrate your report. Consider using screen shots to enhance your submission. Refer to the earlier section 'Assessment Information' for essay/report writing skill resources. The Internet can also be searched for advice on business report structures.

A. History of management accounting

B. Black Swans (Taleb)

C. Balanced scorecard

D. Sustainability and the role of the accountant.