Reference no: EM132544720 , Length: 1333 Words

HI5001 Accounting for Business Assignment Help and Solution, Holmes Institute - Assessment Writing Service

Question 1:

Fiona Sporty uses a purchases journal, a cash payments journal, a sales journal, a cash receipts journal and a general journal. Indicate in which journals the following transactions are most likely to be recorded.

1. Purchased inventories on credit.

2. Sales of inventory on credit.

3. Received payment of a customer's account.

4. Payment of monthly rent by cheque.

5. End of period closing entries

Question 2:

Below is information about Lisa Ltd's cash position for the month of June 2019.

1. The general ledger Cash at Bank account had a balance of $21,200 on 31 May.

2. The cash receipts journal showed total cash receipts of $292,704 for June.

3. The cash payments journal showed total cash payments of $265,074 for June.

4. The June bank statement reported a bank balance of $41,184 on 30 June.

5. Outstanding cheques at the end of June were: no. 3456, $1,448; no. 3457, $84; no. 3460, $70 and no. 3462, $410.

6. Cash receipts of $10,090 for 30 June were not included in the June bank statement.

7. Included on the bank statement were:

• a dishonoured cheque written by a client James Ltd, $136

• a credit for an electronic transfer from a customer of $644

• interest earned, $44

• account and transaction fees, $120.

Required

a) Update the cash receipts and cash payments journals by adding the necessary adjustments and calculate the total cash receipts and cash payments for June.

b) Post from cash receipts and cash payments journals to the Cash at Bank ledger account and balance the account.

c) Prepare a bank reconciliation statement at 30 June.

d) What is the amount of cash that should be reported on the 30 June balance sheet?

Question 3:

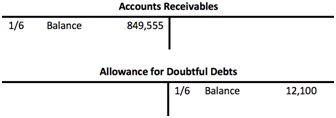

On 1 June, Mason and Boyce had Accounts Receivable and Allowance for Doubtful Debts accounts as below. Ignore GST.

During June, the following transactions occurred:

1. Revenue earned on credit, $1,195,000.

2. Sales returns, $24,100.

3. Accounts receivable collected, $1,400,000.

4. Accounts written off as uncollectable, $15,851.

Based on an ageing of accounts receivable on 30 June, the firm determined that the Allowance for Doubtful Debts account should have a credit balance of $13,500 on the balance sheet as at 30 June. Ignore GST.

Required

(a) Prepare general journal entries to record the four transactions and to adjust the Allowance for Doubtful Debts account.

(b) Show how accounts receivable and the allowance for doubtful debts would appear on the balance sheet at 30 June.

(c) On 29 June, Kim Ltd, whose $2,400 account had been written off as uncollectable in June, paid its account in full. Prepare journal entries to record the collection.

Question 4:

Tamworth Trading Ltd is a company operating in the retail sector. The beginning inventory of Product EF5089 and information about purchases and sales made during June are shown below.

|

|

|

|

Units

|

Unit price $

|

|

June

|

1

|

Inventory

|

6,100

|

2.20

|

|

|

4

|

Purchases

|

4,600

|

2.25

|

|

|

9

|

Sales

|

4,100

|

|

|

|

12

|

Purchases

|

4,100

|

2.40

|

|

|

21

|

Sales

|

6,000

|

|

|

|

26

|

Purchases

|

3,100

|

2.50

|

Tamworth Trading Ltd uses the perpetual inventory system, and all purchases and sales are on credit. Selling price is $5 per unit. A stocktake on 30 June revealed 7700 units in inventory. Ignore GST.

Required

a) Using the FIFO method, prepare an appropriate inventory record for Product EF5089 for June.

b) Prepare an income statement down to the gross profit for Tamworth Trading Ltd for June.

Question 5:

Nevertire Ltd purchased a delivery van costing $52,000. It is expected to have a residual value of $12,000 at the end of its useful life of 4 years or 200,000 kilometres. Ignore GST.

Required

a) Assume the van was purchased on 1 July 2019 and that the accounting period ends on 30 June. Calculate the depreciation expense for the year 2019-20 using each of the following depreciation methods

• straight-line

• diminishing balance (depreciation rate has been calculated as 31%)

• units of production (assume the van was driven 78,000 kilometres during the financial year).

b) Record the adjusting entries for the depreciation at 30 June 2021 using diminishing balance method.

c) Show how the van would appear in the balance sheet prepared at the end of year 2 using Straight-line method.

Attachment:- Accounting for Business Decisions.rar