Reference no: EM132959298

HA3042 Taxation Law - Holmes Institute

Question 1

Sanjay is a new recruit in a consulting company and after few months he realised that in order to secure his promotion within the company, Sanjay must keep up the good standard and gaining the master degrees in business will boost his chance. So, Sanjay enrols as a part time student at Holmes College in Melbourne for MBA program. Sanjay subsequently incurs the following expenses:

|

|

|

$

|

|

Enrolment Fees

|

|

499

|

|

Text Books

|

|

200

|

|

Travelling expenses from Work to College

|

|

300

|

|

Tuition Fees (assuming Sanjay didn't utilise HELP)

|

|

6000

|

Please advise how much deductions that Sanjay are entitled to claim. Please give short explanations and section of the laws when applicable

Question 2

Karanjit runs a delivery/courier business and had to replace the motor in one of his delivery vans. The original petrol motor had seized and need to be replaced. Karanjit decided to replace the petrol motor with aa diesel motor since it is more fuel efficient. The cost of replacing the motor was $25,000. If Karanjit replace it with the petrol motor, it will only cost $18,000.

Please discuss the deductibility of the outgoing under S25-10

Question 3

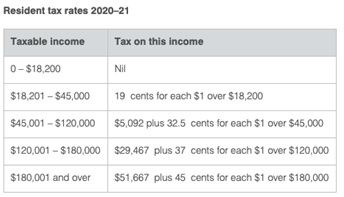

Manpreet Kaur a 45 years old employee (Resident Individual) that have annual salary of $98,000 during Tax Year 20-21, where she also received a fully franked dividend from resident public company for the amount of $6,300. Manpreet got some eligible deductions for the year to the amount of $5,800. Manpreet has private insurance cover during the year. Manpreet has paid tax during the year on Manpreet's salary for the amount of $27,500 (PAYG). Manpreet also still have HELP loan balance ($15,000) that Manpreet still needs to pay.

Based on the above information, what will be Manpreet tax payable/refund for the year 20-21 tax year?

Please take account on Medicare Levy, Medicare Levy Surcharge, PAYG, and HELP's repayment

Question 4

Navneet and Rohit are partners in small accounting consultancy firm. Both partners contributed $80,000 as capital at the beginning of the partnership. Navneet also transferred the ownership of her office as an additional capital into the partnership. (where the market value of the office at that time was $150,000).

The partnership agreement stated that Navneet will receive 65% distribution of Net Partnership Income while Rohit will be received 35%. The partnership also going to pay 9% interest on introduced capital for each partner. Both Navneet and Rohit will receive $35,000 salaries.

During the year, due to COVID 19 the partnership short of working capital hence Rohit provided $50,000 loan toward the partnership where the partnership will give 15% interest on this loan.

For the year ended 30 June 2021, the partnership has an income of $350,000 and total expenditure of $185.000 (including salary and interest payments toward the partners)

Additional Information: Navneet and Rohit are resident single taxpayer with no private health insurance

Required:

1. Calculate the Net Income of Partnership

2. Calculate the Amount available for Distribution

3. Calculate Rohit tax payable (Please consider Medicare and Medicare levy surcharge as well)

Question 5

Maharaj Pty Ltd is an Indian restaurant that specialised in lamb and chicken biryani, Maharaj cater both dine in and take away, Maharaj located in Melbourne CBD where the company pay rents to the landlord that own the space. Maharaj employs 5 salaried staffs and registered for GST.

Maharaj also own 3-bedrooms apartments (residential) that the company rent out for the amount of $750/week ($39,000/year)

For the period ending 30 June 2021, the company recorded the following transactions

|

Amount Included GST where applicable

|

|

Income

|

$

|

|

Sales of Lamb Biryani

|

252,000

|

|

Sales of Chicken Biryani

|

151,200

|

|

Sales of Drinks

|

88,000

|

|

Rental income (Residential Property)

|

39,000

|

|

|

|

|

Expenses

|

|

|

Purchase of Ingredients (Raw Chicken, Lambs)

|

35,000

|

|

Spices

|

10,000

|

|

Cutlery (plates, spoons, forks)

|

5,500

|

|

Electricity

|

19,800

|

|

Bookkeeping/Accounting

|

6,600

|

|

Rental expense (Restaurant)

|

110,000

|

|

Depreciation expense (Furniture, fit outs)

|

31,500

|

|

Interest expense

|

4,650

|

|

Wages (Staffs)

|

160,000

|

|

|

|

|

Rental Property expenses

|

|

|

Management Fee (Payable to real estate agency)

|

2,145

|

|

|

|

Assume that valid tax invoices are available for all of these transactions, determine how much Net amount of GST which is payable to ATO for this period by Maharaj Pty Ltd. You need to provide short explanation for each components and legislation where its applicable.

Question 6

As Covid 19 created havoc in the world's economy, it also restricts people' movement that created a headache for most "Multi National Corporation" as some of their overseas employees stranded within Australia for much longer than their intended stay.

Please review below article and analyse what causing this particular issues and how MNC/accounting firms try to handle the situation

In your answer, you should discuss about the 4 residency tests as well