Reference no: EM13185556

Question 1

Transnational Employment Services (TES) are finalising their financial reports for the year ending 30th June 2014. TES is a recruiting agency which specialises in finding work for people all over the world. Income is generated by charging fees to customers in exchange for helping them find employment both in Australia and overseas. Income is also generated by running seminars to assist clients in up-skilling themselves to make them more marketable and employable. The owner of TES has prepared the financial reports himself with the assistance of a first year accounting student. Unfortunately, the owner has not studied accounting and believes he made a number of mistakes when preparing the end of year financial reports. He has asked you for assistance in finalising the financial reports (and wants you to apply the rules of accrual accounting in preparing the reports). You are given all of the information used to prepare the financial reports for the year ending 30th June 2014. Disregard GST for this question. During your initial investigation you have identified the following issues which may require further action:

(a) All staff for TES work Monday to Friday. The shop does not open on Saturdays or Sundays.

Disregard PAYG tax for the purposes of this question.

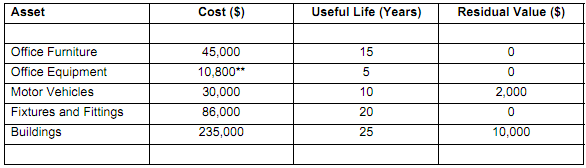

(b) TES controls a number of non-current assets. To make things simple, the owner decided all non-current assets should be depreciated using the straight line depreciation method*. Details relating to assets controlled by TES are shown below:

(c) The telephone bill for the shop was paid by the owner on the 15th of June 2014 - the bill was for $700. The bill was paid using the personal bank account of the owner because he was paying some other personal bills at the same time and forgot to bring his credit card from the business to pay for the business' telephone bill. The owner then took out $700 from the business bank account on the 30thof June to reimburse himself for the payment he made on the 15th of June. He also took out an extra $300 at the same time, on the 30th of June, from the business bank account, for personal use.

(d) On the 30th of June 2014, the owner took office supplies home from the business for personal use. The supplies cost $90. The owner did not record anything in regards to this event.

(e) Additional office furniture (a wall clock) was purchased by the business on the 30th of June 2014. The amount of the purchases was $200 cash. The $200 has been recorded as a debit to the "Maintenance expense" account because the owner was not sure what he should do.

(f) Total wages of $8,400 (6 staff each paid $1,400) are paid to sales staff every fortnight. Sales staff wages had been paid and recorded on the 4th and 18th of June 2014. All employees who work for TES are paid on the 4th and 18th of June for work done up to and including the 4th and 18th of June respectively. No other entries have been processed relating to wages in June 2014.

(g) A client paid $550 on the 15th of June for some seminars to be held on the 8th of July 2014.

The $550 has been recorded as a credit to "Unearned Income" and a debit to "Cash at Bank". On the 29th of June, the client decided to cancel her participation in the seminars due to illness. TES will refund the deposit to the client once all the paperwork has been finalised (it is anticipated that the cancellation of the booking will be finalised on the 30th of June 2014). TES also charges a fee of 10% of any deposit received as an administration fee if an order is cancelled (regardless of the reason for cancelling). That is, TES will keep 10% of the $550 as an administration fee. The cash was refunded to the customer on the 5th of July 2014.

(h) The bank statement for the month of June 2014 shows that a cheque of $200 received from a customer had not cleared with the bank. The bank had recorded that the cheque was dishonoured on the 11th of June. The accountant for TES was not aware of the dishonoured cheque.

(i) Rent for office space (where they conduct their seminars) for 2 months covering June - July was paid on the 1st of June 2014. The amount paid was $1,500. A debit to "Rent Expense" and a credit to "Cash at Bank" for $1,500 was recorded on the 1st of June. On the 30th of June TES found a new office space and all seminar bookings for July were moved from the old office to the new office space. The old office was not used and was left empty for the remainder of the life of the rental agreement. The new office was rented for $700 per month and a 12 month agreement was signed for on the 30th of June and TES paid for 12 months' rent in advance on the 30th of June 2014.

(j) The owner purchased a DVD player for the business to use to play holiday DVD's in the office as a marketing tool to convince clients to book into the seminars. He purchased the DVD player from his own personal bank account on the 1st of April 2014 and gave the DVD to the business to use. He recorded this contribution of the DVD player as a debit to "Office Equipment" and a credit to "Owner Contributed Asset Income". The DVD player cost $800.

(k) TES hired a part time accountant at the beginning of June 2014 and will pay the accountant on the last day of each calendar month. The accountant is being paid $3,600 per month. No entry has been processed for the wages (to record the amount owing or the payment) - they were paid on the 30th of June 2014.

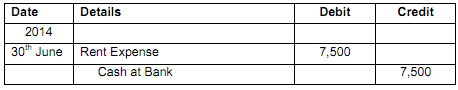

(l) Rent for the administration office (separate to the office referred to in part (i) above) used by TES was paid in cash on the 1st of February 2014. The amount paid was $18,000 and was for the 12 months covering 1st February 2014 - 31st January 2015. The accountant for TES was not sure how to treat this payment and the only entry you can see which relates to this payment is on the 30th of June. Details of the entry posted is shown below:

(m) Annual insurance for the business is overdue. Insurance is $1,750 per year and is normally paid on the 1st of June for 12 months. TES did not receive the original renewal notice from the insurance company because it was sent to the wrong address by the insurance company.

TES has subsequently paid the $1,750 on the 30th of June 2014 and recorded a debit to "Prepaid Insurance" and a credit to "Cash at Bank" for $1,750. As a gesture of goodwill by the insurance company, the insurance company allowed TES to be covered for free for June 2014 due to the administrative error in the delivery of the bill to TES plus the company gave TES an additional 2 months of insurance coverage for no extra charge.

REQUIRED

Prepare the general journal entries to make the necessary adjustments for the information presented to you above. (If you believe a journal entry is not required, please explain why you believe this to be the case).