Reference no: EM131106741

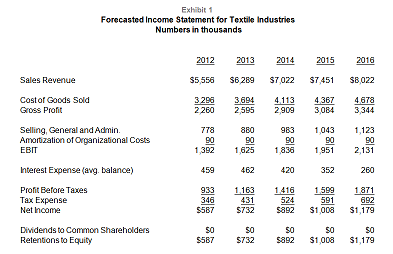

Blackrock Investments is looking to buy Textile Industries, with the actual purchase occurring on December 31, 2011. Blackrock has created forecasted balance sheets and income statements for Textile Industries following the acquisition which reflect how Blackrock will run the firm (see attached pages… Excel spreadsheets are on the course website).

Textile Industries currently has a capital structure of $2 million in debt and $6 million in equity (both are market values). Their current equity beta is 1.60. The market risk premium is 6.3%. The yield on 30- year Treasury bonds is 3.00%. The marginal corporate tax rate is 37%.

Blackrock expects that, after 2016, Textile’s FCFs will grow with inflation (which is expected to be 2% per year). Blackrock will purchase Textile Industries by borrowing much of the purchase price today and then paying down the debt over time. The cost of the debt to be used to finance the purchase of Textile (both long-term debt and the revolving credit line) has a yield of 10%. After 2016, they will have paid down the debt to a permanent level, expecting that the tax savings from the interest expense will stay constant into perpetuity. There are no net operating loss (NOL) carryforwards at Textile Industries.

1Using the APV method, calculate the firm value of Textile Industries to Blackrock. Be sure to include a spreadsheet that clearly shows your work and calculations. (This means that the TA should be easily able to see how you arrived at your solution. You do not need to show the equations in your spreadsheet.)

2You have the following information about some of Textile Industries closest competitors. Use the price multiples valuation method to get 2 more estimates of the value of Textile Industries.

|

|

Yoya Supplies, Inc.

|

Mye Company

|

BabyTea Industries

|

|

Price/Earnings ratio (on next year’s expected earnings)

|

14.7

|

13.1

|

17.8

|

|

Market value of assets/Book value of assets ratio

|

3.5

|

2.1

|

3.9

|

Forecasted Balance Sheets for Textile Industries numbers in thousands

|

|

Dec. 31, 2011

|

2012

|

2013

|

2014

|

2015

|

2016

|

|

Cash

|

$75

|

$75

|

$75

|

$75

|

$75

|

$75

|

|

Accounts Receivable

|

0

|

556

|

629

|

702

|

745

|

802

|

|

Inventory

|

3,294

|

3,692

|

4,114

|

4,367

|

4,678

|

4,867

|

|

Organization Costs-Current

|

90

|

90

|

90

|

90

|

90

|

0

|

|

Total Current Assets

|

3,459

|

4,413

|

4,908

|

5,234

|

5,588

|

5,744

|

|

Land

|

1,686

|

1,686

|

1,686

|

1,686

|

1,686

|

1,686

|

|

Plant and Equipment

|

873

|

1,248

|

1,623

|

1,998

|

2,373

|

2,748

|

|

Gross PP&E

|

2,559

|

2,934

|

3,309

|

3,684

|

4,059

|

4,434

|

|

Accum. Depreciation

|

0

|

175

|

424

|

749

|

1,148

|

1,623

|

|

Net PP&E

|

2,559

|

2,759

|

2,885

|

2,935

|

2,911

|

2,811

|

|

Organization Costs-Noncurrent

|

360

|

270

|

180

|

90

|

0

|

0

|

|

Total Assets

|

$6,378

|

$7,442

|

$7,973

|

$8,259

|

$8,499

|

$8,555

|

|

Payables & Accruals

|

$195

|

$372

|

$416

|

$440

|

$471

|

$489

|

|

Debt-Current Portion LTD

|

600

|

600

|

600

|

600

|

600

|

0

|

|

Revolving Line of Credit

|

1,683

|

2,583

|

2,938

|

2,908

|

2,709

|

2,168

|

|

Total Current Liabs.

|

2,478

|

3,555

|

3,954

|

3,948

|

3,780

|

2,657

|

|

Debt, non-current

|

2,400

|

1,800

|

1,200

|

600

|

0

|

0

|

|

Total Liabilities

|

4,878

|

5,355

|

5,154

|

4,548

|

3,780

|

2,657

|

|

Common Stock

|

1,500

|

1,500

|

1,500

|

1,500

|

1,500

|

1,500

|

|

Retained Earnings

|

0

|

587

|

1,319

|

2,211

|

3,219

|

4,398

|

|

Total Equity

|

1,500

|

2,087

|

2,819

|

3,711

|

4,719

|

5,898

|

|

Total Liabilities & Equity

|

$6,378

|

$7,442

|

$7,973

|

$8,259

|

$8,499

|

$8,555

|

Attachment:- assignment 3 exhibits.rar

|

Question regarding the available analysis on the brexit

: What we would like is a 3 page report on all available analysis on the Brexit, and based on your analysis which sectors will be see large negative or positive impacts. Also we would like coverage on 2-3 companies which will see a large impact as w..

|

|

Teller corporations post closing trial balance

: Teller Corporation's post-closing trial balance at December 31, 2010, was as follows. At December 31, 2010, Teller had the following number of common and preferred shares.

|

|

Do you think that more single fathers would be willing

: Search in your community (Vancouver, Washington) to find resources available to young fathers. Using the Journal, list the resources you found. If there were more services to address the needs of single fathers, do you think that more single fathe..

|

|

Forecasted balance sheets for textile industries number

: Blackrock Investments is looking to buy Textile Industries, with the actual purchase occurring on December 31, 2011. Blackrock has created forecasted balance sheets and income statements for Textile Industries following the acquisition which reflect ..

|

|

Outline an experiment for validating the chigirev-bialek

: Using the idea of the Grassberger-Procacia correlation dimension described in Section 13.10, outline an experiment for validating the Chigirev-Bialek algorithm as a possible estimator of manifold-dimensional complexity

|

|

What is the 90-day forward rate

: Assume that interest rate parity holds and that 90-day risk-free securities yield 5% in the United States and 5.3% in Britain. In the spot market, 1 pound = $2. a. Is the 90-day forward rate trading at a premium or a discount relative to the spot rat..

|

|

An investment heavy in stocks produces the best results

: The simulation output from Example 11.7 indicates that an investment heavy in stocks produces the best results. Would it be better to invest entirely in stocks? Answer this by rerunning the simulation. Is there any apparent downside to this strat..

|

|

Determine the current balance of retained earnings

: The following information has been taken from the ledger accounts of Sampras Corporation. Determine the current balance of retained earnings.

|