Reference no: EM13850304

Question 1.

Please provide your name

Fill in the ___________

Question 2.

A booming economy with a fixed or stable nominal exchange rate _________________ .

Note: Think of the impact of a booming economy of prices.

( ) inevitably brings about an appreciation of the real exchange rate.

( ) inevitably brings about a depreciation of the real exchange rate.

( ) inevitably brings about a stabilization of the real exchange rate.

( ) inevitably brings about increased volatility of the real exchange rate.

Question 3x.

You are a currency trader with $1,000,000 (or the euro-equivalent amount) of available funds to borrow for one year. You arrive at work this morning and see the following data from Thomson Reuters on your computer screen:

Spot exchange rate $1.00 per Euro

One-year forward rate $1.01 per Euro

Dollar one-year interest rate 2.10%

Euro one-year interest rate 1.05%

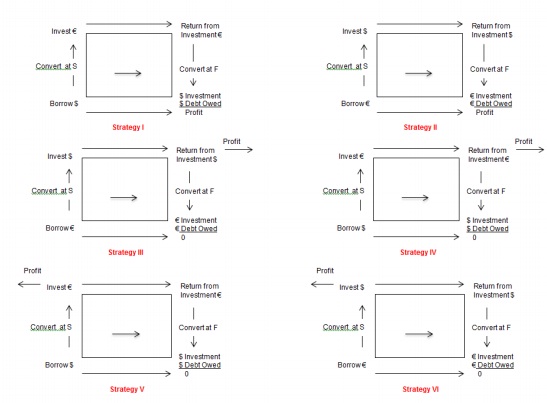

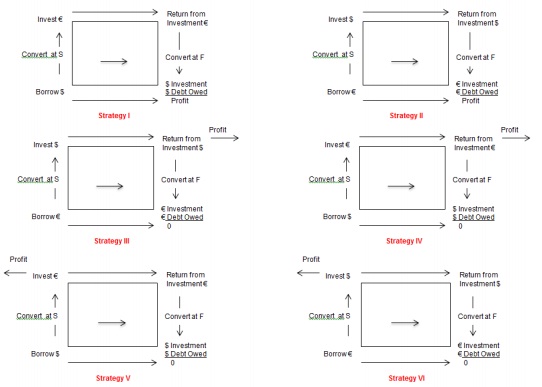

Note: Refer to the image below in order to answer several of these questions.

a. What is the forward premium on the euro? (The value of the euro in the forward market vs. the spot market express in dollars as a percentage). Express your answer as a percentage to two decimal places and exclude the "%" sign.

b. Given the spot rate and forward rate on the euro, what should be the difference in interest rates (the interest rate in the dollar less the interest rate in the euro) based on covered interest rate parity (use what is described as the approximate form in the slide deck)? Express your answer as a percentage to two decimal places and exclude the "%" sign.

c. Does a covered interest arbitrage opportunity exist? Type in "Yes" or "No"

d. Which of the strategies below would you implement to exploit the arbitrage opportunity and recognize your profits in euros in one year? Provide your answer as "Strategy" followed by Roman numerals.

e. What would be your arbitrage profits? Do not round intermediate results and express your answer (in euros) to two decimal places.

Question 3y.

You are a currency trader with $1,000,000 (or the euro-equivalent amount) of available funds to borrow for one year. You arrive at work this morning and see the following data from Thomson Reuters on your computer screen:

Spot exchange rate $1.00 per Euro

One-year forward rate $1.01 per Euro

Dollar one-year interest rate 2.10%

Euro one-year interest rate 1.05%

Note: Refer to the image below in order to answer several of these questions.

a. Which of the strategies below would you implement to exploit the arbitrage opportunity and recognize your profits in dollars immediately (use Roman numerals in your answer)?

b. What would be your arbitrage profits? Do not round intermediate results and express your final answer (in dollars) to two decimal places.

Question 4.

Which of the following best describes the real exchange rate?

( ) The real exchange rate removes currency from the calculation and expresses the rate of exchange in terms of real goods

( ) When APPP holds, the real exchange rate is 1

( ) In addition to the nominal exchange rate (S), the real exchange rate depends on price levels in the countries

( ) When RPPP holds, the real exchange rate does not change over time

( ) All of the above

( ) a and c

Question 5.

An identical basket of goods sold in two different countries should have the same price in both countries after adjusting for the exchange rate, assuming no restrictions on sales, no transportation costs, no taste differences, and no other market frictions. This principle is known as:

( ) Relative purchasing power parity

( ) Interest rate parity

( ) Price equality

( ) Absolute purchasing power parity

Question 6.

All else equal, an exporter prefers to sell its product in countries whose currency is__________ relative to APPP; whereas, a multinational corporation prefers to locate subsidiaries in countries whose currency is currently __________ but __________ relative to APPP.

( ) overvalued; overvalued; depreciating

( ) overvalued; undervalued; appreciating

( ) undervalued; overvalued; depreciating

Question 7.

If Relative Purchasing Power Parity holds, US dollar inflation is 3 percent, and Uruguayan peso inflation is 8 percent, which of the following is the best answer?

( ) The cost in US dollars for American tourists to Uruguay will increase at 3 percent

( ) The cost in US dollars for American tourists to Uruguay will increase at 8 percent

( ) The cost in US dollars for American tourists to Uruguay will increase at 11 percent

( ) The cost in in Uruguayan pesos for Uruguayan tourists to the US will increase at 3 percent

( ) The cost in Uruguayan pesos for Uruguayan tourists to the US will increase at 8 percent

( ) The cost in in Uruguayan pesos for Uruguayan tourists to the US will increase at 11 percent

( ) c and f

( ) a and e

( ) b and d

Question 8.

The following statement: "When RPPP is violated, there can be real appreciation in € despite depreciation in the nominal $ per € exchange rate," is:

( ) True

( ) False

Question 9.

Suppose you observe a spot exchange rate of $1.50/€. If interest rates are 5% APR in the U.S. and 3% APR in the euro zone, what is the no-arbitrage 1-year forward rate?

( ) €1.5291/$

( ) $1.5291/€

( ) €1.4714/$

( ) $1.4714/€

Question 10.

A U.S.-based currency dealer has good credit and can borrow $1,000,000 or €800,000 for one year. The one-year interest rate in the U.S. is i$ = 2% and in the euro zone the one-year interest rate is i€ = 6%.

The spot exchange rate is $1.25 = €1.00 and the one-year forward exchange rate is $1.20 = €1.00. Show how to realize a certain dollar profit via covered interest arbitrage.

Note: Do not use the "approximate" form of interest rate parity.

( ) Borrow $1,000,000 at 2%. Trade $1,000,000 for €800,000; invest at i€ = 6%; translate proceeds back at forward rate of $1.20 = €1.00, gross proceeds = $1,017,600.

( ) Borrow €800,000 at i€ = 6%; translate to dollars at the spot, invest in the U.S. at i$ = 2% for one year. In one year, translate dollars into euros at the forward rate of $1.20 = €1.00 to yield €848,000. Net profit $2,400.

( ) Borrow €800,000 at i€ = 6%; translate to dollars at the spot, invest in the U.S. at i$ = 2% for one year. In one year, translate dollars into euros at the forward rate of $1.20 = €1.00 to yield €850,000. Net profit €2,000.

( ) Both c and b

Question 11.

Suppose that you are the treasurer of IBM with an extra U.S. $1,000,000 to invest for six months. You are considering the purchase of U.S. T-bills that yield 1.810% (that's a six month rate, not an annual rate by the way) and have a maturity of 26 weeks. The spot exchange rate is $1.00 = ¥100, and the six month forward rate is $1.00 = ¥110. What must the interest rate in Japan (on an investment of comparable risk) be before you are willing to consider investing there for six months?

( ) 11.991%

( ) 1.12%

( ) 7.45%

( ) -7.45%

Question 12.

An Italian currency dealer has good credit and can borrow $1,000,000 or €800,000 for one year. The one-year interest rate in the U.S. is i$ = 2% and in the euro zone the one-year interest rate is i€ = 6%.

The spot exchange rate is $1.25 = €1.00 and the one-year forward exchange rate is $1.20 = €1.00. Show how to realize a certain euro-denominated profit via covered interest arbitrage. Note: Do not use the "approximate" form of interest rate parity.

( ) Borrow $1,000,000 at 2%. Trade $1,000,000 for €800,000; invest at i€ = 6%; translate proceeds back at forward rate of $1.20 = €1.00, gross proceeds = $1,017,600.

( ) Borrow €800,000 at i€ = 6%; translate to dollars at the spot, invest in the U.S. at i$ = 2% for one year. In one year, translate dollars into euros at the forward rate of $1.20 = €1.00 to yield €848,000. Net profit $2,400.

( ) Borrow €800,000 at i€ = 6%; translate to dollars at the spot, invest in the U.S. at i$ = 2% for one year. In one year, translate dollars into euros at the forward rate of $1.20 = €1.00 to yield €850,000. Net profit €2,000.

( ) Both c and b

Question 13.

A currency dealer has good credit and can borrow either $1,000,000 or €800,000 for one year. The oneyear interest rate in the U.S. is i$ = 2% and in the euro zone the one-year interest rate is i€ = 6%. The spot exchange rate is $1.25 = €1.00 and the one-year forward exchange rate is $1.20 = €1.00. Show how to realize a certain profit via covered interest arbitrage.

Note: Do not use the "approximate" form of interest rate parity.

( ) Borrow $1,000,000 at 2%. Trade $1,000,000 for €800,000; invest at i€ = 6%; translate proceeds back at forward rate of $1.20 = €1.00, gross proceeds = $1,017,600.

( ) Borrow €800,000 at i€ = 6%; translate to dollars at the spot, invest in the U.S. at i$ = 2% for one year. In one year, translate dollars into euros at the forward rate of $1.20 = €1.00 to yield €848,000. Net profit $2,400.

( ) Borrow €800,000 at i€ = 6%; translate to dollars at the spot, invest in the U.S. at i$ = 2% for one year. In one year, translate dollars into euros at the forward rate of $1.20 = €1.00 to yield €850,000. Net profit €2,000.

( ) Both c and b

Question 14.

Suppose you observe a spot exchange rate of $1.50/€. If interest rates are 3% APR in the U.S. and 5% APR in the euro zone, what is the no-arbitrage 1-year forward rate?

( ) €1.5291/$

( ) $1.5291/€

( ) €1.4714/$

( ) $1.4714/€

Question 15.

Suppose that you are the treasurer of IBM with an extra U.S. $1,000,000 to invest for six months. You are considering the purchase of U.S. T-bills that yield 1.810% (that's a six month rate, not an annual rate by the way) and have a maturity of 26 weeks. The spot exchange rate is $1.00 = ¥100, and the six month forward rate is $1.00 = ¥110. The interest rate in Japan (on an investment of comparable risk) is 13 percent. What is your strategy?

( ) Take $1m, invest in U.S. T-bills.

( ) Take $1m, translate into yen at the spot, invest in Japan, and repatriate your yen earnings back into dollars at the spot rate prevailing in six months.

( ) Take $1m, translate into yen at the spot, invest in Japan, hedge with a short position in the forward contract.

( ) Take $1m, translate into yen at the forward rate, invest in Japan, hedge with a short position in the spot contract

Question 16.

Forward parity states that _____________

( ) any forward premium or discount is equal to the expected change in the exchange rate.

( ) any forward premium or discount is equal to the actual change in the exchange rate.

( ) the nominal interest rate differential reflects the expected change in the exchange rate.

( ) an increase (decrease) in the expected inflation rate in a country will cause a proportionate increase (decrease) in the interest rate in the country.

Question 17.

The International Fisher Effect suggests that ____________

( ) any forward premium or discount is equal to the expected change in the exchange rate.

( ) any forward premium or discount is equal to the actual change in the exchange rate.

( ) the nominal interest rate differential reflects the expected change in the exchange rate.

( ) an increase (decrease) in the expected inflation rate in a country will cause a proportionate increase (decrease) in the interest rate in the country.

Question 18.

Due to the integrated nature of their capital markets, investors in both the U.S. and U.K. require the same real interest rate, 2.5%, on their lending. There is a consensus in capital markets that the annual inflation rate is likely to be 3.5% in the U.S. and 1.5% in the U.K. for the next three years. The spot exchange rate is currently $1.50/£.

a. Compute the nominal interest rate per annum in both the U.S. and U.K., assuming that the Fisher effect holds. Note: Express your answer as a percent to two decimal places and do not include "%" (1.23 not 1.23%)

US: ___________

UK: ___________

b. What is your expected future spot dollar-pound exchange rate in three years from now? ___________

c. Can you infer the forward dollar-pound exchange rate for one-year maturity? ___________

Question 19.

The Fisher effect states that:

( ) any forward premium or discount is equal to the expected change in the exchange rate.

( ) any forward premium or discount is equal to the actual change in the exchange rate.

( ) the nominal interest rate differential reflects the expected change in the exchange rate.

( ) an increase (decrease) in the expected inflation rate in a country will cause an (approx.) equal increase (decrease) in the nominal interest rate in the country.