Reference no: EM131071860

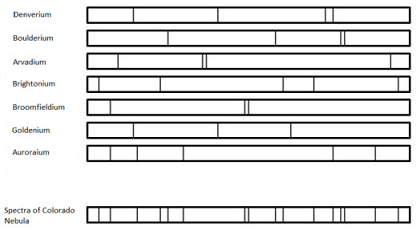

Vectors and Functions of Several Variables Exercise

1. A 500-lb load hangs from three cables of equal length that are anchored at the points (-2, 0, 0), (1, √3, 0), and (1, -√3, 0). The load is located at (0, 0, -2√3). Find the vectors describing the forces on the cables due to the load.

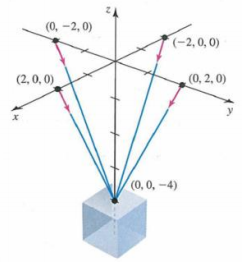

2. A 500-lb load hangs from four cables of equal length that are anchored at the points (±2, 0, 0) and (0, ±2, 0). The load is located at (0, 0, -4). Find the vectors describing the forces on the cables due to the load.

3. A clothing company makes a profit of $10 on its long-sleeved T-shirts and $5 on its short-sleeved T-shirts. Assuming that there is a $200 setup cost, the profit on T-shirts sales is z = 10x + 5y - 200, where x is the number of long-sleeved T-shirts sold and y is the number of short-sleeved T-shirts sold. Assume that x and y are nonnegative.

a. Graph the plane that gives the profit using the window [0, 40] X [0, 40] X [-400, 400].

b. If x = 20 and y = 10, is the profit positive or negative?

c. Describe the values of x and y for which the company breaks even (for which the profit is zero).

4. Suppose you make a one-time deposit of P dollars into a saving account that earns interest at an annual rate of p% compounded continuously. The balance in the account after t years is B (p, r, t) = Pert, where r = p/100 (for example, if the annual interest rate is 4%, then r = 0.04). Let the interest rate be fixed at r = 0.04.

a. With a target balance of $2000, find the set of all points (P, t) that satisfy B = 2000. This curve gives all deposits P and times t that result in a balance of $2000.

b. Repeat part (a) with B = $5000, $1500, and $2500 and draw the resulting level curves of the balance function.

c. In general, on one level curve, if t increases, does P increase or decrease?

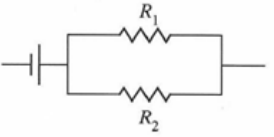

5. Two resistors in an electrical circuit with resistance R1 and R2 wired in parallel with a constant voltage give an effective resistance of R, where 1/R = 1/R1 + 1/R2.

a. Find ∂R/∂R1 and ∂R/∂R2 by solving for R and differentiating.

b. Find ∂R/∂R1 and ∂R/∂R2 by differentiating implicitly.

c. Describe how an increase in R1 with R2 constant affects R.

d. Describe how a decrease in R2 with R1 constant affects R.

|

William monthly payments

: If the simple annual interest is 4.2 percent, what are William's monthly payments? To the nearest dollar, how much will William owe on hisstudent loan after he makes payments for three years? Please show how you concluded the answer

|

|

Do you think prostitution should be legalized

: Do you think pornography is harmful to American society? Do you think that pornography should be restricted in the United States? Explain your answers.

|

|

Discuss the functions of grievance procedures

: Discuss the functions of grievance procedures.

|

|

Computing the net income

: The average total assets for company x equal $1,000,000 while the firm earns a net profit margin of 10% with an asset turnover ratio of two. What is their net income?

|

|

Find the vectors describing the forces on the cables

: MA3410: Vectors and Functions of Several Variables Exercise. A 500-lb load hangs from three cables of equal length that are anchored at the points (-2, 0, 0), (1, √3, 0), and (1, -√3, 0). The load is located at (0, 0, -2√3). Find the vectors descri..

|

|

Estimate of the stock current price

: The company's stock has a beta of 1.8, the risk-free rate is 3.5%, and the market risk premium is 6%. What is your estimate of the stock's current price? Round your answer to the nearest cent.

|

|

Discuss the role of the federal government

: CSEC 670 Assignment - How do the emerging cyber security technologies that you identified coupled with prioritized research and development improve cyber security?

|

|

Prepare the business combination valuation entries

: Prepare the business combination valuation entries and pre-acquisition entries at I January 2017. Prepare the business combination valuation entries and pre-acquisition entries at 31 December 2017.

|

|

Amount of financing offered by the french government

: Suppose it turns out that having $800 million in franc financing actually adds to Disney's economic exposure. How should this affect Disney's willingness to accept the full amount of financing offered by the French government?

|