Reference no: EM13342439

Problem 1

A company uses a periodic inventory system. At the end of the annual accounting period, December 31, the accounting records provided the following information for a product.

|

|

Units

|

Unit Cost

|

|

Inventory, December 31 Year 1

|

2,000

|

$4

|

|

For the current year:

|

|

|

|

Purchase , April 11

|

5,000

|

$6

|

|

Purchase, June 1

|

3,000

|

$9

|

|

Inventory, December 31 Year 2

|

4,000

|

|

Compute ending inventory and cost of goods sold under FIFO, LIFO, and average cost inventory costing methods.

Problem 2

A company uses the FIFO inventory costing method and has a perpetual inventory system. All purchases and sales were cash transactions. The records reflected the following for January.

|

|

Units

|

Unit Cost

|

|

Beginning Inventory

|

100

|

$1.50

|

|

Purchase, January 4

|

200

|

$1.10

|

|

Sale, January 18 at $2.20 per unit

|

110

|

|

|

Purchase, January 22

|

100

|

$1.60

|

|

Sale, January 28 at $2.40 per unit

|

170

|

|

Determine the cost of goods available for sale, the ending inventory, and the cost of goods sold. Then create the journal entries for January 4 and 18.

Problem 3

A company just completed a physical inventory count at year-end, December 31. Items were counted and costed on a FIFO basis. The inventory amounted to $40,000. The following information was not included in the inventory amount.

(a) Goods costing $600 were being used by a customer on a trial basis.

(b) A customer purchased goods for cash amounting to $2,650, but the amounts were not delivered until the next year. The cost of the goods for the company were $1,300, and that amount was included in the physical inventory count.

(c) Goods that have not arrived by December 31 from a supplier amounted to $4,550 with the terms FOB shipping point.

(d) The company shipped $600 worth of goods to a customer, FOB destination. The goods are expected to arrive in January of the next year.

Begin with the $40,000 inventory amount and adjust the ending inventory using the additional items. Assume that the company's accounting policy requires including in inventory all goods for which it has title (ownership). Use the fact that the change in title (ownership) is determined by the shipping.

Question:

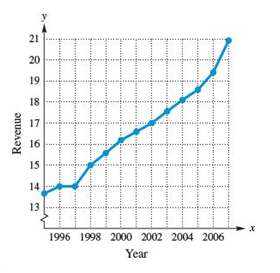

Business The accompanying graph shows the revenue (in billions of dollars) generate by the hardware industry in the United States from 1995 to 2007. Find the approximate average change in the revenue for each period.

a) 1996 to 2002

b) 2002 to 2007

Question:

Business The cost of producing xitems is

C(x)=1,000+.24x^2 (0≤x≤20,000)

Find the marginal cost C^' (x).

Find C'(100)

Find the actual cost to produce the 101st item.

Compare the answers to (b) and (c). How are they related?

Question:

Health The eating behavior of a typical human during a meal can be described by

I(t)=27+72t-1.5t^2 ,

Where t is the number of minutes since the meal began and I(t) represents the amount (in grams) that the person has eaten by time t.

Find the rate of change of the intake of food for a person 5 minutes into a meal, and interpret it.

Verify that the rate at which food is consumed is zero 24 minutes after the meal starts.

Comment on the assumptions and usefulness of this function after 24 minutes. On the basis of your answer, determine a logical range for the function.