Reference no: EM131247115

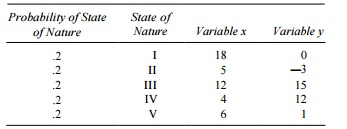

Given two random variables, x and y,

a) Calculate the mean and variance of each of these variables, and the covariance between them.

b) Suppose x and y represent the returns from two assets. Calculate the mean and variance for the following portfolios:

c) Find the portfolio that has the minimum variance.

d) Let portfolio A have 75% in x and portfolio B have 25% in x. Calculate the covariance between the two portfolios.

e) Calculate the covariance between the minimum variance portfolio and portfolio A, and the covariance between the minimum variance portfolio and portfolio B.

f) What is the covariance between the minimum variance portfolio and any other portfolio along the efficient set?

g) What is the relationship between the covariance of the minimum variance portfolio with other efficient portfolios, and the variance of the minimum variance portfolio?

|

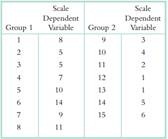

Calculate the variance of an equally weighted portfolio

: Calculate the variance of an equally weighted portfolio. - Calculate the covariance of a portfolio that has 10% in asset 1, 80% in asset 2, and 10% in asset 3 with a second portfolio that has 125% in asset 1, - 10% in asset 2, and -15% in asset 3.

|

|

Desktop administration at a remote satellite office

: The desktop administration at a remote satellite office called you to let you know that after the installation of Windows, he noticed that the FLIP 3D is not working. Of courseyou prepare a list of questions to ask and have possible recommendation..

|

|

Describe difference between internal and external validity

: For what types of data would you use nonparametric versus parametric statistics? Briefly describe the difference between internal and external validity.

|

|

Strong authentication solution

: Discuss ways that an organization may streamline the administration required to implement and maintain a strong authentication solution.

|

|

Find the portfolio that has the minimum variance

: Calculate the mean and variance of each of these variables, and the covariance between them. - Find the portfolio that has the minimum variance.

|

|

Away from their computers

: After users are authenticated, what measures can be employed in order to maintain security when users are away from their computers?

|

|

Show that the firms cannot gain by deviating

: In the game described in the text, is there a subgame perfect Nash equilibrium in which the players choose sales caps of less than 15 in the first period? If so, describe such an equilibrium and show that the firms cannot gain by deviating. If not..

|

|

Computing devices now able to acquire automatically

: For two decades, user input devices typically comprised a keyboard and a mouse. This left computers virtually "blind" to the world. A whole new class of devices has now changed this. Read Wired.com's article How Context-Aware Computing Will Make G..

|

|

Establishing a network connection

: In your option what are the challenges in establishing a network connection between two points over a large distance, describe your own knowledge of this network configuration.

|