Reference no: EM13687403

Managerial Finance

1. Hoover Inc. has current assets of $350,000 and fixed assets of $650,000. Current liabilities are $100,000 and long-term liabilities are $250,000. There is $120,000 in preferred stock outstanding and the firm has issued 10,000 shares of common stock. Compute book value (net worth) per share

2. Find the firms Break Even Point in number of units

Sales (1.000 units) 110.000

Variable costs 90.000

Contribution margin 40.000

Fixed manufacturing costs 50.000

Operating income 10.000

Interest 40.000

Earnings before taxes 12.000

Taxes (30°0 528.000

Net Income 1.000

TEW COMPANY

Balance Sheet

As of December 31, 2007

|

ASSETS

Cash

Accounts Receivable

Inventory

Net Plant and Equipment Total Assets

|

$20,000

80,000

50,000

250.000

$400,000

|

LIABILITIES AND STOCKHOLDERS' EQUITY

Accounts Payable Accrued Expenses

Long-Term debt

Common Stock

Paid-In capital

Retained earnings

Total Liabilities and Stockholders' Equity

$40,000

60,000

130,000

100,000

10,000

60.000

$400,000

TEW COMPANY

Income Statement

For the Year Ended December 31, 2007

Sales (all on credit) $500,000

Cost of Goods Sold 200.000

Gross Profit 300,000

Sales and Administrative Expense 20,000

Fixed Lease Expenses 10,000

Depreciation 40.000

Operating Profit 230,000

Interest Expense 20.000

Profit before Taxes 210,000

Taxes (35%) 73.500

Net Income $136,500

3. Given the information below compute the following ratios .

A. Using the DuPont method, return on assets (investment)

B. TEW's return on equity is ____.

C. Times interest earned for TEW Company is ____.

D. TEW's average collection period is

E. TEW's total asset turnover is?

F. TEW's quick ratio is ____.

G. TEW's Current ratio is ____.

H. TEW's debt to assets ratio is ____.

I. Fixed charge coverage for TEW Company is ____.

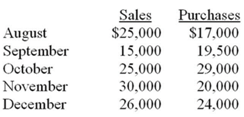

4. The Amber Magic Shoppe has forecast its sales revenues and purchases for the last 5 months of 20XX to be as follows:

65% of sales are on credit. On the basis of past experience, 50% of the accounts receivable are collected the month after the sale and the remainder are collected two months after the sale. Purchases are paid 30 days after they are incurred. The firm had a cash balance of $5,000 as of September 30, and its minimum required cash balance is $4,000. It had no beginning loan balance. Prepare a cash budget for October, November, and December.

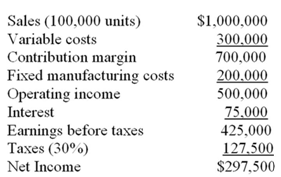

5. Find the degree of combined leverage

6. Your client just turned 75 years old and plans on retiring in 10 years on her 85th birthday. She is saving money today for her retirement and is establishing a retirement account with your office. She would like to withdraw money from her retirement account on her birthday each year until she dies. She would ideally like to withdraw $50,000 on her 85th birthday, and increase her withdrawals 10 percent a year through her 89th birthday (i.e., she would like to withdraw $73,205 on her 89th birthday). She plans to die on her 90th birthday, at which time she would like to leave $200,000 to her descendants. Your client currently has $100,000. You estimate that the money in the retirement account will earn 8 percent a year over the next 15 years.

Your client plans to contribute an equal amount of money each year until her retirement. Her first contribution will come in 1 year; her 10th and final contribution will come in 10 years (on her 85th birthday). How much should she contribute each year to meet her objectives?