Reference no: EM13126023

1. Consider the following discrete probability distribution function for the variable X:

|

X

|

10

|

12

|

14

|

16

|

18

|

|

f(x)

|

.02

|

.7

|

.05

|

.2

|

.03

|

a) Is this a proper probability mass function? How do you know?

b) Find the mean, variance, and standard deviation of X, showing your work.

c) What is the probability that any draw from this distribution, say X, is less than 16 [i.e. find P(X<16)]?

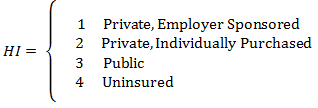

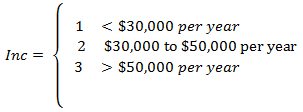

2. Consider the following discrete probability mass function for the variables Health Insurance and Income. Health Insurance indicates whether each individual possesses health insurance coverage and, if so, what type, with

and Income measures gross income class, with

The joint pmf is given as:

|

HI

|

Inc

|

|

1

|

2

|

3

|

|

1

|

.03

|

.13

|

.44

|

|

2

|

.01

|

.01

|

.03

|

|

3

|

.07

|

.03

|

.08

|

|

4

|

.10

|

.06

|

.01

|

a) Is this a proper probability mass function? How do you know?

b) What is the probability that an individual drawn from this distribution holds public health insurance? What type of probability is this (e.g. joint, marginal, or conditional)?

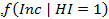

c) Construct the conditional probability distribution (pmf) of Income given that an individual is covered by a private, employer sponsored health insurance plan; i.e., construct the table or graph that shows,  .

.

d) What is the probability that an individual earns $30,000 or more per year given that they are insured by at least some form of insurance (i.e. not uninsured)?

e) Calculate the mean income class for those individuals with private, employer sponsored insurance. Is this greater than or less than the mean income class for those with private, individually purchased insurance? Any thoughts regarding the comparison?

f) Find the covariance between HI and Inc and provide an interpretation of the sign of the statistic.

g) Are HI and Inc independent? How do you know?

|

Compute the issue price of each of the following bonds

: $10,000,000 face value, serial bonds repayable in 40 equal semi-annual installments of $500,000, which includes coupon payments and repayment of principal, for 20 years, priced on the market to yield 6% compounded semi-annually. Round your answer ..

|

|

Should ira follow her friends advice

: A friend has suggested that Ira sell the stock and contribute the 20,000 in proceeds rather than contribute the stock. Should Ira follow her friends advice? Why?. Assume the fair market value is only $13,000. In this case, should Ira follow the fri..

|

|

Valencies and syntactic roles and basic phrase

: QUIZZIE 1 VALENCIES AND SYNTACTIC ROLES QUIZZIE 2 Basic Phrase Structures

|

|

The development of a specific mental disorder

: Analyze the factors (both genetic and environmental) contributing to the development of a specific mental disorder (of your choice) and discuss steps that could be taken to reduce the incidence of that disorder. Be sure to focus on prevention, not tr..

|

|

Find the covariance between hi and inc

: Calculate the mean income class for those individuals with private, employer sponsored insurance. Is this greater than or less than the mean income class for those with private, individually purchased insurance? Any thoughts regarding the compari..

|

|

Compute mass mole fraction and avg molecular weight

: Calculate mass, mole fraction and avg. molecular weight of air, Calculate the constituent (a) mass, (b) mole fraction (c)average molecular weight of air at 25 degree centigrade, 1 atm, and molar density of all listed gases

|

|

Who are the five sponsoring organizations

: Download the COSO ERM executive summary(free of charge). According to the first page of the summary, what does enterprise risk management encompass?

|

|

Equations-permutations and combinations

: As a business owner, there are many decisions that you need to make on a daily basis, such as ensuring you reach the highest production levels possible with your company's products. Your company produces two models of bicycles: Model A and Model B..

|

|

Company cost of preferred stock

: If the company were to sell a new preferred issue, it would incur a flotation cost of 5.00% of the price paid by investors. What is the company's cost of preferred stock?

|