Reference no: EM131318662

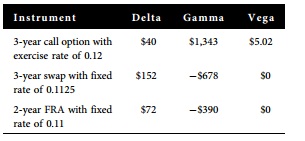

The following table lists three financial instruments and their deltas, gammas, and vegas for each $1 million notional principal under the assumption of a long position. (Long in a swap or FRA means to pay fixed and receive floating.) Assume that you hold a $12 million notional principal long position in the three-year call option, an $8 million notional principal short position in the three-year swap, and an $11 million notional principal long position in the FRA. Each derivative is based on the 90-day LIBOR.

a. As described above, you have three instruments currently in your portfolio. Determine your current portfolio delta, gamma, and vega. Describe in words the risk properties of your portfolio based on your calculations.

b. Assume that you have to maintain your current position in the call option but are free to increase or decrease your positions in the swap and FRA and you can add a position in a one-year call with a delta of $62, a gamma of $2,680, and a vega of $2.41.

Find the combination of notional principals that would make your overall position be delta hedged, gamma hedged, and vega hedged.

|

What is the price of stock

: A stock is expected to grow 3% per year. What is the price of this stock if the required return is 9%? The stock is expected to pay a $1.4 dividend next year.

|

|

Check the international banking page

: Review the website of a major bank. Check the International banking page. Provide a brief summary of the services provided. After reviewing this information, indicate if you would use services provided by this bank if you were to expand a business..

|

|

Devise a scheme that exploits this potential parallelism

: What constraint does this approach impose on the relation between the page size and the cache lookup mechanism? Explain.

|

|

Opportunity cost of holding cash

: In addition, the total estimated cash costs (transfers and carrying cost) for the firm, based on 16 transactions per year, are $5,760. On what opportunity cost of holding cash was this analysis based?

|

|

Find the combination of notional principals

: Find the combination of notional principals that would make your overall position be delta hedged, gamma hedged, and vega hedged.

|

|

Minimum cost cash balance

: Each time Hott deposits money in its account, a charge of $2.00 is assessed to cover clerical costs. If Hott can hold marketable securities that yield 5 percent, and then convert these securities to cash at a cost of only the $2 deposit charge, wh..

|

|

Would you expect demand for ski butternut lift tickets

: Would you expect demand for Ski Butternut lift tickets to be elastic? Why or why not? What role do the product life cycle, competition, and perceptions of quality play in Ski Butternut'spricing?

|

|

Discuss the cultural factors that influence consumers

: Conduct an analysis using secondary sources of information on the geo-demographic data (age, income, gender, location) of your target consumers and discuss the cultural factors that influence consumers in the buying behaviour and decisions.

|

|

Develop justification for adhering to the approach

: Strengths in techniques are actually encouraging clients to engage in self-evaluation, to determine if their current actions are working or not and to help them commit to changing their ways. When working with drug addicts, the reality therapist c..

|