Reference no: EM133203413 , Length: Word count: 2 Pages

Problem 1: You are given the following data for a company: Cost of debt = 8%, cost of retained earnings = 12%, cost of new common equity = 14%, tax rate = 35% and retained earnings = $1000. The firms target capital structure is 40% debt and 60% common equity. Compute the following:

A. Retained earnings break point

B. WACC below the RE break point

C. WACC above the RE break point:

Problem 2: The cost of debt for firm XYZ is 6%. It's tax rate is 40%. The cost of retained earnings is 12% and the cost of external common equity is 14%. Retained earnings is $5000. The target capital structure calls for 45% debt and 55% equity. Compute the following:

A. Retained earnings break point

B. WACC below the RE break point

C. WACC above the RE break point

Problem 3: The firm referred to in problem 2 has 3 projects available: One with a cost of $4000 and an IRR of 18%; one with a cost of $3000 and an IRR of 20%; and one with a cost of $6000 and an IRR of 6%. Do the following:

Compute the optimal capital budget. In other words, how much capital must the firm raise in order to invest in all projects whose IRR exceeds the WACC?

What projects should be accepted?

Problem 4: A potential CB project has the following cash flows: CF0 = -$500, CF1 = $300, CF2 = $200, CF3 = $150. WACC = 6%. Compute the following:

A. Payback Period

B. NPV

C. IRR

Problem 5: A project has a WACC of 8% and an initial cash outlay of $1000. The life of this project is 4 years and cash flows are expected to be $400 per year. Compute the following:

Payback Period

NPV

IRR

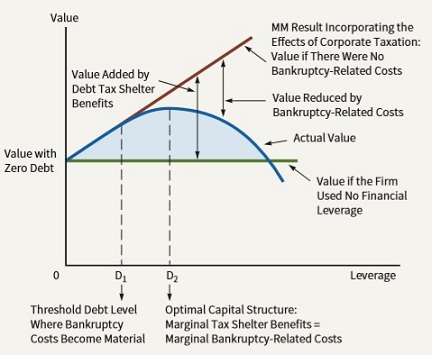

Problem 6: Please refer to the curved line in figure and explain the reason for the following: The line initially has an upward slope, but gradually begins to slope downward as you move further out along the horizontal axis.

Problem 7: Please explain the following statement: There are times when a cut in dividends can be a positive signal.

Problem 8: Consider the Dividend Irrelevance Theory and explain the following: Generally speaking, why is there an inverse relationship between dividends and the potential for growth?

Problem 9: Consider the Bird in the Hand Theory and explain the following: Why are dividends less risky than pursuing growth opportunities?