Reference no: EM131531321

Assignment:

Problem 1

Lucille is considering the purchase of insurance coverage on a family heirloom diamond necklace. The necklace is value at $500,000 and Lucille's net wealth is $900,000. She estimates the probability that the necklace is lost or stolen to be π = 0.15. Furthermore, Lucille's utility function over final wealth is given by

u(x) = x0.5

Suppose that the insurance company offers Lucille any amount of coverage C at a premium rate p = 0.16.

(a) Find the optimal amount of coverage that Lucille will purchase.

(b) Now suppose that π, the probability that the loss occurs, increases to 0.155. What do you expect will happen to Lucille's optimal amount of coverage compared to part (b) (increase, decrease, or stay the same)?)

(c) Find the new optimal amount of coverage that Lucille will purchase if π = 0.155.

Problem 2

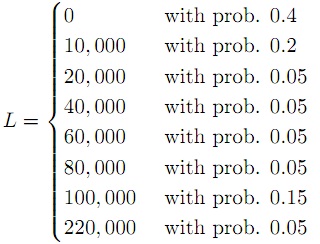

Consider a farmer who is trying to choose between a coinsurance policy and a deductible policy to protect against damage to her farming lands. The value of the loss, and the corresponding probabilities of each value, are given as follows:

The farmer's initial wealth is W = 280, 000.

The Coinsurance policy offers to pay α = 0.75 fraction of any loss incurred. Under the Deductible policy, the insurance company pays nothing if the loss is less than D = $19, 000, then pays any losses incurred beyond D; that is, the insurance company pays L - D if L > D. Both policies are offered for a premium amount P = $12, 000.

(a) Which contract would the farmer choose if she is an expected utility maximizer with u(x) = x0.4? (Keep 5 decimal places throughout)

(b) Which contract would the farmer choose if she is an expected utility maximizer with u(x) = x0.8? Is the answer different than in (a)? If so, explain why.

Problem 3

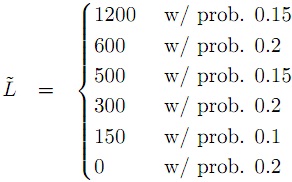

Tommy has initial wealth equal to 2000 but faces a potential loss, L, which may take one of 6 possible values with various probabilities. These are summarized below;

Suppose that his insurance company offers two hybrid insurance contracts - each with a deductible and a coinsurance component, as explained below.

Contract A: The insurance company will pay nothing for a loss that is less than a deductible amount of $400, but for any losses higher than $400, they will pay 70% of the difference between the loss and the deductible. The premium amount for this contract is $250.

Contract B: The insurance company will pay nothing for a loss that is less than a deductible amount of $550, but for any losses higher than $550, the insurance company will pay 100% of the difference between the loss and the deductible. The premium amount for this contract is also $250.

(a) For each contract/policy, calculate Tommy's expected wealth under the two contracts.

(b) Then, for each contract/policy, calculate the expected utility it generates for Tommy, assuming that his utility function is u(x) = x0.4. Which contract does he prefer?

Problem 4

Tim owns a house, but is moving to a new job overseas. He's decided to sell his house, but doesn't have much time; thus, he plans to post a take-it-or-leave-it sale price offer with price x on a listings website for one day. The probability that some buyer accepts an offer x is denoted by q, and given by q = 2 - x where x can be any number between 1 and 2 (expressed in millions of dollars). For example, x = 1.5 corresponds to 1.5 million dollars, and the probability the house would sell at x = 1.5 would be q = 2 - 1.5 = 0.5. If the house does not sell, Tim can sell his house to the company he is joining at a price of 1 (million dollars).

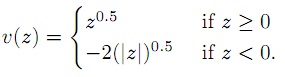

Suppose that Tim is a prospect theory maximizer, with an overall value function V. Assume that his underlying value function over changes relative to his reference point is

where |z| denotes the absolute value of z. Suppose that Tim is pessimistic and thus his reference point is equal to 1 (million dollars). In this case, selling the house for x will generate a gain of (x - 1) (million dollars). Furthermore, suppose that Tim's overall value function for a risky prospect (z1, q ; z2, 1-q) is given by

V(z1, q ; z2, 1 - q) = qv(z1) + (1 - q)v(z2).

That is, Tim does not apply any probability weighting function to the objective probability q.

(a) Write down the risky prospect generated by a generic choice of x and for the specific risky prospect generated by x = 1.25. (1 point)

(b) What is the overall value V Tim gets from the prospect generated by a choice of x = 1.25?

(c) Would Tim prefer to choose x = 1.5 or x = 1.25?

(d) Now suppose that Tim is actually optimistic and thus his reference point is equal to 2 (million dollars).

In this case, selling the house for x will generate a loss of -(2 - x) (million dollars). For this case, what is the overall value V Tim gets from the prospect generated by a choice of x = 1.25? (1 point)

(e) Continuing with the changes made in part (d), would Tim prefer to choose x = 1.5 or x = 1.25? Does your answer differ from the answer to part (c)?

Problem 5.

Matt is deciding how much to invest in a risk-free asset with fixed rate of return rf = 0.2 and a risky asset with random rate of return x˜ given by

Suppose Matt has w = 500 to invest and a utility function over final portfolio v given by u(v) = v0.9.

(a) Calculate the optimal amount α∗ for Matt to invest in the risky asset.

(b) Suppose Matt's wealth decreases to w = 300. What would you expect his optimal investment to be in this case?