Reference no: EM13309899

Paper Inc.'s Board of Directors has requested a set of pro-forma financial statements for the proposed acquisition of Scissor Company.

For the past several years paper Inc.'s Executive Management Team has received continued pressure from its investors for their lack of growth (markets share, revenue, and profits). On May 1, 2012 the Chief Executive Officer, Chief Operating Officer, and the Chief Financial Officer all resigned under duress (pressured by Board of Directors to resign).

For the past six months, paper Inc.'s Board of Directors and Executive Management Team had been in discussions with Scissor Company's Board of Directors about a possible merger/ acquisition (paper Inc. acquiring 75% of Scissor Company). The paper Inc. Board has determined that this acquisition would be in the best interest of its shareholders.

The Board has requested that the Accounting Department provide pro-forma financial statements (income statement, statement of retained earnings, and balance sheet) for the proposed consolidated company. In addition, the Board has asked for a detailed explanation on how the consolidation process works. They specifically requested a walk-through of the consolidation workpaper(s).

Detailed Request:

1. prepare a consolidated balance sheet (Date of Acquisition) assuming the acquisition had taken place on January 1, 2012 (remember to show workpaper detail).

2. prepare a proforma income statement, statement of retained earnings, and balance sheet (assuming the acquisition had taken place on January 1, 2012) as of December 31, 2012 (remember to show workpaper detail using the 3-section format).Apply the cost method.

3. Document all general ledger journal entries (REAL Entries) that would take place using the assumptions above.

Joel Wilson

Base Data:

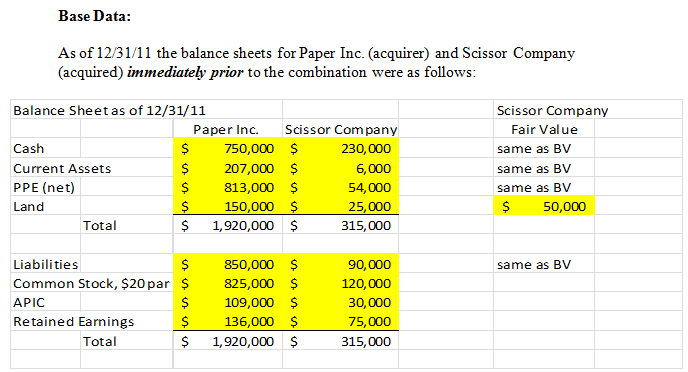

As of 12/31/11 the balance sheets for paper Inc. (acquirer) and Scissor Company (acquired) immediately prior to the combination were as follows:

Key Data and Assumptions:

- As of 12/31/11 FV of Scissor Company net assets is equal to BV with the exception of Land, which has a FV of $50,000.On January 1, 2012, paper Inc. common stock had a fair value of $30 per share. It is expected that paper Inc.'s common stock will have a fair value of $30 per share on 12/31/2012.

- Assume thatpaper Inc. issues 9,600 shares of its $20 par value common stock for 75% of Skins outstanding stock on January 1, 2012.

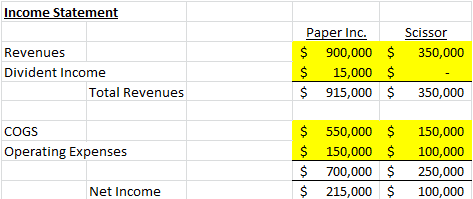

- Assume that the income statements for paper Inc. and Scissor are the following in fiscal year 2012. In addition, assume paper Inc. had dividends declared of $40,000 and Scissor Company declared $20,000.