Reference no: EM131115732

Task 1 (Preparing Financial Statements)

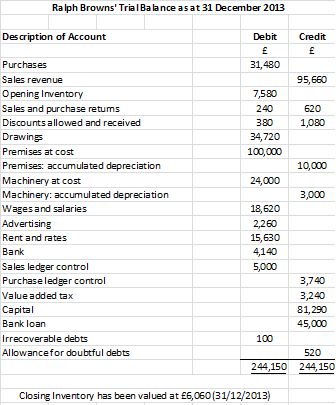

The following trial balance has been extracted by the book - keeper, for Ralph Browns' business as at 31 December 2013.

• Depreciate premises at 2 percent per annum using the straight line method

• Depreciate machinery at 12.5 percent per annum using the straight line method

• Allowance for doubtful debts is to be 5 % of receivables

• Wages accrued are £500, and advertising prepaid is £350

Required:

Prepare Ralph Browns' Statement of Profit and Loss for the year ended 31 December 2013 and Statement of Financial Position as at that date.

Task 2 (Case Study Analysis)

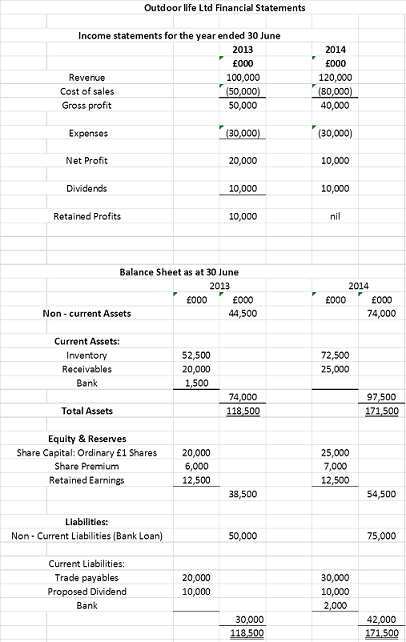

Outdoor Life ltd is a Medium size company operating in the county of Berkshire, England. They manufacture and retail Bicycles and associated accessories for riders, as well as outdoor equipment like Tents, Tarp, and Sleeping Bags etc. Currently they have two plants which manufacture the bicycles and outdoor equipment and five retail stores (Four in London and one in Berkshire) which sell their own brands.

The business was started in 2007, by John Taylor and Mick Leeson (both directors of the company), both avid Cyclists and outdoor enthusiast. The business in its early years did better than was expected and as a result has grown to its existing capacity. This growth was explained by John Taylor in an article published by Nature life in its June issue of 2012,

‘The businesses growth has been as a result of us producing high quality bicycles and outdoor products which our customers seem to appreciate and like. In addition our sales in the London area have grown significantly with respect to our bikes as customers want to live healthier lifestyles, which I believe is partially explained by the London Olympics'.

In recent times, the performance of the company has not been as good as was hoped. The board of directors have concluded that the revenue of the company is not where it should be - the results for the year to 30 June 2013 fell below budget. As a consequence the board have responded by implementing a three prong strategy to turn the fortunes of the company around. They are as follows;

• Cutting prices with the hope that market share will be increased.

• Extending longer credit facilities to, other retailers who want to stock the ‘Outdoor life' Brand.

• The acquisition of additional and state of the art machinery in order to be able to manufacture better and more products.

The directors' are now reviewing the financial statements for the year ended 30 June 2014 to see whether their strategies have worked, i.e. improving the financial performance and position of the company.

Required:

Required:

Prepare a report for the Board of Directors of Outdoor Life Ltd examining the Financial Performance and Position of the company for the years ended 30th June 2013 and 2014.

Your report should focus on the Profitability, Liquidity/Efficiency and Financial Position of the company over the two years in question. In addition your report should include the Benefits and Drawbacks of using ratio analysis. The following ratios are to be calculated (to be placed in the appendix) and used to help your analysis:Assumptions:

• Credit sales are 60% of total revenue.

• Credit purchases are £70,000 in 2013 and £90,000 in 2014

The above ratios and their calculation for both years should be displayed in the Appendix of the report and serve as a basis for your comments and recommendations to the board.In terms of length, your report should be 1,250 words.

|

Profitability:

- Gross Profit Percentage

- Net profit percentage

- Return on capital employed

Financial position:

|

Liquidity/Efficiency:

· Current ratio

· Quick ratio

· Receivables collection period

· Payables collection period

|

Students will be assessed on:

• How well they have covered the learning outcomes (1-3 listed above) in their essay.

• Knowledge, understanding and analysis

• Standards of English and Harvard Referencing (within the essay and bibliography)

• The structure, layout and editing of your essay.

Attachment:- KHALIL ACC Module Guide Principles of Finance and Accounting 2014-2015.rar

|

What role do the various courts play in making

: How are the Federal District Courts, the Federal Courts of Appeal, and the U.S. Supreme Court different? How are they similar? What role do the various courts play in making or interpreting law that applies to businesses, employees of those firms,..

|

|

What is the correlation between the two securities

: Suppose you own a two-security portfolio. You have 54% of your money invested in Security X and the remainder in Security Y. The standard deviations of Securities X and Y are 30 percent and 25 percent. What is the correlation between the two securiti..

|

|

Ethical hot spots-legal issues-boundary issues

: Ethical "Hot Spots." These are grouped into categories. 1. Choose one "hot spot" listed in each of the following categories: Legal Issues, Boundary Issues, and Confidentiality Issues. Your choices should be of particular "hot spots" that you are surp..

|

|

Create illustration of structure of u.s. health care system

: Create an illustration of the structure of the U.S. health care system and its components. These components should include: Four primary functions and Types of services.

|

|

Financial performance and position of the outdoor life ltd

: Outdoor Life ltd is a Medium size company operating in the county of Berkshire, England. They manufacture and retail Bicycles and associated accessories for riders, as well as outdoor equipment like Tents, Tarp, and Sleeping Bags etc. Currently they ..

|

|

What is the beta of security xyz if its dividend is expected

: The market expected return is 8% with a standard deviation of 18%. The risk free rate is 3.5%. Security XYZ has just paid a dividend of $5 and has a current price of $80. What is the beta of Security XYZ if its dividend is expected to grow at 2% per ..

|

|

What impairment loss would jjw corporation record its books

: At the end of Year 11, JJW Ltd. owns a patent with a remaining useful life of 10 years and a carrying amount of $400,000. What impairment loss would JJW Corporation record on its books if it is a publicly traded enterprise

|

|

Pilot approach phases installation staged incremental

: What are the advantages and disadvantages of the installation methods our book describes? Direct Installation "Cold Turkey" Parallel Installation (Old system runs with the new) Single Location "Pilot Approach" Phases Installation "Staged Incremental"..

|

|

Payroll tax entries cedarville company pays

: Payroll Tax Entries Cedarville Company pays its office employee payroll weekly. Below is a partial list of employees and their payroll data for August. Because August is their vacation period, vacation pay is also listed.

|