Reference no: EM132218519

Part A - Microeconomics:

Answer any five (5) of the following questions.

Question 1:

(a) Suppose that oil prices rise sharply for years as a result of a war in the Middle East. Illustrate with a diagram what happens to the:

(i) Demand for automobiles?

(ii) Demand for home insulation?

(iii) Demand for coal?

(iv) Demand for tyres?

(v) Demand for bicycles?

(b) Explain the impact of external costs and external benefits on resource allocation;

(c) Why are public goods not produced in sufficient quantities by private markets?

Question 2:

(a) Explain why scarcity forces individuals and society to incur opportunity costs. Give specific examples.

(b) Suppose a chocolate bar manufacturer promotes its products by advertising and opportunity to win a 'free car'. Is this car free because the winner pays zero for it? Illustrate and explain using a diagram.

(c) Why is the production possibility frontier bowed outwards?

Question 3:

In some large cities, motorists pay a fee when they bring their vehicles into the busiest part of the city (congestion charge).

(a) Illustrate with a diagram and explain how this charge is an example of the price system at work;

(b) How do you think that the authorities would determine the level of the charge if they have a particular target for the reduction in the number of vehicles entering the congestion charge zone?

(c) Given that revenues from these congestion charges are invested in the city's transport system, how will this affect the charge level holding all other variables constant?

Question 4:

(a) Suppose the income elasticity of demand for pre-recorded music compact disks is +7 and the income elasticity of demand for a cabinet maker's work is +0.7. Compare the impact on pre-recorded music compact disks and the cabinet maker's work of a recession that reduces consumer incomes by 10 per cent.

(b) How might you determine whether MP3 music players and the pre-recorded music compact disks are in competition with each other?

(c) Interpret the following Income Elasticities of Demand (YED) values for the following and state if the good is normal or inferior;

YED= +0.8 YED= -2.4

(d) Interpret the following Cross-Price Elasticities of Demand (XED) and explain the relationship between these goods.

XED= + 0.85

XED= -4.5

Question 5:

(a) Discuss the following statement: 'In the real world there is no industry which conforms precisely to the economist's model of perfect competition. This means that the model is of little practical value'.

(b) Illustrate with a diagram and explain the short-run perfectively competitive equilibrium for both (i) the individual firm and (ii) the industry;

(c) Illustrate with a diagram and explain the long-run perfectly competitive equilibrium for the firm.

Question 6:

(a) Suppose you own a coffee shop. List some of the fixed inputs and variable inputs that you would use in operating the shop.

(b) Baubles and Beads manufacturing produces 100 hammers per day. The total fixed cost for the plant is $4,000 per day and the total variable cost is $13,000 per day. Calculate the average fixed cost, average variable cost, average total cost and total cost at the current output level.

(c) Explain conditions under which labour might be treated as a variable cost and conditiOns under which it would be treated as a fixed cost.

Question 7:

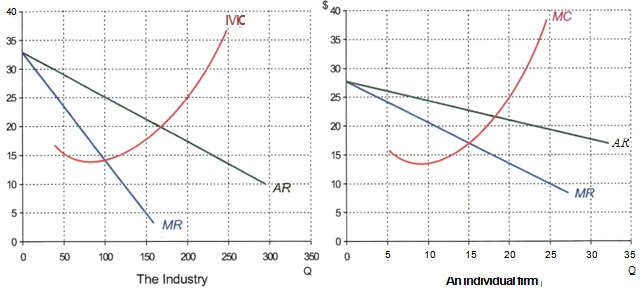

The following diagrams illustrate an industry under oligopoly consisting of 10 equal-sized firms and a particular firm in that industry. Each of the firms produces an identical product.

(a) Assuming that the firms form a cartel, what price will the cartel choose if it wishes to maximise overall profits for the cartel?

(b) What total output must the cartel produce in order to maintain this price?

(c) To what output will an individual firm be restricted if this price is to be maintained (assume all firms are permitted to produce the same level of output)?

(d) If the other firms stick to this output, how much would an individual firm be tempted to produce if it wished to maximise its own profit at the agreed price?

(e) If it undercut the cartel price, what price and output would maximise its profit (assuming that the other members did not retaliate?

Part B - Macroeconomics

Question 8:

Suppose the following are national accounting data for a given year for Malaysia (hypothetical data).

|

Amount (Billions $AUD)

|

|

Consumption of fixed capital

|

285

|

|

Gross private domestic investment

|

725

|

|

Government consumption expenditures

|

720

|

|

Government investment expenditures

|

165

|

|

Imports

|

-550

|

|

Exports

|

625

|

|

Household consumption expenditure

|

3010

|

|

Net property income paid overseas

|

-35

|

(a) Calculate GDP and the country's gross national expenditure using the expenditure approach;

(b) Derive the country's gross national product (GNP);

(c) Derive the country's net national product (NNP);

(d) Derive the country's current account balance;

(e) Derive the country's gross national savings.

Question 9:

Using the aggregate demand - aggregate supply (AD-AS) diagram, show how the four economic events would affect economic activity, the price and employment levels. (Note: use a separate AD-AS diagram for each event)

(a) A decrease in personal income tax;

(b) An increase in workforce skills through special training programs;

(c) An decrease in exports;

(d) An increase in an economy's capital stock.

Question 10:

(a) Describe three problems of using fiscal policy to achieve a precise level of GDP.

(b) Why is frictional unemployment inevitable in an economy characterised by imperfect job information and non-zero job-search time?

(c) Is structural unemployment something macroeconomic policymakers should be concerned about? How does it differ from cyclical unemployment?

Question 11:

(a) Illustrate and explain with diagrams the difference between demand-pull and cost-push inflation;

(b) Provide (describe) two (2) causes of each type of inflation

Question 12:

(d) If the Bank Negara Malaysia sold RM800 million of government securities to private sector money markets, holding other things being held constant, what is the effect on:

Please explain your answer.

(i) The economy's monetary base;

(ii) Short-term money market interest rates;

(iii) Longer-term maturity interest rates;

(iv) Aggregate demand, economic activity and inflation.

(e) Explain what happens (if anything) to the economy's monetary base when the Bank Negara Malaysia sells RM800 million in foreign currency to one of the banks operating in the country.

(f) Which policy is more expansionary: RM200 billion increase in government spending for goods and services or a RM200 billion cut in taxes? Explain why.

Question 13:

The Keynesian and Monetarist schools of thought differ somewhat.

(a) Why is the shape of the aggregate supply curve important to the debate between the Keynesians and Monetarists?

(b) If the investment demand curve was vertical, which view of monetary policy (i.e. Keynesian and Monetarist) impact on investment spending, aggregate demand, and economic activity be more correct?

(c) Explain how they differ regarding an increase in the money supply causing inflation;

Question 14:

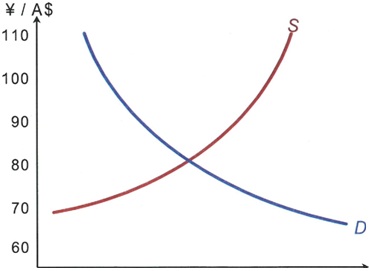

The following diagram shows a demand curve and supply curve of the Australian Dollars against the Japanese yen.

(a) Who is demanding Australian dollars in the foreign exchange market and for what purpose?

(b) Who is supplying Australian dollars in the foreign exchange market and for what purpose?

(c) Mark the equilibrium exchange rate.

(d) Now illustrate the effect of an increased demand for dollars and a decreased supply.

(e) Has the exchange rate appreciated or depreciated? Appreciated / Depreciated