Reference no: EM13729375

Today is February 1. Henry, the financial manager of Mesa Mines Inc., is looking at the budget for next year. Mesa is a medium-sized mining company that develops and extracts gold ore, then forwards it to a major company that smelts Mesa's ore and stores the gold in return for royalties when the metal is sold. Last year, mine output grew at the rate of 9% and rising prices of gold resulted in a record profit. The company increased its inventory of gold at the senior company to 26,700 troy ounces, due to smelting difficulties that delayed sales. The average cost of this gold inventory is US$1,300 per ounce, and gold traded at about US$1,700 per ounce at year end. Since then, the price has dropped to about US$1,600 per ounce. Henry believes that Mesa needs a minimum price of US$1,500 per ounce to make a reasonable profit.

Although Henry is happy that his company has unrealized profit from its gold inventory, he is aware that the price of gold is very volatile. With a potential increase in interest rates, he is worried that sales will weaken and prices will drop.

Henry does not want to be forced to sell under downward market pressure. Mesa might not sell its gold Inventory before the price drops below US$1,500 per ounce, and could be left with a declining price, creating losses. Further complicating this issue is that gold Is priced In US$ and the company operates in C$.

Mesa sold gold futures on 14,500 ounces in August at a price of US$1,575 per ounce. The mine produces about 4,500 ounces of gold per month. Henry expects to be able to sell current production on a monthly basis, but the backlogged sales in inventory may take six months to clear.

Gold futures options are sold on the CME Group's Commodity Exchange (COMEX), where contracts are for 100 ounces.

a.

i. How can Henry use options to hedge Mesa's gold revenues?

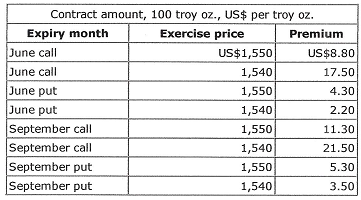

ii. Henry obtained the information shown in Exhibit A from his broker. If Henry hopes to gradually sell all of Mesa's current gold inventory plus projected production during the next six months, how many ounces should he consider hedging? Which of the following options should Henry buy or sell to make an effective, cost-efficient hedge?

Exhibit A: Gold futures option premiums

b. How many options should Henry buy to cover sales, and what is Mesa's total cost of premiums for the option contracts?

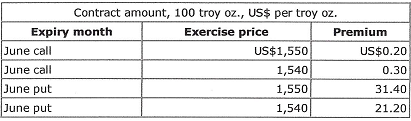

c. Assume Henry purchased June options to hedge part of his potential losses. However, at the end of April, Mesa has a purchaser for 12,000 ounces of gold at the market price, which is US$1,520 per ounce. Option prices are now as shown in Exhibit B. Suppose the total premium paid for the June contracts was US$35,000. Ignoring the time value of money, what is the effective price per ounce that Henry will receive for the April sale?

d. Comment on the effectiveness of the June hedge using the realized price at the end of April.

e. Mesa's senior managers receive an annual bonus plan based on earnings before interest, taxes, and depreciation (EBITD). This bonus plan pays an increasing premium for performance higher above budget and nothing if performance is below budget. Mesa's new treasurer suggests to Henry that the firm should take an opportunistic approach to risk management and try to profit from the use of gold futures and options.

i. Explain the alternative risk management approaches and their advantages and disadvantages for a medium-sized gold producer such as Mesa. State which approach you think is appropriate for Mesa and why.

ii. Explain how Mesa's bonus plan based on EBITD could give an incentive for management to work harder for shareholders, and how it could cause agency or ethical issues.

|

Pipeline maintenance and refinery safety

: This case investigates the ethical, negligence, and environmental issues related to an oil spill, cost cutting, corporate culture, social responsibility, and the regulatory cycle. Your focus is not so much on workplace safety as much as what ethic..

|

|

How long will it take him to repay loan to the nearest year

: As a student at P.U., Bob Karp borrowed $12,000 in student loans at an annual interest rate of 9%. If Bob repays $1,500 per year, how long will it take him to repay the loan to the nearest year?

|

|

Discuss the process for amending the constitution

: Analyze and discuss the significance of the Bill of Rights and subsequent notable amendments to U.S. democracy. Discuss the process for amending the Constitution. Is this a "fair" process? Explain.

|

|

What is cost of capital to firm for this project-hurdle rate

: The risk free rate is 2.75%, measured by a long-term U.S. government bond. The total market return is expected to be between 12% over the foreseeable future. A biotech firm without production experience is considering making a drug in-house and profi..

|

|

Explain the alternative risk management approaches

: Explain the alternative risk management approaches and their advantages and disadvantages for a medium-sized gold producer such as Mesa.

|

|

Create a value proposition statement or a tag line

: Regarding the managerial implication of these analyses, create a value proposition statement or a tag line for the two stores-JCPenney and Nordstrom

|

|

What will next years assets be at the end of the year

: The firm earned $7,000 in sales last year while selling 20,000 units. Net Income that same year was $850. At the end of that same year, the Balance Sheet reflected $11,000 in total assets, having $3,500 in debt and $7,500 in equity accounts. The firm..

|

|

What will next years net income be and assets be

: The firm earned $7,000 in sales last year while selling 20,000 units. Net Income that same year was $850. At the end of that same year, the Balance Sheet reflected $11,000 in total assets, having $3,500 in debt and $7,500 in equity accounts. What are..

|

|

Summarize apples supplier responsibility information

: Assignment: Challenges in the Global Business Environment- Summarize Apple's Supplier Responsibility information

|