Reference no: EM132801674

Question 1. Consider an equation to explain salaries of CEOs in terms of annual firm sales, return on equity (roe, in percentage form), and return on the firm's stock (ros, in percentage form)

(i) In terms of the model parameters, state the null hypothesis that, after controlling for sales and roe, ros has no effect on CEO salary. State the alternative that better stock market performance increases a CEO's salary.

(ii) Using data, the following equation was obtained by OLS

Give an interpretation to each estimated coefficient.

(iii)Test the null hypothesis that ros has no effect on salary against the alternative that ros has a positive effect. Carry out the test at the 10% significance level.

(iv) Would you include ros in a final model explaining CEO compensation in terms of firm performance? Explain.

Question 2. Are rent rates influenced by the student population in a college town? Let rent be the average monthly rent paid on rental units in a college town in the United States. Let pop denote the total city population, avginc the average city income, and pctstu the student population as a percentage of the total population. One model to test for a relationship is

(i) State the null hypothesis that size of the student body relative to the population has no ceteris paribus effect on monthly rents. State the alternative that there is an effect.

(ii) What signs do you expect for and Explain.

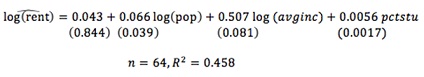

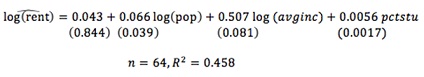

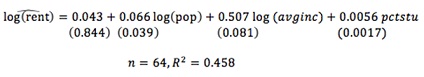

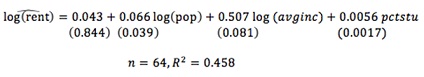

(iii) The equation estimated using 1990 data for 64 college town is

What is wrong with the statement "A 10% increase in population is associated with about a 6.6% increase in rent"?

(iv) Test the hypothesis stated in part (i) at the 1% significance level.