Reference no: EM131115589

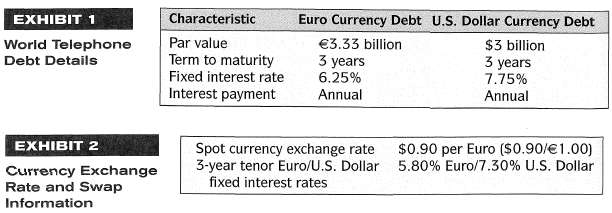

Ashton Bishop is the debt Manager for World Telephone, which needs €3.33 billion Euro financing for its operations. Bishop is considering the choice between issuance of debt denominated in:

Euros (€), or U.S. dollars, accompanied by a combined interest rate and currency swap.

a. Explain one risk World would assume by entering into the combined interest rate and currency swap.

Bishop believes that issuing the U.S.-dollar debt and entering into the swap can lower World's cost of debt by 45 basis points. Immediately after selling the debt issue, World would swap the U.S. dollar payments for Euro payments throughout the maturity of the debt. She assumes a constant currency exchange rate throughout the tenor of the swap.

Exhibit 1 gives details for the two alternative debt issues. Exhibit 2 provides current information about spot currency exchange rates and the 3-year tenor Euro/U.S. Dollar currency and interest rate swap.

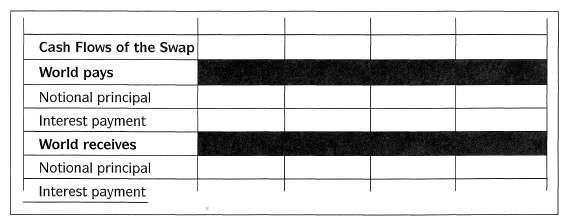

b. Show the notional principal and interest payment cash flows of the combined interest rate and currency swap.

Note: Your response should show both the correct currency ($ or €) and amount for each cash flow.

Answer problem b in the template provided.

Template for problem b

c. State whether or not World would reduce its borrowing cost by issuing the debt denominated in U.S. dollars, accompanied by the combined interest rate and currency swap. Justify your response with onereason.

|

Prepare a statement of retained earnings for ashwood inc

: Prepare a statement of retained earnings for Ashwood for the year ended December 31, 2007. Assume that only single period financial statements for 2007 are presented.

|

|

The major duty of the magnuson-moss warranty act

: The major duty of the Magnuson-Moss Warranty Act is to require the FTC to issue rules regarding consumer product warranties. Using zip codes as a factor in denying credit has been determined to be illegal by the FTC due to possible discrimination tha..

|

|

Confidence intervals for the proportion of the population

: out of the 3,200 respondents, 640 answered yes and the remainder no. find 95% confidence intervals for the proportion of the population who would say yes (Z value for 95% is 1.96)

|

|

Prepare journal entries to record transactions

: Compute the amounts of any liability for compensated absences that should be reported on the balance sheet at December 31, 2010 and 2011.

|

|

Explain one risk world would assume

: Explain one risk World would assume by entering into the combined interest rate and currency swap. Show the notional principal and interest payment cash flows of the combined interest rate and currency swap. Note: Your response should show both the c..

|

|

Based on various strategies used for marketing products

: Based on the various strategies used for marketing products and services in the online environment, show how these strategies relate to the model of online consumer behavior and e-business. Discuss the specific differences between the terms e-commerc..

|

|

Question regarding the consumption of soft drinks

: It is known that the average yearly consumption of soft drinks by college students nationwide is 50 gallons (µ = 50) with a standard deviation of 3.5 gallons (σ = 3.5).

|

|

Which is the lead cost alternative in years one five and ten

: Which is the lead cost alternative in Years 1, 5, and 10? How much would the variable cost per unit have to be in Year 5 for the automated alternative to justify the additional annual fixed cost of the automated alternative over the manual alterna..

|

|

Define social networking

: Define social networking. Also discuss benefits of marketing with social networks. What do you mean by microblogging and discuss how microblogging can help businesses to achieve marketing objectives.Describe the purpose and typical structure of a dis..

|