Reference no: EM13831800

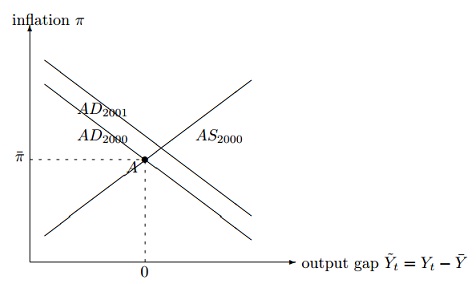

1. Consider the following AS-AD short-run framework. Assume that up to period t = 2000 the economy has been resting at the long-run equilibrium (Point A). The Fed. decides an expansionary policy with shifting AD curve to the right (AD2000 =⇒ AD2001).

a) Consider the traditional short run model (i.e., without rational expectations). What is the outcome of the expansionary policy? Label the point.

b) Consider the new Classical model that assumes rational expectations and flexible prices. What is the outcome if the Fed's policy is completely anticipated by people? Draw new curve if necessary. Label the point.

c) Now consider New Keynesian model that assumes rational expectations and sticky prices. What is the outcome if the Fed's policy is completely anticipated by people? Draw new curve if necessary. Label the point. You may want to draw the curve on the same plot for b).

2. Consider the following balance sheet of the First New Bank.

Table 1: Consolidated Balance Sheet for the First New Bank

|

Assets

|

|

Liabilities and Capital

|

|

|

Reserves

|

(R)

|

Deposits

|

$90 mil.

|

|

Securities

|

$15 mil.

|

Bank borrowing

|

$30 mil

|

|

Loans

|

$95 mil.

|

Bank capital

|

$5mil

|

|

Total Assets

|

$125 mil

|

Total liabilities and Capital

|

(L)

|

a) What is the total liabilities and capital of the Bank? Fill out (L) appropriately.

b) What is the amount of reserves of the Bank? Fill out (R) appropriately

c) Assume that the reserve requirement applied to the Bank's deposit is 10%. Calculate "required reserves" for the Bank. How much is the Bank holding in "excess reserves"?

d) What reasons could explain why banks hold excess reserves even though loans or securities earn a higher return?

e) Suppose the Bank gets caught up in the euphoria of the housing market, only to find that $5 mil. of their loans became worthless later. What would be the new Bank capital when these bad loans are written off (valued at zero)? (capital requirement is not considered yet.) Does the Bank face any problem in the capital account except capital requirement? It yes, what is the problem?

f) Now suppose the U.S. government and the Federal Reserves adopt Basel I Accord. So the Bank should hold as bank capital at least 8% of its own risk weighted assets. The following list shows risk weights for each type of assets. Suppose the all the securities that the Bank holds are federal government bonds, its $50 mil. of loans are housing mortgages, and the rest of its loans including what the Bank lost are corporate loans. Again, $5 mil. loans should be written off. How much capital does the Bank need to satisfy the requirement?

0 cash, government and central bank bonds

20% bank and securities firm debts

50% municipal revenue bonds, residential mortgages

100% other private sector loans such as corporate and consumer loans

g) Suppose the Bank cannot issue new stock because it is too hard during a recession. What else can the Bank do to replenish capital?