Reference no: EM133168887

HI5003 Economics For Business - Holmes Institute

Question 1

Assume that during the years 2022 to 2025 Woodland Republic could produce only two commodities: tractors and rice. Also, assume that Woodland Republic can procuce at any of the positions represented by the production possibility schedule below.

|

|

A

|

B

|

C

|

D

|

E

|

F

|

G

|

H

|

|

Tractors

|

0

|

2

|

4

|

7

|

9

|

11

|

13

|

14

|

|

Rice (in tons)

|

100

|

95

|

85

|

70

|

60

|

50

|

30

|

0

|

a. Suppose in 2022 the economy is producing at point D. What is the opportunity cost of producing 6 more tractors in 2023

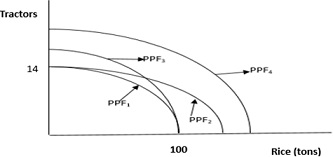

b. Use the figure below to answer the questions that follow.

i. Suppose, in 2024 the Minister of Finance in Woodland Republic advises the World Bank that in order to increase rice production and tractor manufacturing, each sector requires AUD50 billion, or a total of AUD100 billion. This AUD100 billion is made available by the World Bank. Explain the impact of these AUD100 billion budgetary allocations to the economy of Woodland Republic.

ii. Suppose in 2025Woodland Republic begins to manufacture fertilizers. Explain theimpact of the discovery of fertilizers on the Woodland Republic economy.

Question 2

John plans to start a milk and pizza business in 2022. Suppose John owns a rental premises from which his rental earnings are AUD 3,000 per month. He asks the rental people to leave and uses the premises for the milk and pizza business.

The table below represents John's January business summary:

|

Item

|

Cost (AUD)

|

|

1 Milk truck

|

120,000

|

|

Milk stainless cans

|

20,000

|

|

Milk cooler

|

40,000

|

|

2 litre milk packs (Number of packs bought depend on demand. Assume January average expenditure)

|

30,000

|

|

Pizza ingredients (Ingredients used depend on demand. Assume January expenditure)

|

4,000

|

|

2 cashiers (Assume a cashier per section [Milk and Pizza]. Also, wages depend on hours worked. Assume January average wages per cashier)

|

3,000

|

|

2 bakers (Wages depend on hours worked. AssumeJanuary average wages per baker)

|

3,500

|

|

Pizza packaging boxes (Boxes depend on demand. Assume average January boxes used)

|

2,000

|

|

Pizza special oven

|

25,000

|

|

i. Milk production per day: 300 litres per day

Note: Assume 90,000 litres per month produced and bought.

ii. Pizza production per day is 500 pizzas. Assume 15,000 pizzas per month are produced and all that are produced are sold.

|

|

Use the table to answer the questions below.

a. Calculate John's fixed cost and average fixed cost for eachsection.

b. Calculate John's variable cost and average variable cost for each section.

c. Assume John sells milk atAUD2.50 per litre. Also, assume John sells each pizza at AUD10.00. Calculate John's accounting profit and economic profit for the month of January.

Question 3

Assume that Airbus and Boeing are the only firms that manufacture planes in the world. Answer the questions below.

a. What is the market structure in which Airbus and Boeing operate? Explain your answer using the market characteristics for the two firms (Airbus and Boeing).

b. Examine the market entry barriers that deter other firms from entering the market structure for Airbus and Boeing.

c. What do you understand by the term "Mutual Interdependence" for Airbus and Boeing.

Question 4

a. In 2021, theWoodland Republic Bureau of Statistics publication indicated thatthe Consumer Price Index (CPI) of the country increased to 109.2 in 2021 from 106.5 in 2020. Calculate Woodland Republic's inflation rate in 2021.

b. The Woodland Republic's Population Secretariat published the following information in 2021:

• Total population: 30 million

• Labor force: 80% of the total population

• Employed population: 21.5 million

Use the information provided to answer the following questions:

i. Calculate the population that is excluded from the labour force in Woodland Republic in 2021 and indicate at least four sectors that are excluded from labour force.

ii. Calculate the Woodland Republic's unemployment rate in 2021.

Question 5

(i) Use two (2) coincidental indicators to explain the conditions that are experienced in a nation during a recession.

(ii) Examine the causes of business cycle fluctuations in a nation.

(iii) Suppose the following information was published by the Australian Bureau of Statistics in 2017:

|

Item

|

Amount (AUD billion)

|

|

Household consumption

|

5,029.81

|

|

Government consumption

|

20,340.92

|

|

Exports

|

1,386.39

|

|

Value of cocaine seized at Sydney Airport

|

20,500

|

|

Value of intermediate goods in tractor manufacturing

|

502,003

|

|

Gross private domestic investment

|

352.69

|

|

Imports

|

386.95

|

|

Components used in the manufacture of cars

|

40,000

|

|

Gifts

|

15,236

|

|

Government investment

|

88.19

|

|

Value of second-hand goods

|

500.00

|

|

Value of banned endangered species elephant tasks seized at Melbourne Airport

|

600.00

|

Use the information provided to calculate Australia's GDP in 2017

Question 6

Due to the severity of COVID 19 on households, the government of Australia announced Job Keeper Allowances to be given to the labour force that had lost employment.

a. Examine the impact of Job Keeper Allowances during the COVID 19 recession on Australia's economy.

b. Examine two reasons that could explain why the government of Australia terminated Job Keeper Allowances though COVID 19 still impacted Australia.

c. Assume the government of Australia spent AUD50 billion on allowances given to Job Keeper beneficiaries. Assume that despite the family financial stress, 15% of the Job Keeper Allowances was the total beneficiary savings.Further, assume all other factors remain constant. Calculate the total effect of the Australian government Job Keeper Allowancespending on aggregate demand for the economy.