Reference no: EM13214795

1. Evaluate the performance of a company using various financial analytical tools.

2. Analyse different patterns of cost behaviour and apply cost-volume-profit analysis to business decisions.

3. Select and apply investment appraisal techniques appropriately.

4. Evaluate the performance of business units using both financial and non-financial measures.

Part A

Assume that you are a Financial Analyst working for Muscat Investment L.L.C. Evaluate the financial performance of a company listed in the Muscat Securities Market (MSM) by taking into consideration the following instructions.

Instructions:

i. Select a company from MSM (Other than Banking and Investment companies)

ii. Collect financial reports for five consecutive years.

iii. Use annual financial statements for analysis. Avoid using quarterly statements.

iv. Provide references for the data collected (use Coventry Harvard style of referencing). Company websites can also be used for data collection.

v. From the financial statements and additional information collected by you complete the below mentioned tasks.

TASKS

1. Compute the following ratios for each year.

a. Liquidity Ratios

b. Profitability Ratios

c. Efficiency Ratios

d. Capital Structure Ratios (Gearing)

e. Market Ratios (dividend, PE etc.)

2. On the basis of literature review and from the above computations analyse the performance of the company in terms of profitability, liquidity and efficiency.

3. As a Financial analyst, would you recommend buying this company shares. Why or why not? Discuss.

Part B:

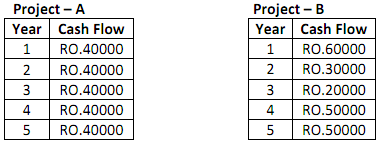

Q1. Gulf Oasis is considering two mutually exclusive projects. Both require an initial cash outlay of RO. 100,000 each. The estimated life of the both projects is five years. The company's required rate of return is 10%. The projects will be depreciated on a straight line basis. The net cash flows expected to be generated by the projects are as follows:

a) Evaluate the proposals by:

i. Net present value method

ii. Internal rate of return method

iii. Profitability index method

On the basis of these measures (calculations) only, which project would you recommend?

b) What non-financial factors, would you consider while deciding between projects? On the basis of literature review, justify your recommendations.

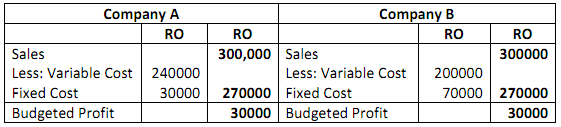

Q2. Two businesses Company A and Company B sells the same type of product in the same type of market. Their budgeted Profit and Loss Accounts for the coming year are as follows:

You are required to:

(a) Calculate break - even point of each business

(b) Calculate the sales volume at which each business will earn RO.5000 profit

(c) Calculate margin of safety of each business

(d) State which business is likely to earn greater profit in condition of:

(i) Heavy demand for the product

(ii) Low demand for the product