Reference no: EM131119861

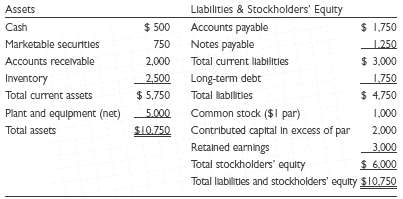

The Southwick Company has the following balance sheet ($000):

Financial Ratios

Current ratio ........ 1.92

Quick ratio ....... 1.08

Debt-to-equity ratio ...... 0.79

Evaluate the impact of each of the following (independent) financial decisions on Southwick's current, quick, and debt-to-equity ratios:

a. The firm reduces its inventories by $500,000 through more efficient inventory management procedures and invests the proceeds in marketable securities.

b. The firm decides to purchase 20 new delivery trucks for a total of $500,000 and pays for them by selling marketable securities.

c. The firm borrows $500,000 from its bank through a short-term loan (seasonal financing) and invests the proceeds in inventory.

d. Southwick borrows $2,000,000 from its bank through a 5-year loan (interest due annually, principal due at maturity) and uses the proceeds to expand its plant.

e. The firm sells $2,000,000 (net) in common stock and uses the proceeds to expand itsplant.

|

Summary of the history and lasting individual

: Write a summary of the history and lasting individual, social and cultural impact (including likely future impact, if relevant) of four different media technologies (for example, print, telegraph, telephone, radio, television, Internet, and so on)..

|

|

Which of the following actions proposed by the cfo

: Which of the following actions proposed by the CFO do you believe will actually achieve this objective? Why or why not?

|

|

Information systems-concepts-design and analysis

: What is a Data Warehouse? What are the differences between data warehouse and traditional databases? What are the various concept of Data Warehouse (OLAP, Data Mining?

|

|

Identify company for which wish to develop strategic plan

: Identify a company for which you wish to develop a strategic management plan. You may wish to conduct some preliminary research to help you understand a little more about the company you chose.

|

|

Evaluate the impact of each of the following financial decis

: Evaluate the impact of each of the following (independent) financial decisions on Southwick's current, quick, and debt-to-equity ratios: The firm reduces its inventories by $500,000 through more efficient inventory management procedures and invests t..

|

|

Describe the management team in your business

: Describe the team concept, group dynamics, and the strengths and weaknesses of business teams.

|

|

Course title-managing web and database technology

: Web Technology Impact Through the Reshaping Your Business with Web 2.0, we have gone through key technologies such as Mashup, AJAX, APIs, Security and Compliance.

|

|

Analysis of the implementation status student

: The second part of the paper (practice) will be the description/analysis of the implementation status student services at the community college of your choice, including following information (2 - 3 pages):

|

|

Effects of external variables in social science research

: Discuss the importance of minimizing the effects of external variables in social science research, and the problems one may encounter if this is not accomplished.

|