Reference no: EM131536659

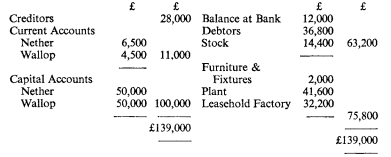

Question: Nether and Wallop were equal partners and their Balance Sheet at 31st December, 1961, was as follows:

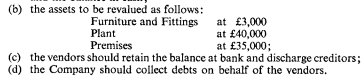

On 1st January, 1962, they formed a company with an authorised capital of £200,000, half in 6 per cent. Cumulative Preference Shares and half in Ordinary Shares of £1 each, to take over the business. It was agreed that:

(a) the purchase consideration should be £150,000, payable by allotment at par of 50,000 Preference Shares and 80,000 Ordinary Shares, and the balance in cash

Shares were allotted to the vendors on 1st January, 1962, and the balance of the purchase consideration was paid to them on 1st March, 1962. The Company completed the collection of debts, with the exception of bad debts amounting to £750, by April 15th, 1962, and paid the net proceeds on that date. Partnership creditors were paid off by 15th March, discounts of £400 being received. The vendors paid the costs incidental to formation of the Company and the amount, £2,000, was refunded by the Company on 1st March. Close the books of the partnership and also draft the Balance Sheet of the Company as at 1st January, 1962