Reference no: EM131245

Question 1

Can our goal of maximizing the value of the shares conflict with other goals such as avoiding unethical or illegal behaviour? In particular, do you think issues like customer and employee safety, the environment, and the general good of society fit into this framework, or are they essentially ignored? Support your views with specific examples.

Question 2

As an investor, do you think some managers are paid too much? Do their rewards come at your expense? Support your argument with relevant examples.

Question 3

You wish to deposit $250,000 for one year and have had the Subsequent quotes from three different financial institutions. For each quote state the interest that would be earned and the effective annual interest rate.

i. 8% per annum, effective

ii. 2% per quarter, effective

iii. 8% per annum, compounded monthly

What is the effective annual interest rate if

i. you made four payments of $500 into an account every three months starting in three months' time, and you have $2,091.81 in your account in one years' time?

ii. how would your answer in (i) change if the first payment was made today and all other factors remain constant?

Question 4

Mary is 40 years old today and plans to work until her 65th birthday and then retire, anticipating that she will need sufficient savings to support her until she is 85 years old.

(The average life expectance of females in Australia is 81.) Mary believes she will need an annual income of $45,000 during retirement to maintain her life style. She currently earns $54,000 and her employer contributes 9% pa to a superfund whose long term earning rate is 5.4%. On retirement Mary intends to leave her investment in the superfund and draw funds as required.

How much will Mary need in the fund on her 65th birthday, given annual withdrawals of $45,000 (20 withdrawals) the first on her 65th birthday, such that there is nothing left in the fund on her 85th birthday?

If Mary currently has $60,000 in her fund and her employer contributes annually as described above with the next contribution on her 41st birthday, and the last on her 65th birthday, how much will the fund be worth on her retirement?

How much extra does Mary have to contribute on an annual basis, to meet the target on her 65th birthday (as determined in (a) above)?

If Mary contributes $1,000 for the next 10 years and $3,000 for the remaining 15 years, will she still meet her target?

Question 5

You have decided to invest in a company, Joint. Co., which has developed a new coupling joint which you believe, has great potential. The company is due to pay its first dividend of $0.30 in one year's time. Your research has shown that after the first dividend payment, you expect the dividend to grow by 8% for the next two years, 12% for the Subsequent two years, before settling into its long term growth rate of 6%.

How much would you be willing to pay for a share in the company today given that you require a return of 9.5%pa?

Question 6

To fund its research Joint Co. initially issued 10 year bonds two years ago with a face value of $1,000 and a coupon rate of 7%, paid semi-annually.

i. If the yield on these bonds is currently 9%, what is the price of a bond today?

ii. It is expected that the yield on these bonds will fall to 6.5% in four years' time. What will their price be at that time?

iii. Illustrate why the yield on the bonds may fall, and the effect this fall will have on the price.

Part B

This case is intended to be an introduction to the various methods used in capital budgeting and looks at some of the decisions that may have to be made when evaluating projects. It is also designed to develop skills in using spreadsheets. You should set up a spreadsheet at the start to help analyse the problems. When using a spreadsheet, any tables that you wish to present to the reader should be embedded into a Word document as an ordinary table.

Question 1

What is the project's net present value (NPV)? Illustrate the economic rationale behind the NPV. Could the NPV of this particular project be different for SRC than for one of Wang's other potential customers? Illustrate.

Question 2

Determine the proposed project's internal rate of return (IRR). Illustrate the rationale for using the IRR to Compute capital investment projects. Could the IRR for this project be different for SRC than for another customer? Illustrate.

Question 3

Consider one of SRC executives uses the payback method as a primary capital budgeting decision tool and wants some payback information.

a. What is the project's payback period?

b. What is the rationale behind the use of payback period as a project evaluation tool?

c. What deficiencies does payback have as a capital budgeting decision method?

d. Does payback provide any useful information regarding capital budgeting decisions?

Question 4

Under what conditions do NPV, IRR, and PI all lead to the same accept/reject decision? When can conflicts occur? If a conflict arises, which method should be used, and why?

Question 5

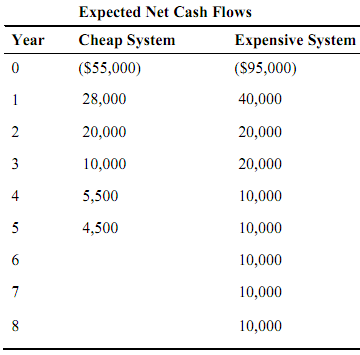

A second capital budgeting decision that David developed was the choice between two different Wang's products. Again, using SRC as a model he produced the Subsequent figures.

Both systems are part of Wang's general inventory, and therefore can be replaced indefinitely in the future. Using SRC's cost of capital of 10%, which system should be purchased? Why?

Question 6

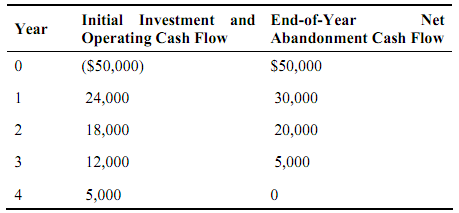

A third capital budgeting decision that David is able to make is when to abandon a system. Consider a system that has an engineering life of 4 years (that is, the system will be totally worn out after 4 years). However, if the system were taken out of service, or 'abandoned' prior to the end of 4 years, it would have a positive salvage value. Here are the estimated net cash flows for the system.